Believe it or not, in an economic boom new car sales could fall, thanks to car sharing. Car sharing services like Zipcar (owned by Avis [CAR]), Car2Go (owned by Daimler [DDAIF]), and Hertz OnDemand [HTZ] offer an alternative to car ownership that improves the utilization of vehicles and should lead to fewer cars on the road.

Household vehicles are stranded assets, for the most part. In fact, data from a national study of driving behavior [1] indicate that private vehicles are in use less than 4% of the time, or about an hour per day on average. With 250 million cars on the road at the end of 2013, that leaves roughly 5.8 billion unused vehicle hours across the country each day.

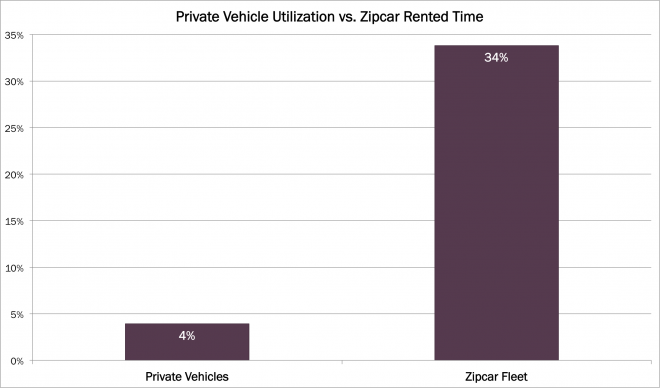

Car sharing services utilize vehicles more efficiently than individual households can. With more than 860,000 members at the end of 2013, Zipcar, is the nation’s largest car sharing service. Members can rent vehicles for as long as they need, and each vehicle can be rented many times in a day. Consequently, cars in the Zipcar fleet are in use nearly 34% of the time, as illustrated below. [2]

Note in the figure above that the time utilization of Zipcars is more than eight times that of private vehicles.[3] If car sharing were to become the norm in the US, the number of cars necessary for currently levels of economic activity would decrease by more than 220 million.

Of course such a profound change could not happen overnight. Many drivers will insist upon owning their own vehicles. Nonetheless, car sharing could have an immediate and significant impact on new car sales, even with minimal adoption rates. We have calculated in the figure below the impact that increased adoption of car sharing would have on new US auto sales under two scenarios: slow adoption and rapid adoption.

In the slow adoption scenario, as defined by 2.5% of drivers converting to car sharing by 2019, new car sales would stay fairly constant year to year, rather than trending up by an average of 2% per year. In a quicker adoption cycle, 5% of drivers would convert, pushing sales down by 7% per year, or nearly 50% by 2019. Instead of rising to nearly 18 million units at an annual rate by 2019, new car sales would drop to roughly 9 million units.

These calculations have assumed that only small proportions of drivers choose car sharing over car buying in the next five years. This assumption reflects the fact that car sharing in its current form cannot meet the needs of all drivers. Zipcar and similar services are usually available in densely-populated metropolitan areas or around college campuses. The residents of these areas are likely to drive less frequently and to have better access to convenient alternative transportation. Suburban commuters, on the other hand, are likely to need vehicles around the same times of day making sharing more difficult.

That said, the US population is migrating into cities, suggesting that more people are moving into Zipcar’s core markets. At the same time, the expansion of ridesharing services like Uber or Lyft into suburbs and small cities makes these areas more navigable for those who do not wish to own cars. Additionally, a sharing service that incorporates autonomous vehicles could appeal to a large number of people, including those who do not currently drive.

Services like Zipcar are rescuing individuals from their stranded asset base. As car sharing penetration increases, new car sales data will no longer be the economic indicator they once were. New car sales could decline, even in an economic boom.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024