Generative AI: A New Consumer Operating System

The history of computing is defined by improving the productivity of individuals and enterprises. The transition from command-line interfaces (CLIs) in the 1970s to graphical user interfaces (GUIs) in the 1980s enabled the abstraction of complex syntax with visual icons and windows. Then, the flattening of the computing learning curve accelerated the adoption of personal computers (PCs) through the 1990s to spawn the World Wide Web and the internet applications built on top of it. At the turn of the last century, touchscreen phones and mobile operating systems placed the power of computing in our palms. Now, generative artificial intelligence (AI) is accelerating the adoption of digital applications and creating the next epochal shift in human-computer interaction.

Products from established companies as well as new hardware entrants are embedding generative AI into operating systems. Indeed, all smartphones are likely to undergo AI-centric redesigns, and future AI wearables with product-market fit could become as commonplace as the smartphone itself.

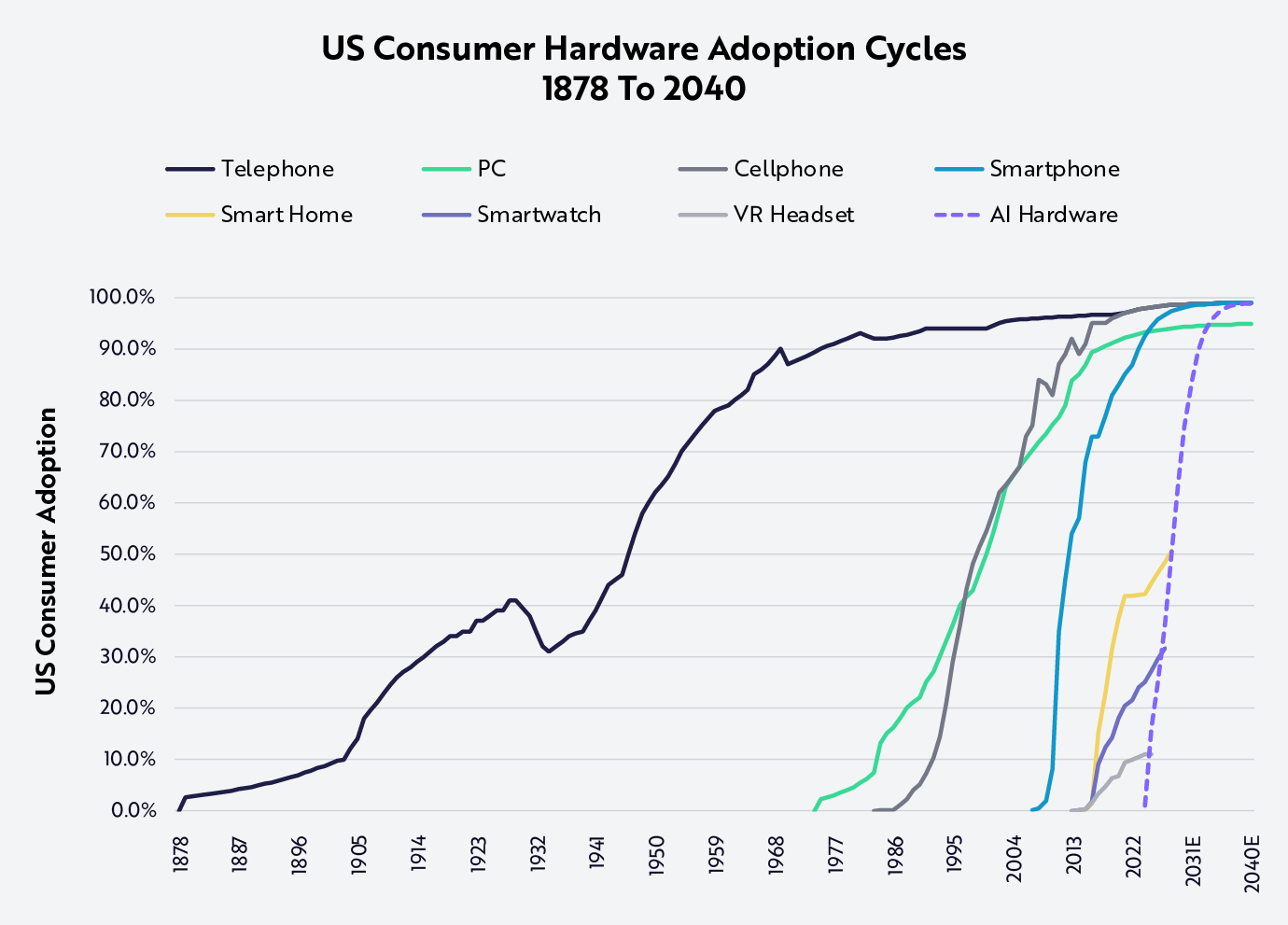

As consumers adopt new form factors, a new period of consumer hardware heterogeneity seems to be emerging that should flourish at least through the end of this decade. Whereas the telephone required nearly 70 years to reach 50% saturation in the US after launching commercially, the personal computer a century later took fewer than 26 years to reach 50% saturation, the cellphone 16 years, and the smartphone only 6, as shown below.

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources including Hartig 1998,1 Dediu 2017,2 and Sidoti et al. 2024,3 as of March 2024, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency.

Our research suggests that AI-enabled consumer hardware—defined as hardware with integrated AI agents—could penetrate 50% of the US internet user base in fewer than four years, and nearly 75% penetration by the end of 2030, up from near-zero in 2022.

In this paper, we present ARK’s research on emerging human-computer interaction that should accelerate the embedding of generative AI and associated hardware systems into everyday user applications.

- Section I analyzes how AI agents enable new commercial consumption practices by simplifying the complexities of traditional operating systems.

- Section II discusses advertising as conducted by AI agents.

- Section III considers the potential of gestural and voice-centric natural user interfaces.

- Section IV looks at historical strategies for winning operating system market share.

AI Agents Can Simplify Commerce

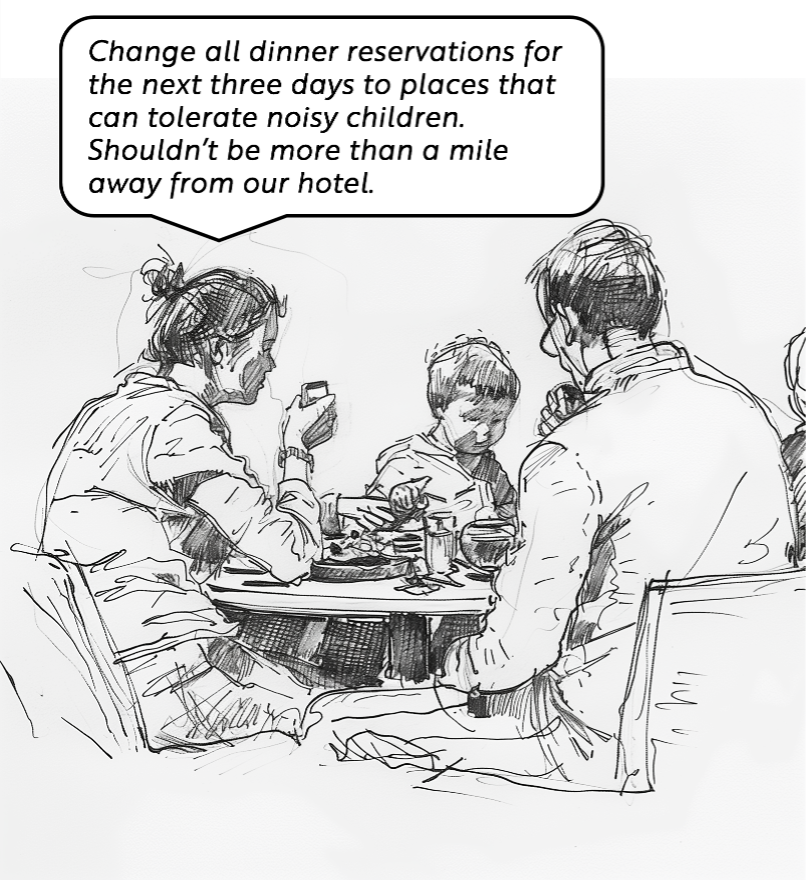

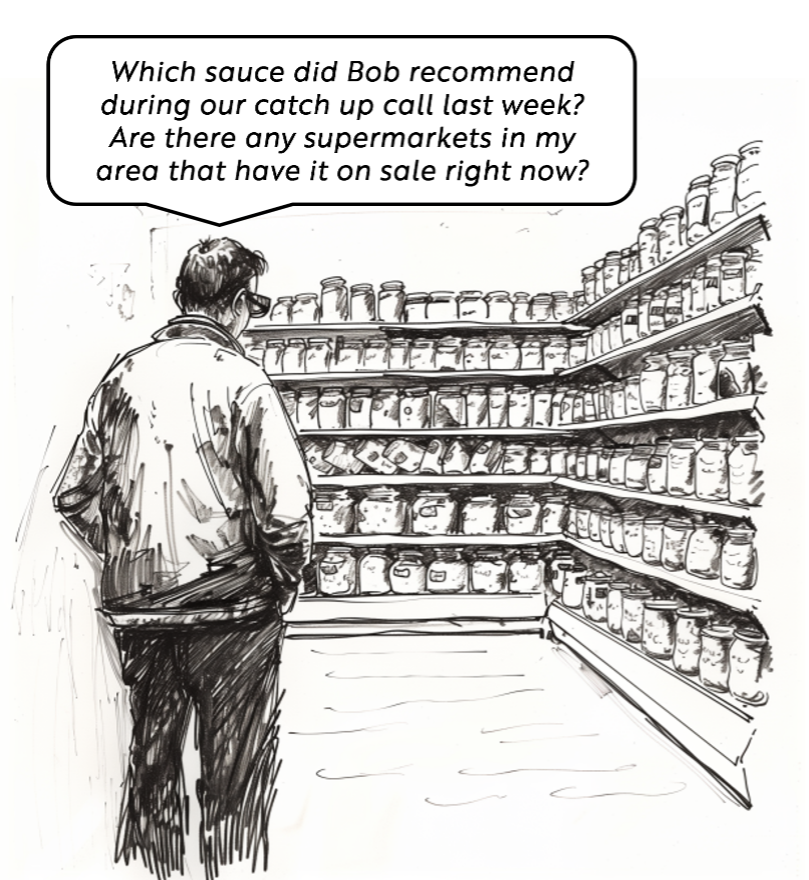

In our view, AI agents are software programmed (1) to understand natural language queries, (2) to execute user-specified tasks across the internet, and (3) to adapt continuously based on user preferences. Just as modern operating systems simplified direct interaction with computing hardware, AI agents are likely to sit atop operating systems (OS) and abstract away the complexities of traditional OS interactions. With access to digital interactions across all authorized consumer software, AI agents could transform the process of purchasing consumer goods and services, automating discovery, research, and hyper-personalized curation and disintermediating direct interaction between consumers and end applications, as illustrated below.

Source: ARK Investment Management LLC, 2024 . The above illustration was generated and assembled by ARK using Midjourney. For illustrative purposes only.

In other examples, consumers planning family vacations might skip extensive research and price comparisons across travel sites and default to expert assistants tuned to their preferences, or select insurance policies, manage healthcare and prescriptions, negotiate home service quotes, and more. According to Cox Automotive, in 2022 consumers increased the time spent on researching new vehicles purchases by 18%, from 12.5 hours in 2021 to nearly 15 hours.4 Enabling instant comparisons among features, prices, and financing options across current marketplaces, AI agents could save consumers significant time on shopping.

While brand recognition and loyalty currently play meaningful roles in consumer purchases, especially of non-discretionary goods and services, brand leverage is likely to shift from consumer-facing applications and marketplaces to trusted AI agents. As a result, AI choices could subsume personal brand preferences in favor of product availability, competitive pricing, and delivery times. If consumers begin to trust AI agent ride-hail recommendations, for example, they could become indifferent to ride-hail brands and options. If AI agent costs continue to drop dramatically, democratizing access to personal assistants, consumer transaction decision making could transform materially.

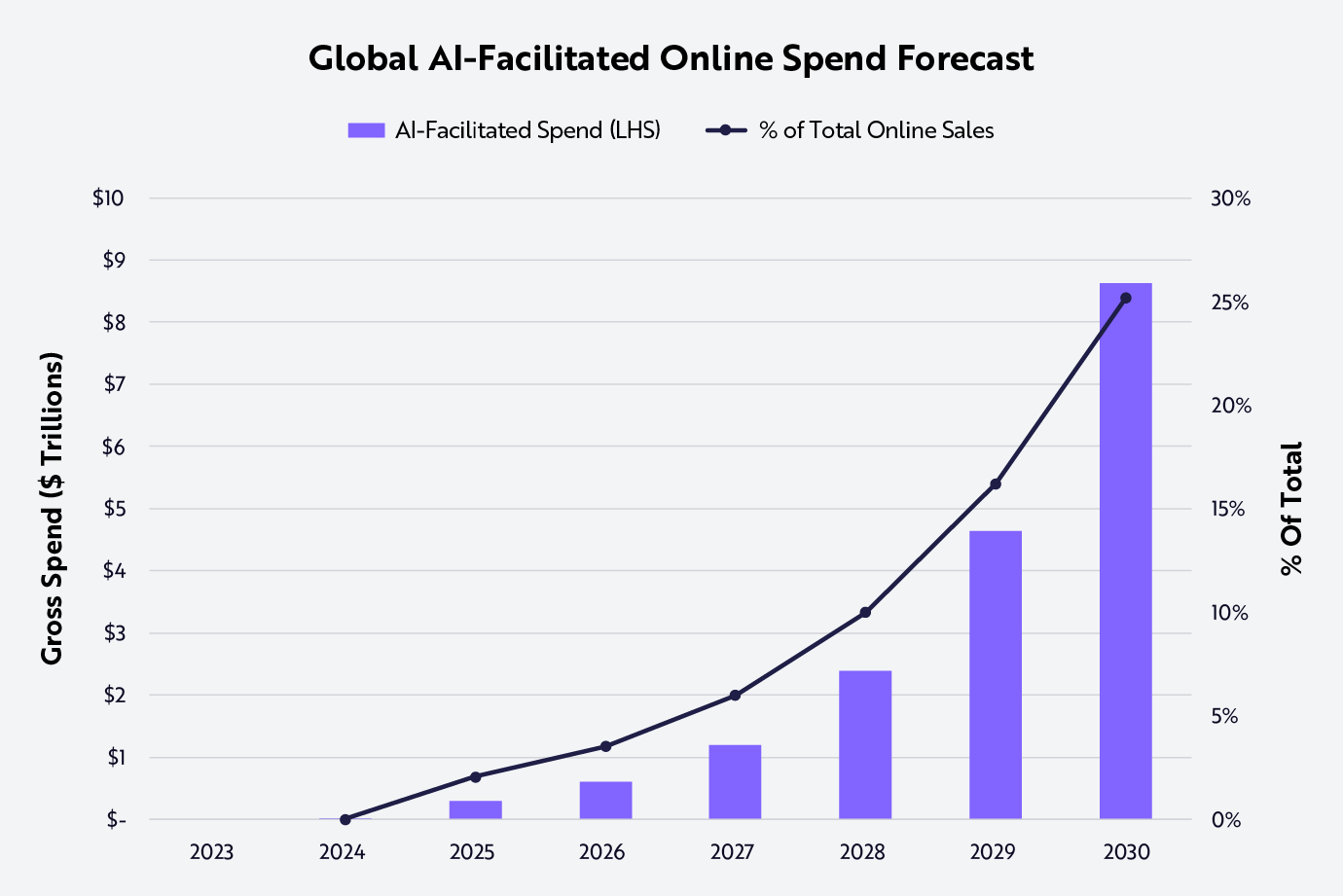

ARK’s research suggests that, by the end of this decade, AI agents could facilitate nearly $9 trillion in global private consumption, growing from little more than zero today. Our estimate includes intermediation at both the application layer, like an AI assistant on a Shopify storefront, and the OS layer, or an all-encompassing personal AI agent. According to our estimates, AI will influence 25% of global online sales of consumer goods and services in 2030, as shown below.

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources as of March 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Forecasts are inherently limited and cannot be relied upon.

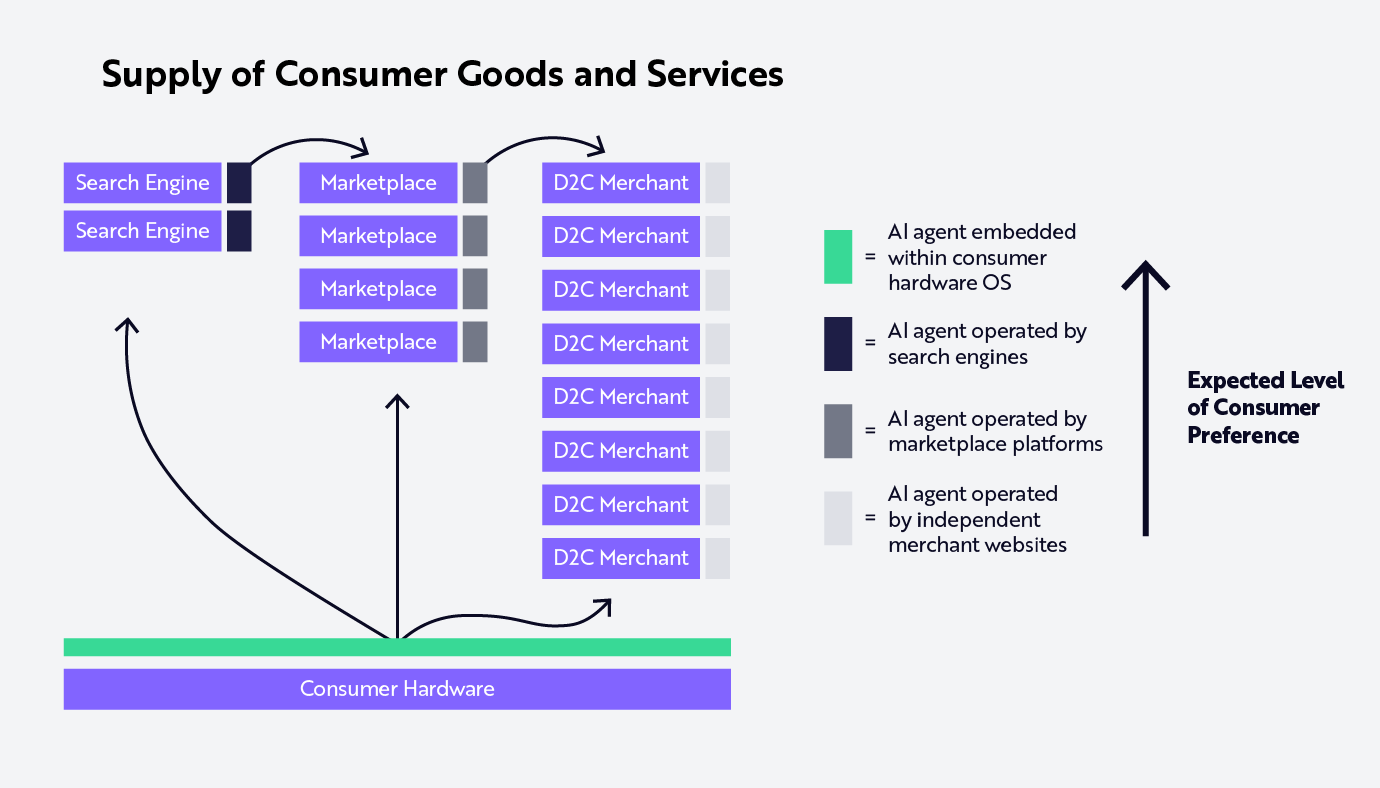

We also anticipate that all digital commerce participants—search engines, marketplace platforms, and direct-to-consumer (D2C) merchants—will compete for AI-facilitated volumes by embedding their own AI assistants on their respective platforms, as illustrated below.

Source: ARK Investment Management LLC, 2024. For illustrative purposes only.

Competitively, in the short term, search engines could ban AI-led traffic from specific operating systems, and marketplaces could ban traffic from specific search engines. Longer term, AI agents at the operating system level are likely to maximize consumer utility, encouraging most marketplaces to offer their inventory.

This process could resemble the way that merchants adopted digital payment methods during the past decade. Despite their preference for cash, brick-and-mortar merchants prioritized consumer preferences, increasing the adoption of credit cards, digital wallets, and buy-now-pay-later (BNPL) methods.

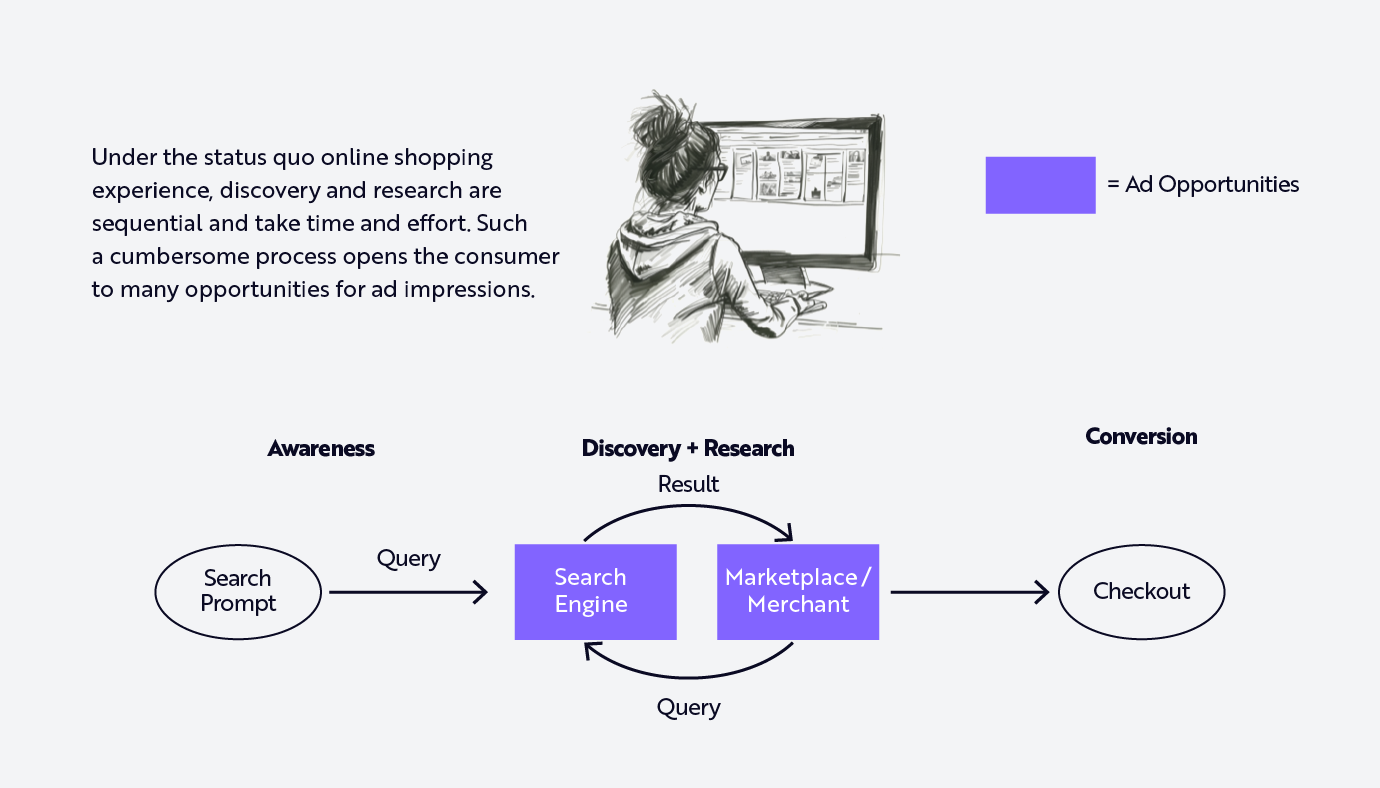

AI Agent Advertising

As consumers shop online in new ways, the digital advertising ecosystem is likely to face substantial disruption, across search, display, and marketplace ad spend. Currently, online shopping involves a sequential process of discovery and research through search queries and results. Importantly, that process created opportunities for ad impressions in search results, on marketplace platforms, and on independent websites across the open web, as illustrated below.

Source: ARK Investment Management LLC, 2024. The above illustration was generated and assembled by ARK using Midjourney. For illustrative purposes only.

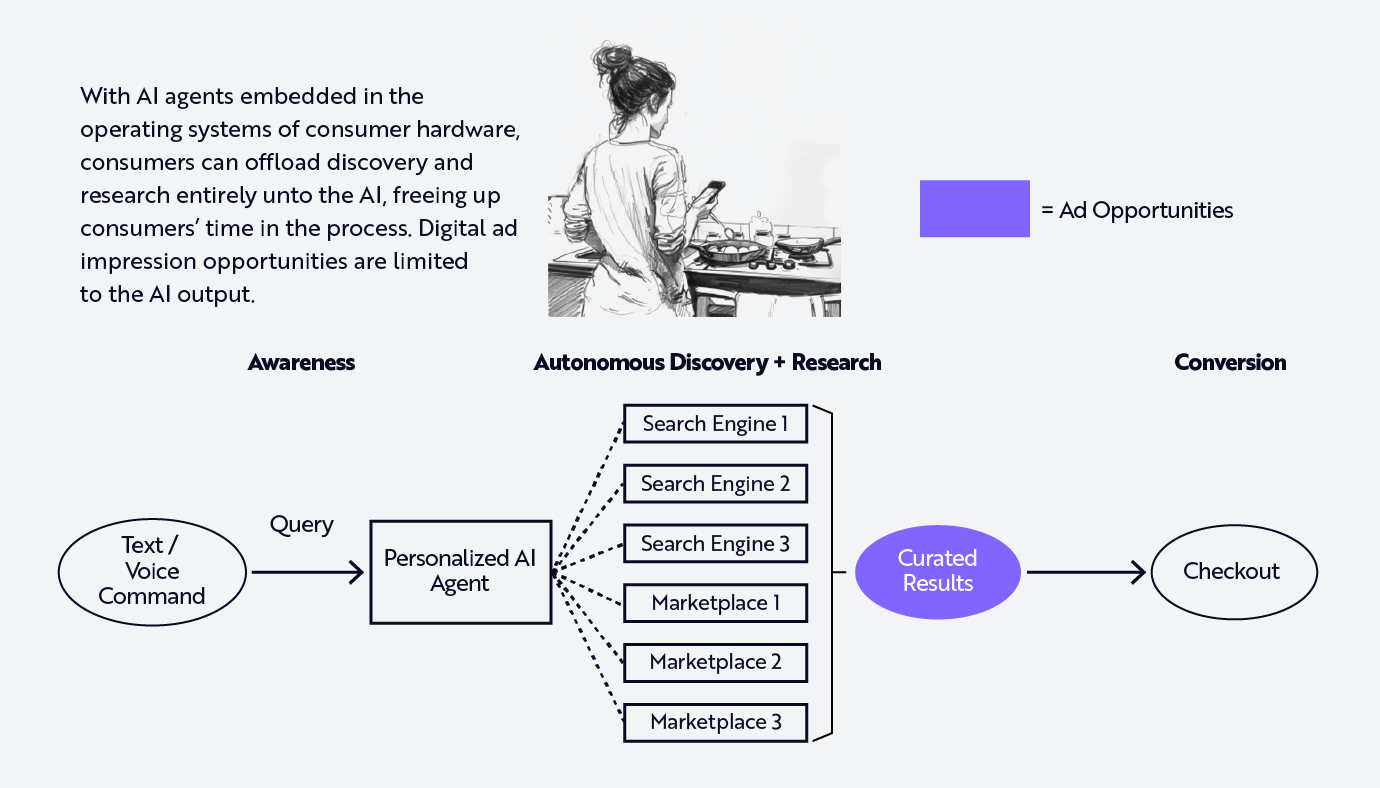

As AI assistants intervene, those advertising opportunities should drop significantly, as shown below.

Source: ARK Investment Management LLC, 2024. The above illustration was generated and assembled by ARK using Midjourney. For illustrative purposes only.

If consumers rely on AI engines instead of manual research, as we believe they will, search engines, marketplaces, and independent websites will lose significant traffic and ad impressions as AI agents increasingly control most viable ad impressions during the transaction process. That said, AI agent advertising will have to be curated to look natural, unobtrusive, and contextual as well as transparent enough to ensure that users can determine the data used to balance privacy and convenience.

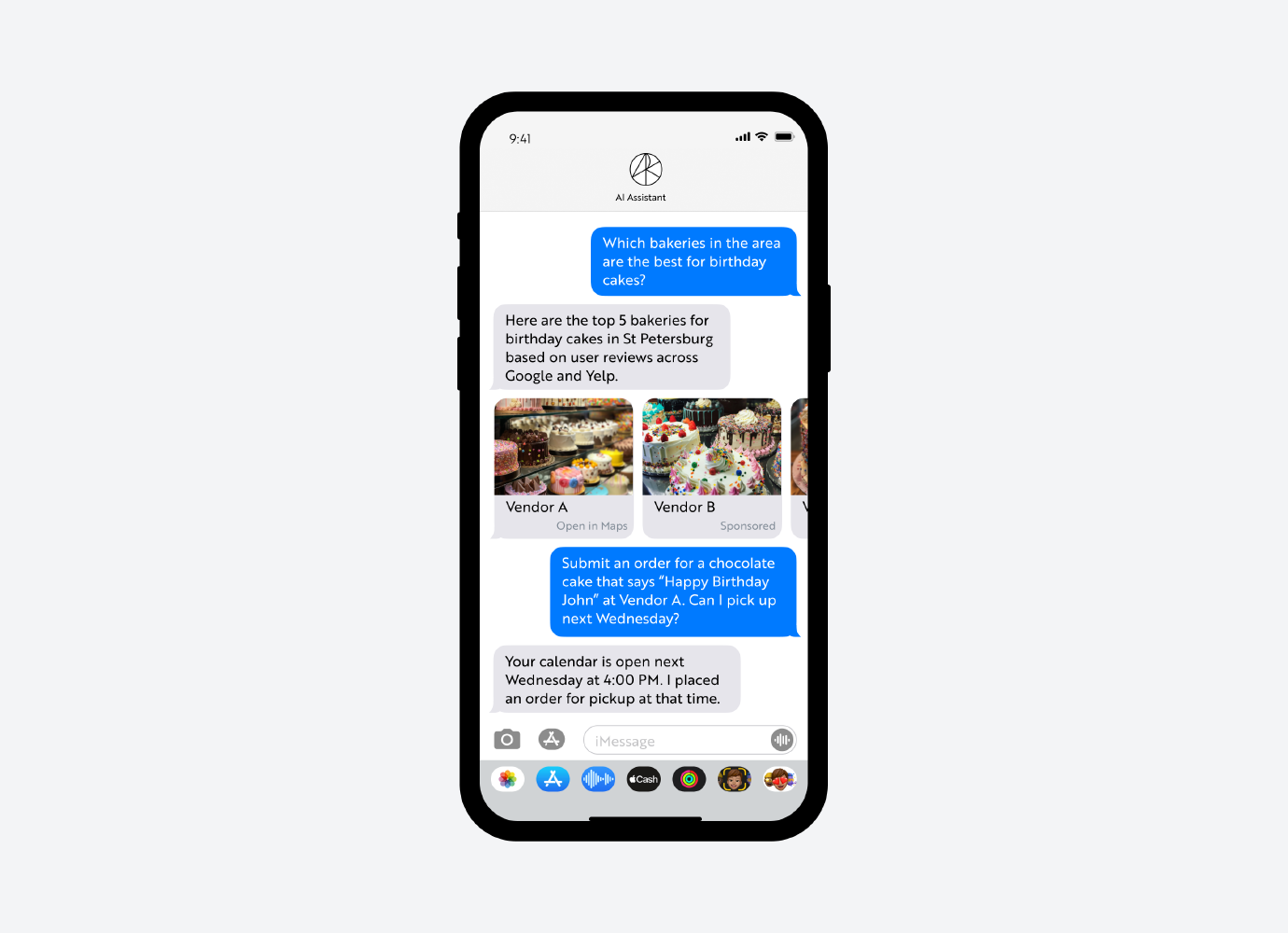

Our research suggests that AI agents will enable two forms of advertising: retrieval-based ads and active intent-generation ads. In response to a specific query or task, retrieval-based ads—like search ads today—could offer targeted ads alongside organic curation. In the image below, we illustrate a fictional chat-based interaction between a user looking for bakery recommendations and the AI agent providing organic sponsored search results. The user follows up with an order for a birthday cake, which the agent accommodates.

Source: ARK Investment Management LLC, 2024. The above illustration was generated and assembled by ARK using Midjourney and Figma. For illustrative purposes only.

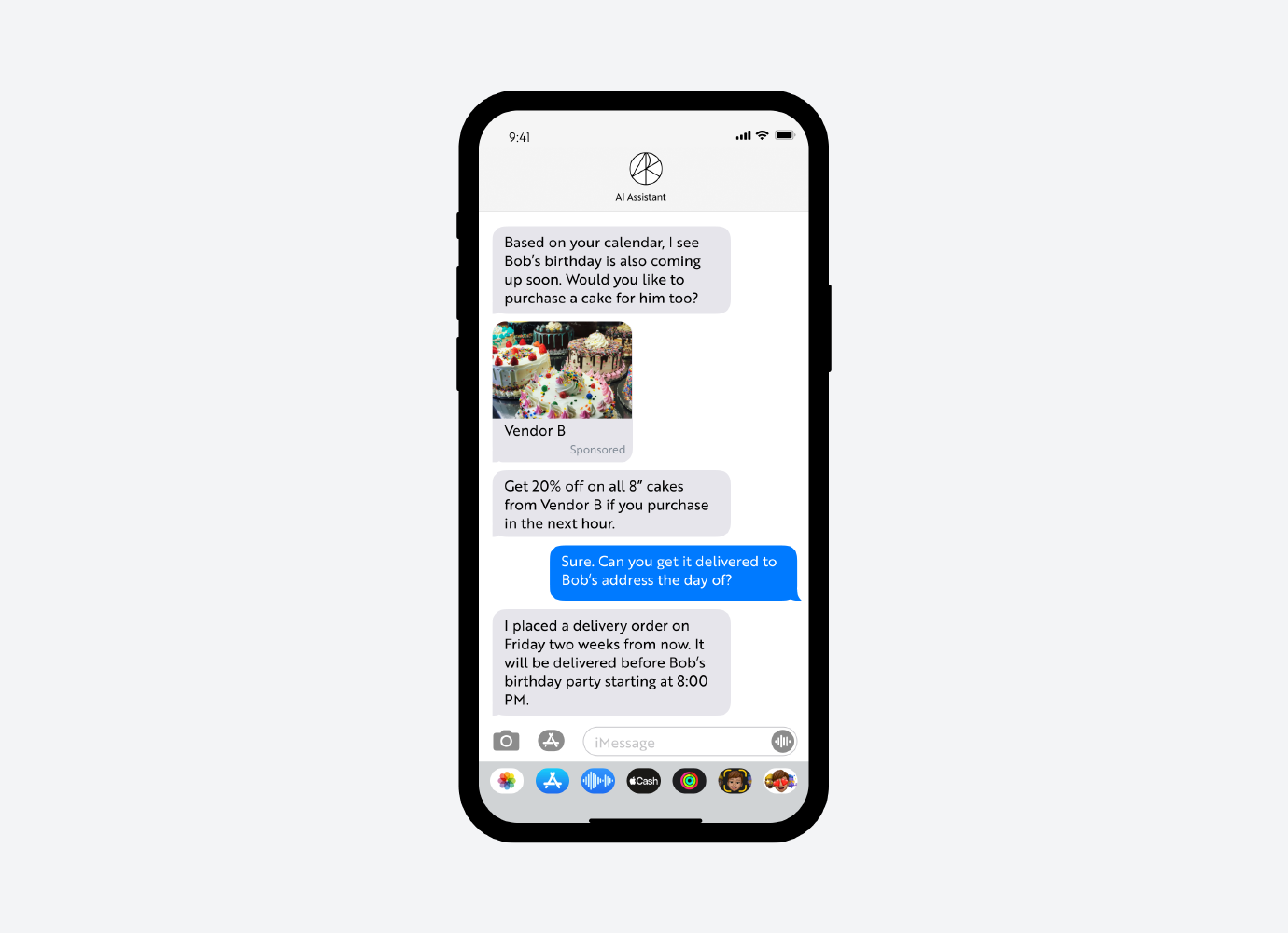

Based on the information that OS-level AI agents access across authorized data sources, active intent-generation will be possible only with OS-level AI agents that personalize recommendations based on information that consumers are willing to release about their behavior across the internet and applications. The image below continues the fictional journey depicted above with subsequent purchase opportunities based on the context provided by consumer calendars. Here, the AI agent presents a discounted offer on a birthday cake for another person’s party registered in the user’s calendar.

Source: ARK Investment Management LLC, 2024. The above illustration was generated and assembled by ARK using Midjourney and Figma. For illustrative purposes only.

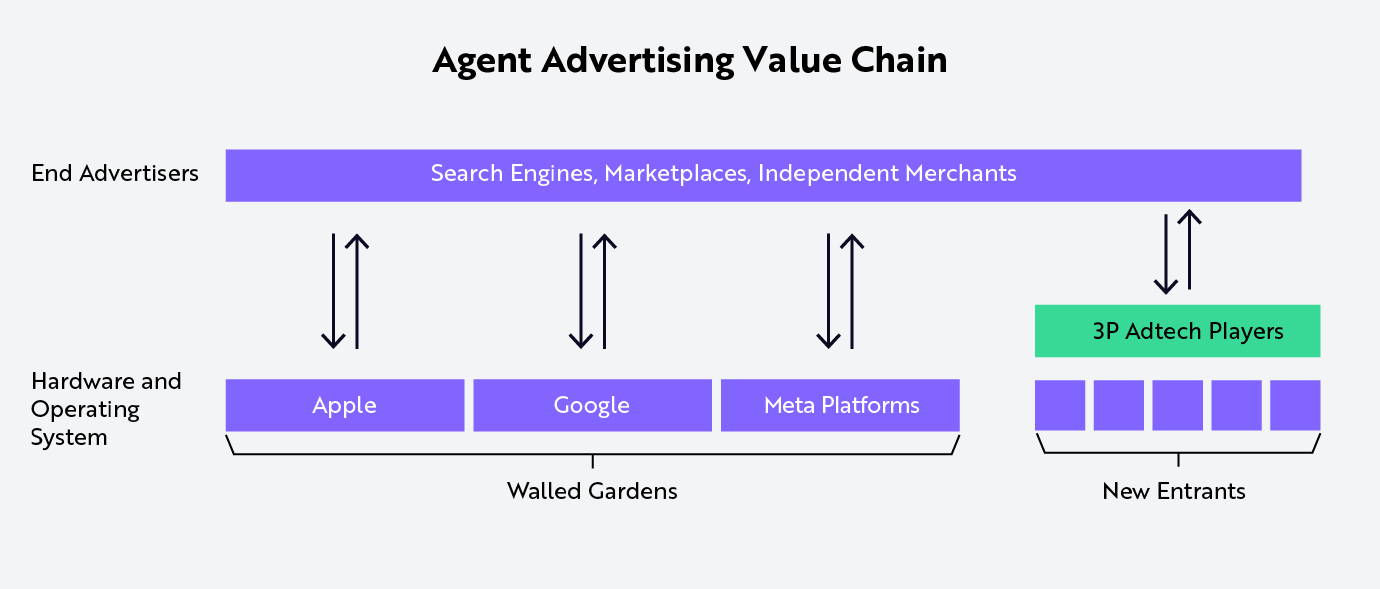

Increased competition from the long tail of AI consumer hardware should expand adtech opportunities, potentially shifting ad spend away from walled gardens to demand aggregators addressing heterogeneous hardware. As commerce channels advertising inventory through agents, OS/hardware like Apple iOS, Google Android, and Meta smart glasses could thrive as walled gardens that require advertisers to interact directly with their ecosystems.

With increased demand for AI wearables, third-party adtech platforms could benefit disproportionately by aggregating agent-derived ad supply. Importantly, search engines, marketplaces, and independent merchants are likely to compete for space inside the curated output of OS-level AI agents, as illustrated below.

Source: ARK Investment Management LLC, 2024. For illustrative purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

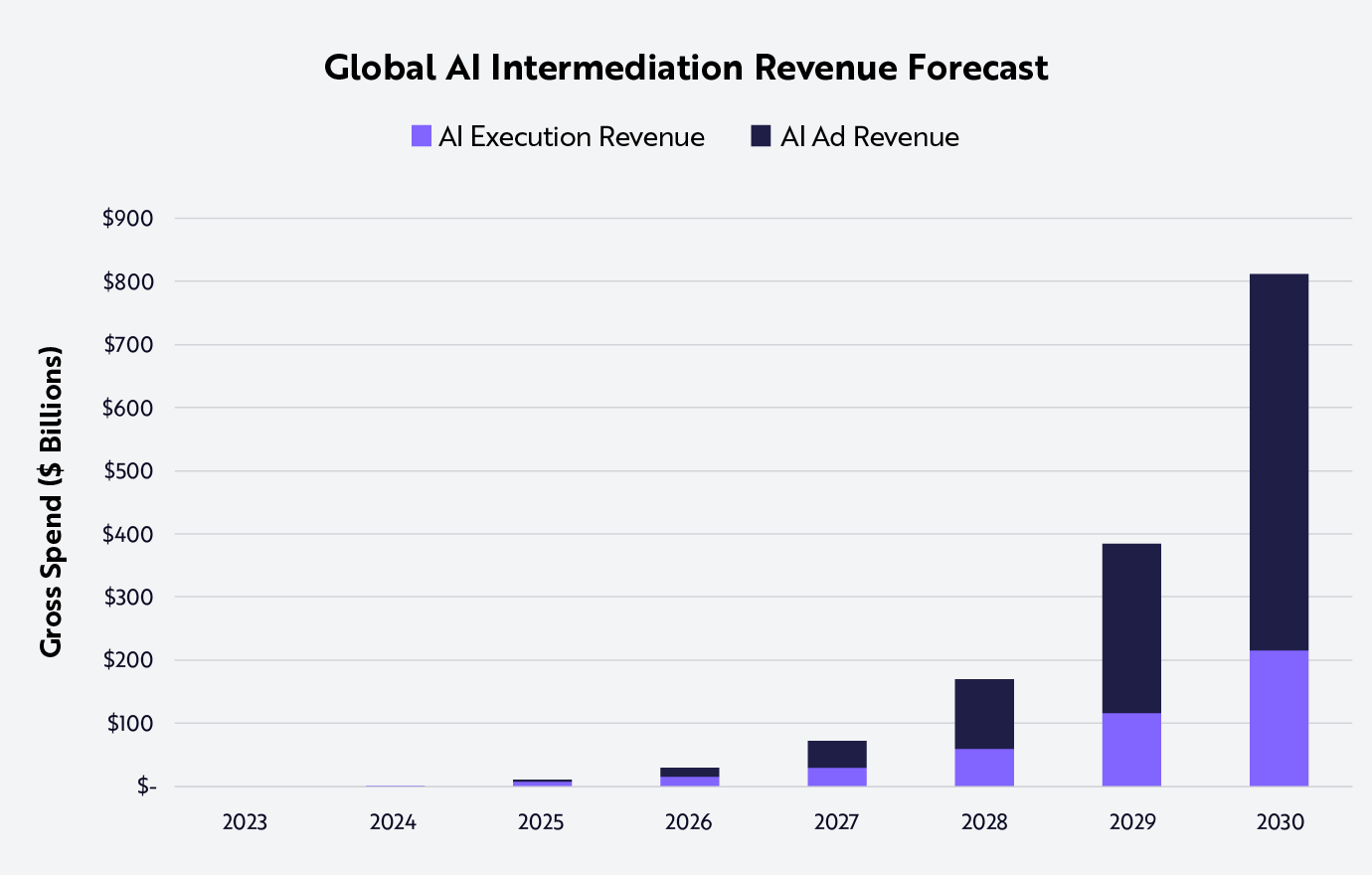

If AI-facilitated ad spend were to approach $9 trillion globally in 2030, AI agents could extract more than $800 billion in total intermediation revenue, up from zero today. The take-rate on purchases could approach 2.5% of revenue, or $220 billion; competition for AI agent-based lead generation could be commoditized, as has been the case in traditional payment processing.

Our research suggests that agent-based advertising should account for 75%—or $600 billion—of the $800 billion in intermediation revenue, at a take rate of 7% on gross advertising spend—the mid-point between (1) the 6% share of US search and display ad spend relative to total online spend on consumer goods and services and (2) Amazon’s 8% ad revenue relative to its US gross merchandise value (GMV).5

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources as of March 2024, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency.

Voice

Just as command-line interfaces of the 1970s gave way to graphical user interfaces of the 1980s, paving the way for modern web-based interfaces, human-computer interaction involving punch cards and complex technical knowledge transformed into keyboard commands informed by little technical expertise. Smartphones and tablets then forged the way to touch and mobile interfaces that simplified our interactions with computers even further.

Today, gesture and voice are the natural user interfaces (NUIs). Whereas early NUIs like Apple’s Siri and Amazon’s Alexa operated with limited functionality, generative AI is likely to realize the potential of NUIs by circumventing physical interactions and transforming complex human-computer interactions into conversations similar to human-human exchanges, as suggested below.

Source: ARK Investment Management LLC, 2024 . The above illustration was generated and assembled by ARK using Midjourney. The illustration depicts a consumer interacting with his AI assistant embedded in his smart glasses to interact with his physical surroundings. For illustrative purposes only.

Voice-centric NUIs also should capture nuanced speech, tone, and emotions that increase personalization. Combined with real-time data from AI wearables, personalization could transform consumer hardware into assistants that predict and respond to user needs.

Voice and wearables, however, need not displace desktop and mobile GUIs. Just as smartphones revolutionized personal computing without rendering PCs obsolete, AI wearables and voice-centric interfaces are likely to augment rather than replace the smartphone.

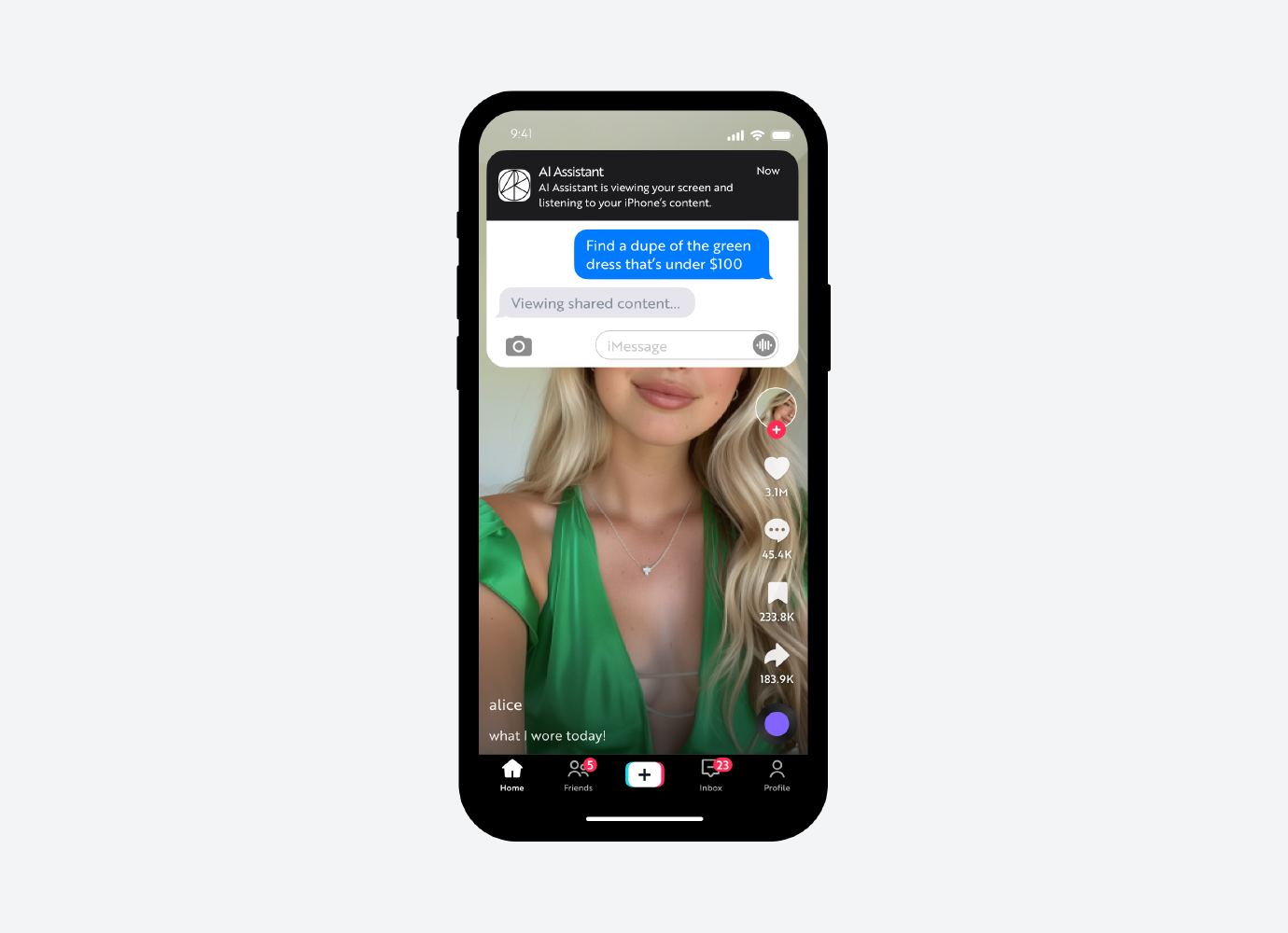

Historically, shifts in computing platforms have created diversification and specialization instead of displacement. Mainframe computers still process data for industries like financial services, healthcare, and government agencies requiring high throughput and extensive security, whiledesktops are preferred to smartphones for video editing, software development, word processing, spreadsheet software, and presentation applications.

Source: ARK Investment Management LLC, 2024. The above illustration was generated and assembled by ARK using Midjourney and Figma. The image illustrates a smartphone user interface in which the user is sharing her screen and audio to an AI assistant real-time, instructing the AI based on the content seen on a short-form video app. For illustrative purposes only.

Our research suggests that smartphones and other screen-based hardware will coexist with new AI hardware for two reasons. First, consumers focused on privacy are likely to use handheld screens for text rather than voice commands in social situations. Second, audiovisual digital entertainment will require screens.

Smartphones could become the central hub of personal hardware ecosystems. If so, smartphones would host stationary devices like desktops and laptops, ancillary screens like tablets, augmented reality and virtual reality (AR/VR) headsets, and AI-enabled wearables to create seamless, interconnected experiences.

Category Winners and Platform Strategy

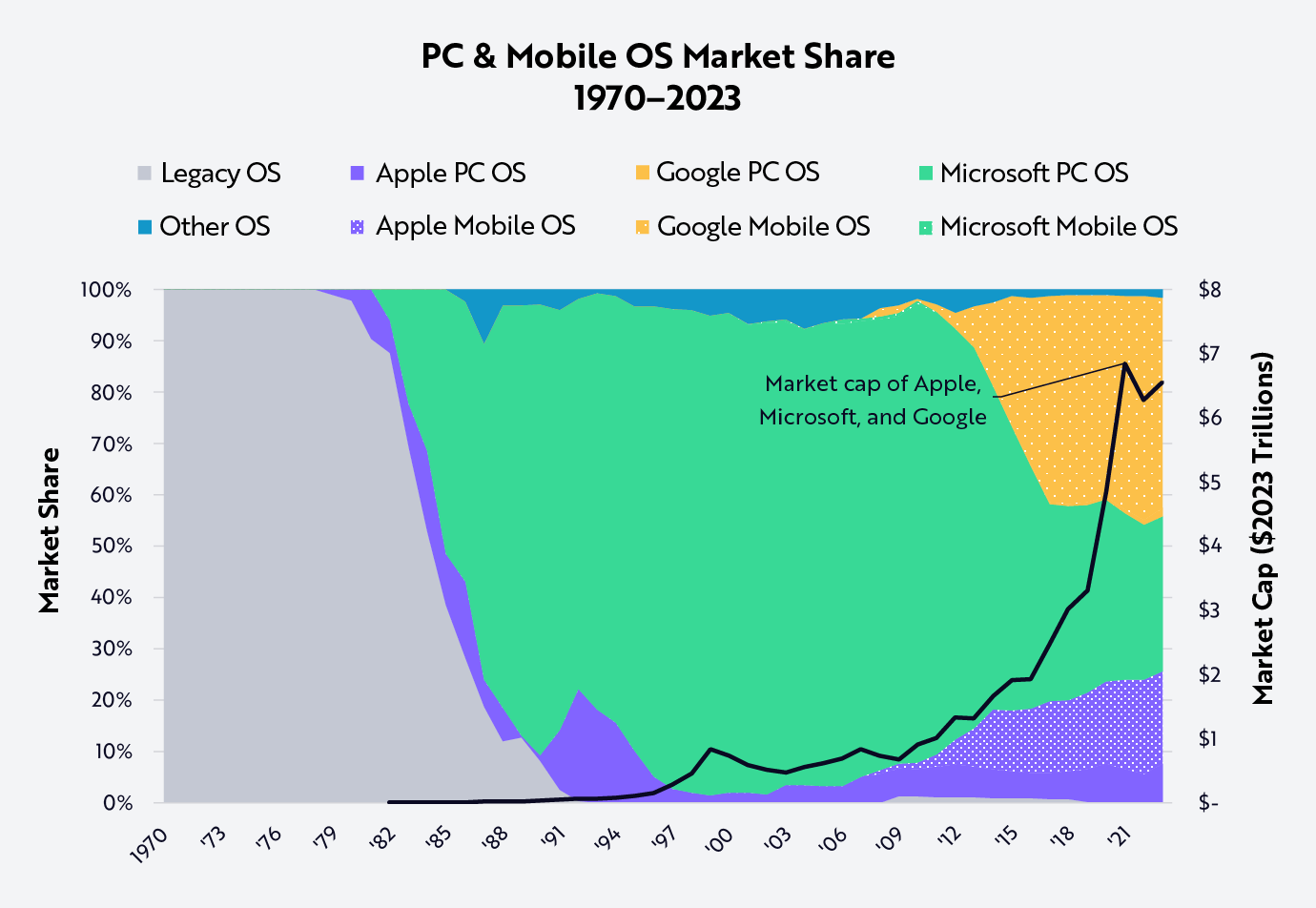

While many investors are assuming that generative AI will benefit incumbent technology companies, market share shifts in response to the desktop OS and the mobile OS suggest that the winning consumer hardware platforms will deploy different strategies.

From 1970 through 2023, the market share shifts in response to the debuts of PC and mobile operating systems are instructive, as shown below.While the initial personal computers appeared in the early 1970s, significant commercialization efforts did not begin until IBM entered the market around 1980. This set the stage for Microsoft, which, although founded in 1975, did not launch its Windows operating system until 1985, ten years after its founding and 14 years after the earliest commercial launch of PCs.

Similarly, Palm OS and Microsoft’s Windows CE both launched in 1996,6 but the mobile market did not begin to scale until the Apple and Google duopoly entered the competition 11 to 12 years later.7 As of 2023, Google dominated the OS war with 43% market share when combined across PC and mobile, well above Microsoft’s 30% and Apple’s 26% share. That said, Apple’s share of the ecosystem’s profits was 53%.8

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources including Ball 2023,9 Eylenburg 2024,10 and StatCounter 202411 as of March 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

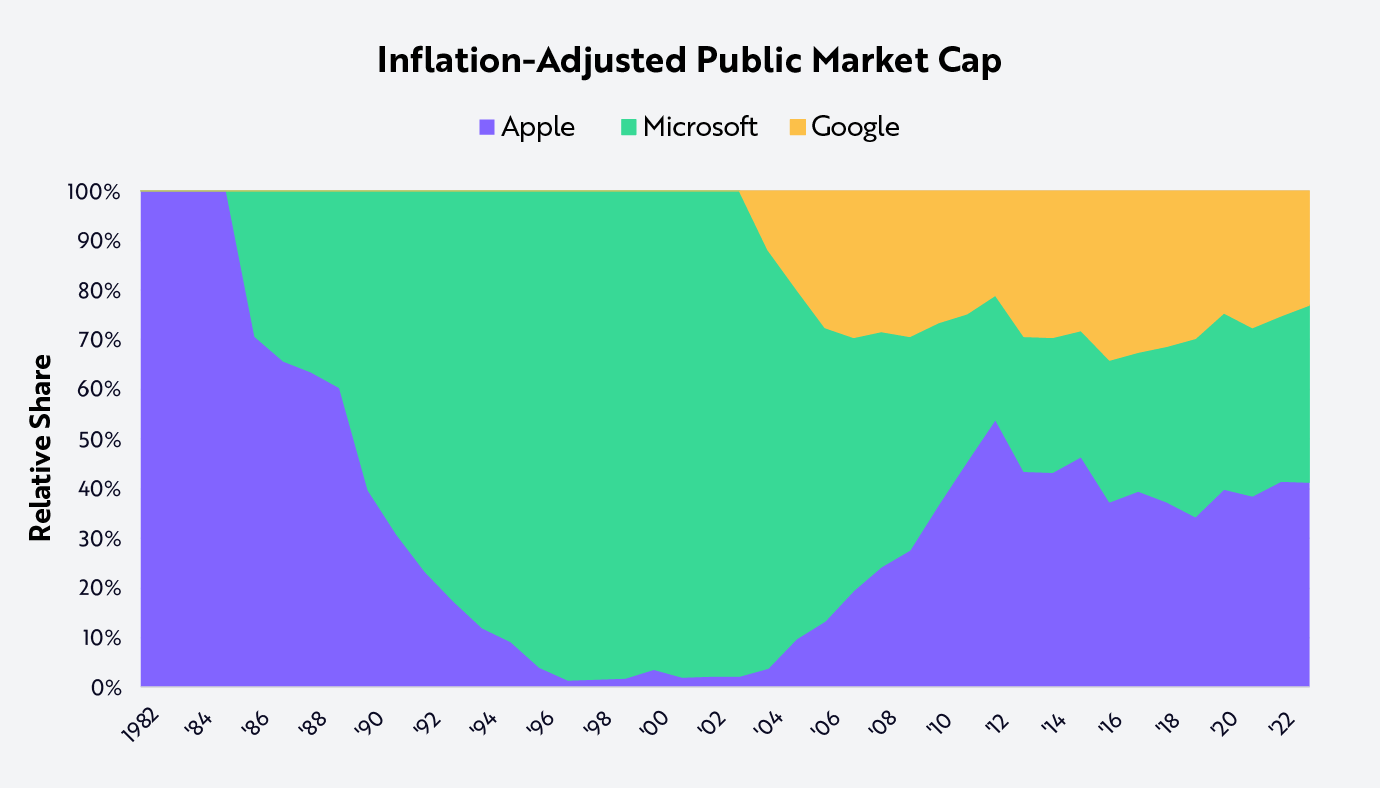

Given the difference between the revenue share and the market cap share of each OS, vertical integration prevailed over the licensing models: Apple commanded 43% relative share of market cap in 2023 compared to Microsoft’s 36% and Google’s 23%, as shown below.

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on historical data from S&P Global, adjusted to 2023 US dollars using the US Consumer Price Index as of March 2024.12 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Both the PC and mobile OS markets experienced fragmentation and fierce battles for dominance in their early years. Among competitors in the PC market during the 1970s and early 1980s were pioneers like Unix, Xerox, CP/M, TRSDOS, Commodore, Atari, and Apple—all eventually outpaced by Microsoft. Similarly, in the mobile market, Palm OS, Microsoft’s Windows CE, and Symbian gave way to the Android and iOS duopoly.

Apple, Google, Microsoft, and Meta currently enjoy significant moats due to their established ecosystems. Apple’s seamless integration of hardware and software fosters a user-friendly and loyal customer base. Google’s Android dominates the mobile OS market by offering open licensing to third-party OEMs, creating a vast ecosystem that monetizes its services. Microsoft leverages its software ecosystem, built through open licensing of Windows, to maintain its dominant position in the PC market. Meta, formerly Facebook, has created a vast social network ecosystem with platforms like Facebook, Instagram, WhatsApp, and Oculus, driving user engagement and monetizing through advertising and virtual reality experiences.

Those moats could deepen with a strategic approach to AI. Apple could further enhance user experiences by integrating advanced AI capabilities, creating more personalized and intuitive interactions. Google could leverage its extensive data and AI expertise to enhance its services, making Android and its ecosystem even more indispensable. Microsoft could use AI to boost productivity and enterprise solutions, solidifying its leadership in both consumer and business markets. Meta could enhance user engagement and experiences across its social platforms and virtual reality environments by integrating sophisticated AI algorithms for personalized content, advertising, and immersive interactions.

These tech giants also benefit from unmatched distribution networks. Apple’s vast retail presence and online channels ensure widespread reach and accessibility. Google’s integration of services across various devices and platforms creates a pervasive ecosystem. Microsoft’s extensive partnerships and enterprise connections that enable it to distribute its software and services globally. Meta’s social platforms have a global user base, and its advertising network reaches billions of users, providing unparalleled distribution for its content and services. Unparalleled distribution capability further strengthens their market positions, making it challenging for new entrants to compete at the same scale.

Despite their leads, however, new entrants might still win by focusing on consumer-centric products that extend beyond the above companies' ecosystems. Consumers’ lackluster reception of recently launched AI wearables like the Humane Ai Pin and the Rabbit R1 indicates that the AI hardware adoption cycle remains in its nascent experimentation stage. That said, by prioritizing innovative and user-friendly designs, new players could carve out niches that appeal to consumer needs not fully addressed by the current leaders. By emphasizing flexibility, customization, and seamless integration across different platforms, newcomers potentially could disrupt established markets and attract a loyal customer base. The ultimate winners are likely to be those who best understand and adapt to evolving consumer demands, proving that, even in a landscape dominated by tech giants, there is room for innovation and competition.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024