A Different Interpretation of Recent Market Signals

With the most recent market signals, the fear trade is back! Yes, the market is grappling with some daunting issues: Ebola, ISIS, Russia, renewed European weakness, and weak retail sales in the U.S. Commodity prices are sliding, fanning fears of broad-based deflation. Some earnings pre announcements, starting with Microchip’s, have been unnerving.

For most of this year, investors have been wondering when all of the bad news in the Middle East, Russia, Africa, China, Japan and Europe would come home to roost in the U.S. equity market. Well, now it has…

While many are disgorging equities in response to what seems like the beginning of the end of this bull market, we address the same concerns and come to a different conclusion. In our view, the market is climbing an enormous wall of worry, and is poised to rebound and scale to new heights.

LOWER OIL PRICES: A MASSIVE TAX CUT

Historically, an accelerated rise in oil prices has tipped the scales into recession and a bear market. For example, oil prices roughly tripled or quadrupled in the one to two years leading up to the recessions and bear markets of 1973-74, 1990-1991, 1998-2000, and 2007-2008. A doubling in oil prices also played a role in the October 1987 crash.

In the context of this long term record, the 25% drop in oil prices since mid June is good news, the equivalent of a massive tax cut. It should be stimulative for most major economies, including the US, Europe, China, and Japan. (Europe, China, and Japan, much more dependent on imported oil than is the US, should benefit disproportionately.) It should bolster profitability…and it should keep the Fed and other monetary authorities on hold, adding support to equity market valuations. In short, it should be a boon for stocks.

Instead, investors seem to be viewing the drop in oil prices through the lens of the 2008-09 financial crisis, this time a deflationary bust triggered by Europe’s slide back toward recession. Memories of the financial shock during the European sovereign debt crisis seem to be triggering a Pavlovian flight to safety.

Looking at the recent market signals, the difference between today and 2008 is that the US economy is not infecting the rest of the world with sub prime debt. Quite the contrary, it is gaining traction, albeit in a pattern of two steps forward, one step back. Initial claims for unemployment insurance, a weekly barometer of the economy’s health, have recovered completely, and consumer and business confidence continue to move up, despite negative headlines. Europe still is hobbled by a structurally intractable debt problem, but rarely has Europe been an engine for growth in our investment lives. Instead, the US is playing that role once again, much like it did in the nineties when Japan, the second largest economy in the world at that time, slipped into its deflationary malaise.

DEFLATION: GOOD?

A deflationary bust is bad, unequivocally. As 2007-09 exemplified, fears of a deflationary bust can ravage equities and low quality bonds whose owners stand to collect little or nothing from bankrupt entities. The dramatic decline in oil prices recently could spell trouble for other companies positively leveraged to energy, but we see little risk of a full fledged deflationary bust, as lower energy prices actually add to consumer and business purchasing power.

We do see several reasons for a deflationary boom, and deflationary booms are good. The technology sector is a rife with examples in which prices fall and unit growth soars, thanks to the high price elasticity of demand for innovations that improve our quality of life. Today, several general purpose technology platforms are converging to foster more of a broad based deflationary boom than we have seen in recent history. Among them are the mobile internet, robots, batteries, and DNA sequencing. Please see our recent <a href=http://ark-invest.com/wp-content/uploads/2020/02/podcast-thumbnail.png target=”_blank”>white paper</a>, with an introduction from <a href=”http://www.laffercenter.com/the-laffer-center-2/” target=”_blank”>Art Laffer</a>, to learn how profoundly they will impact the global economy during the next few years.

EARNINGS: EARLY READ, BUT BETTER THAN EXPECTED

As measured by Bloomberg, earnings have surprised by more than 6% on average, and sales by more that 1%, thus far in this earnings season. While Microchip’s disappointment last week grabbed the headlines as a harbinger for second quarter earnings, Alcoa and Intel surprised significantly on the high side of expectations, as have the financials. We would not be surprised if Microchip’s misfortune is tied more to its competitive positioning in the low end eight bit controller market than to underlying economic activity. Alcoa, Intel, and others are pointing to a much healthier economic backdrop.

VALUATIONS: DEPRESSED?

While some commentators characterize the valuation of the market as rich, and certain sectors as “bubble-like”, we believe that it actually is quite depressed. Either it is depressed, or interest rates are going to move up significantly. Now that oil prices are unwinding, the latter is unlikely. Consequently, the 10 year Treasury yield has some staying power around 2%, and the 30 year around 3%.

Historically, the shortcut to calculating a fair market multiple has been to take the inverse of the long term bond yield which, taken literally today, would be 35-50 times. Normalizing to capture a full market cycle would suggest higher yields and lower multiples, of course…but today’s 14.5 S&P 500 PE ratio is consistent with a normalized long bond yield of 7%. Clearly, on that basis, the equity market is undervalued.

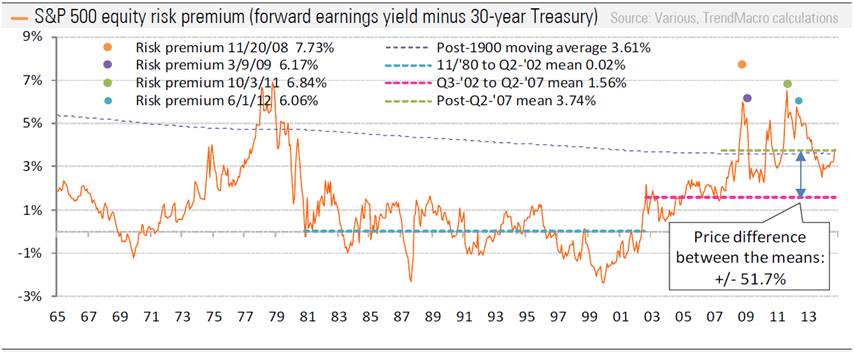

The market’s equity risk premium (ERP) is another way to depict the same thing. As measured by the difference between the S&P 500’s forward earnings yield and the thirty year Treasury bond yield, today’s ERP is 4.2%, a rate not seen since the depths of the European sovereign debt crisis. Low sovereign yields in Ireland, Spain, and most countries in Europe are not telegraphing the risk of a deflationary bust. The attached chart from Trend Macrolytics illustrates how undervalued the market is on this basis.

State of the World, October 2014, Trend Macrolytics

State of the World, October 2014, Trend Macrolytics

OPPORTUNITY: “BUY LOW”

At 4.2%, the equity risk premium suggests that the financial crisis that started in 2007 is still in motion. As more investors begin to understand the market signals better and realize that the global economy is not heading into a deflationary bust but is entering into a combination of deflationary booms, the ERP should decline meaningfully, perhaps all the way back to its 2003-2007 average. If so, the turmoil of the last few weeks, in hindsight, will have been a good opportunity to “buy low” and hop onto the bull market that began in 2009.

Sincerely,

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024