Bitcoin: A Unique Risk-Off Asset?

Because of the 2008 Global Financial Crisis, trust in governments and financial institutions has waned. Since then, events like the European Sovereign Debt Crisis, the U.S. Federal Reserve’s response to COVID19, and the collapse of major US regional banks have exposed the pitfalls of relying on centrally controlled institutions.

Along with the accelerated impact of technological innovation, this deterioration in trust has called into question the effectiveness of traditional risk-off assets in protecting modern portfolios. Are government bonds less risky in the wake of events like the European Sovereign Debt Crisis? Is physical gold less effective as a hedge in a digital economy? Will inconsistent Fed policies threaten the dollar’s role as a reserve currency? While traditional risk-off assets are likely to play a role in portfolio construction, their limitations are giving investors reason to reassess so-called risk-off assets.

While the “risk-on” versus “risk-off” characteristics of traditional assets are mutually exclusive, Bitcoin has introduced a paradigm that is challenging that distinction. Its revolutionary technology and nascency are risk-on, while, as a monetary asset, its absolute scarcity and role as a "bearer instrument”1 are risk-off—thus blurring the traditional distinction.

Bitcoin offers an interesting paradox: enabled by its groundbreaking technological underpinnings, it can act as an effective hedge against economic uncertainty, potentially resulting in exponential growth.

Source: ARK Investment Management LLC, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency.

Created in response to the Global Financial Crisis in 2008, Bitcoin has evolved from a fringe technology to a new asset class worthy of institutional allocation. As the network matures, asset allocators are likely to evaluate seriously bitcoin’s merit as a risk-off asset.

Bitcoin As A Risk-Off Asset

While its explosive growth and price volatility have led many investors and asset allocators to deem bitcoin the epitome of a risk-on asset, we believe that the Bitcoin network embodies risk-off characteristics that enable financial sovereignty, reduce counterparty risk, and enhance transparency.

Bitcoin is the first digital, independent, global, rules-based monetary system in history. By design, its decentralization should mitigate the systemic risks associated with traditional financial systems that rely on centralized intermediaries and human decision makers to dictate and enforce rules. Capital “B” Bitcoin is the financial network that facilitates the transfer and custody of lowercase “b” bitcoin, a scarce digital monetary asset.

Based on its core attributes, we believe bitcoin is the purest form of money ever created. It is:

• a digital bearer asset similar to a commodity.

• a scarce, liquid, divisible, portable, transferable, and fungible asset.

• an auditable and transparent asset.

• an asset that can be fully matched by equity and custodied without liability or counterparty risk.

Importantly, bitcoin’s properties are native to the Bitcoin network, which runs on open-source software. While many institutions coordinate functions in the traditional financial system, Bitcoin operates as a single institution. Instead of relying on central banks, regulators, and other government decision-makers, Bitcoin relies on a global network of peers to enforce rules, shifting enforcement from manual, private, and opaque to automated, public, and transparent.

Given its technological underpinnings, Bitcoin is positioned uniquely relative to traditional risk-off assets, as highlighted below.

| Risk-Off Attribute | Bitcoin | Gold | Government Bonds | Physical Cash |

| Decentralization | Fully decentralized, runs on peer-to-peer software, no central authority. | Decentralized, but requires highly centralized production, distribution, and storage, given physical nature. | Centralized by nature, issued and controlled by governmental entities, subject to arbitrary policy changes and fiscal mismanagement. | Transactions can occur without a central authority, but the value and supply are controlled by government. |

| Supply Limitation | Strictly scarce, predictable, mathematically metered monetary policy, capped at 21 million coins. | Relatively scarce, subject to discoveries of new deposits and advancements in mining technology, making future supply less predictable. | Uncapped issuance, which can lead to potential devaluation in times of aggressive fiscal expansion or monetary easing. | Unpredictable monetary policy, subject to inflation, and unlimited supply expansion. |

| Portability | Digitally native, global, highly portable, infinitely divisible. | Physical asset, cumbersome, expensive to secure and transport. | Digital in nature, but tied to the traditional financial systems, siloed to specific markets. | Physical cash is portable but impractical to carry in large amounts; digital cash requires traditional banking infrastructure. |

| Liquidity | Increasingly liquid, with global trading platforms, a regulated futures market, and spot exchange-traded funds. | Highly liquid, universally recognized store of value. | Highly liquid, but subject to liquidity issues during financial crises and in unstable regions. | Highly liquid, universally accepted for transactions. |

| Market Independence | Historically low correlation2 with traditional assets. | Historically a safe haven, though can be influenced by market conditions. | Sensitive to changes in interest rates and economic outlook. | Sensitive to changes in interest rates and economic outlook, vulnerable to inflation. |

| Accessibility | Universally accessible to anyone with internet access. | Higher barriers to entry, often requires physical storage solutions, trust in third-party custodians, and complex logistical considerations. | Restricted by geographic location and investor qualifications. | Universally accessible but requires physical handling and storage, subject to capital controls in emerging markets. |

| Security & Transparency | Secured by the world's largest computer network; fully auditable and transparent, thanks to blockchain technology. | Secured by physical atomic properties. However, auditability and transparency regarding gold’s origins and purity are prohibitively expensive. | Subject to the credit risk of the issuing government and rely on traditional financial systems for transparency. | Physical cash is subject to theft; digital cash depends on banking security. |

| Counterparty Risk | Can be custodied without liability. With effective key management, bitcoin is easy to conceal and protect, difficult to seize or steal when a private key, equivalent to ownership, is held. | Less concealable and transportable, can be physically confiscated or stolen with relative ease if not stored securely. | Can be frozen or confiscated by governmental authorities as digital records within the traditional financial system. | Physical cash is easy to custody in small amounts, but more difficult to custody in large amounts. Subject to theft. Digital cash is subject to traditional bank counterparty risk. |

Source: ARK Investment Management LLC, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency.

Bitcoin’s Relative Performance By The Numbers

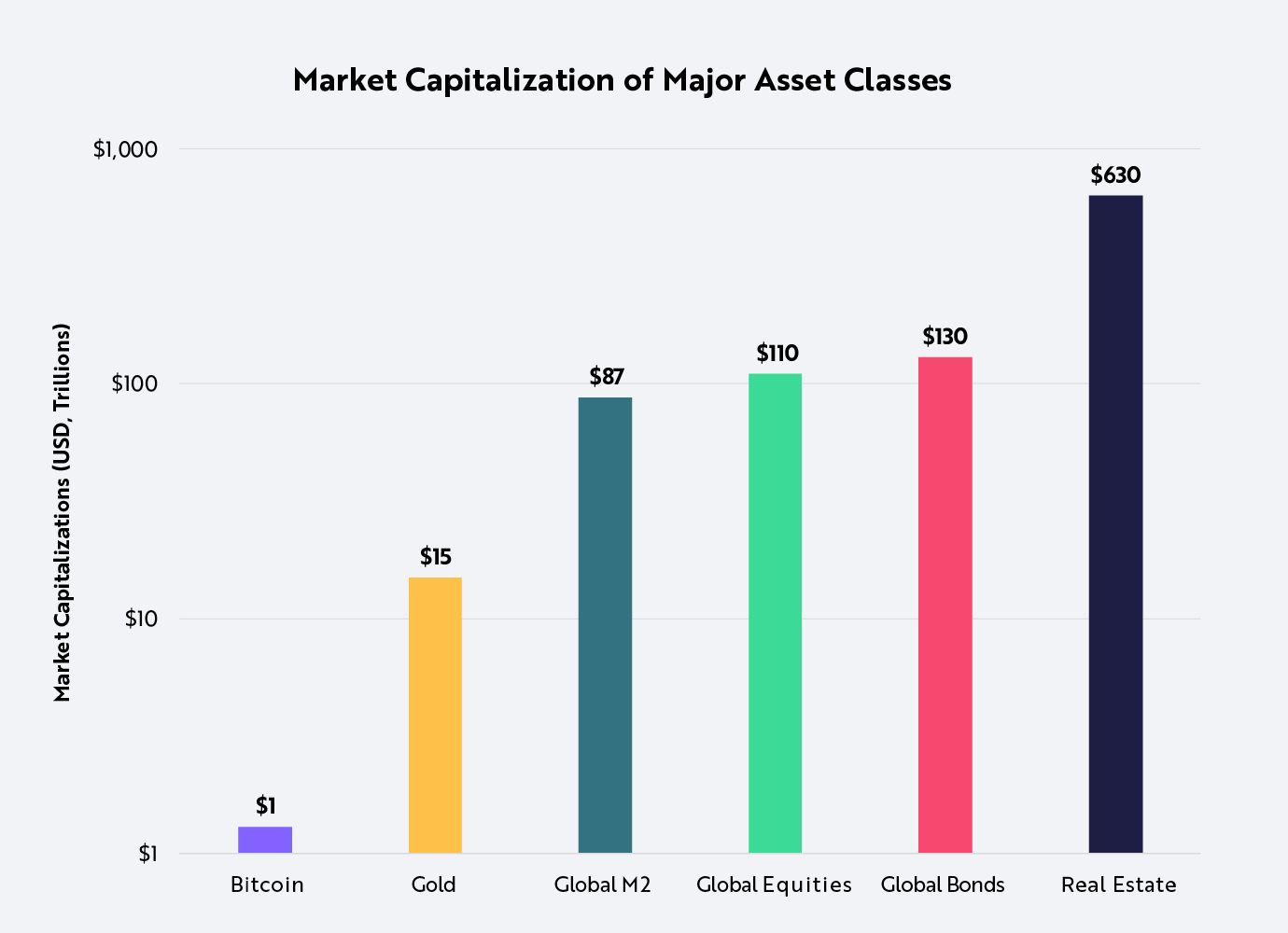

As a nascent asset, bitcoin’s speculative characteristics and short-term volatility have created distractions from its track record. In the last 15 years, bitcoin has scaled to more than $1 trillion in market capitalization, increasing its purchasing power while maintaining its independence.

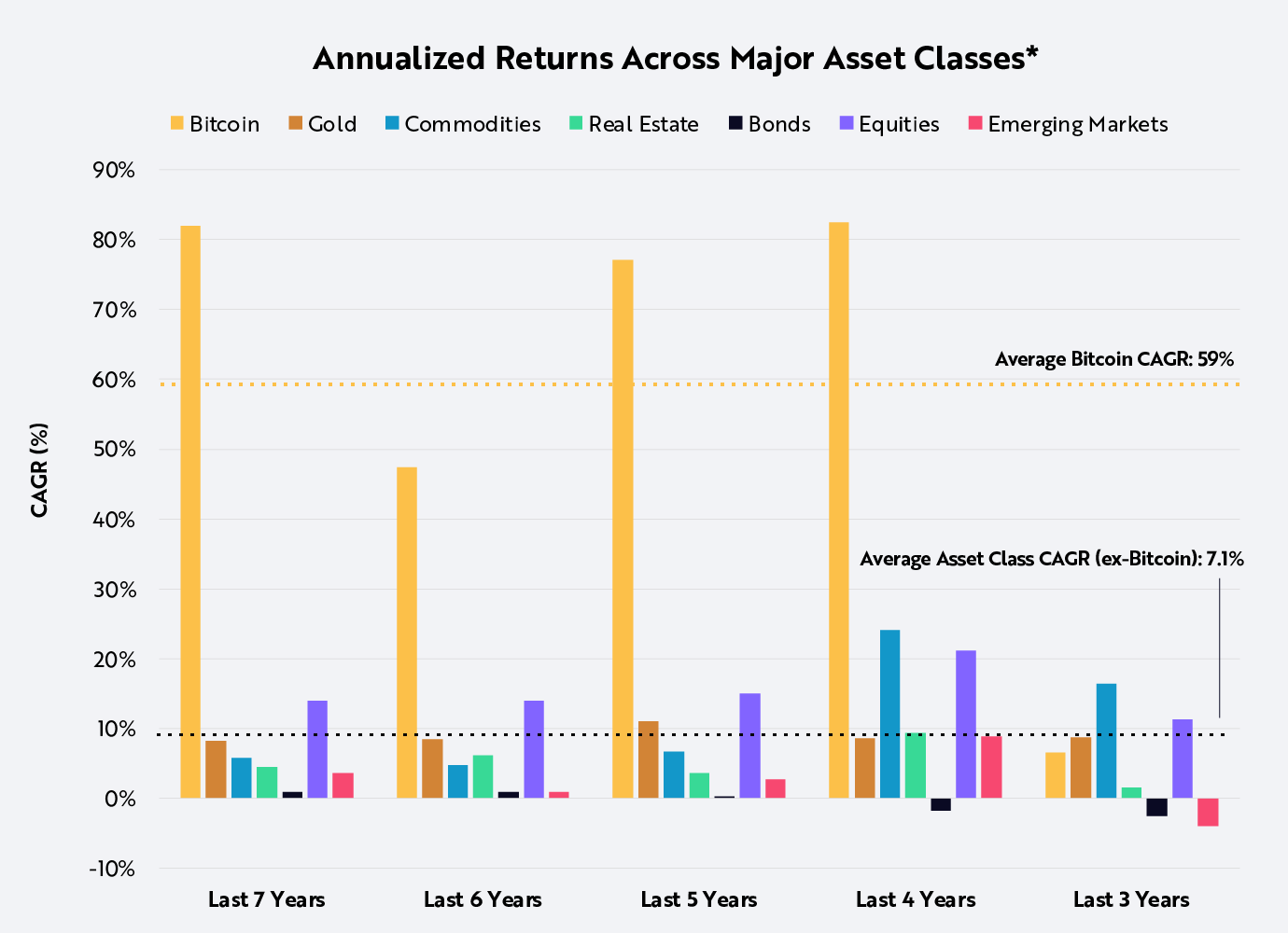

Indeed, over short- and long-term time horizons, bitcoin has outperformed every other major asset class. Over the last 7 years, it has generated annualized returns approaching 60% relative to the 7% on average of other major assets, as shown below.

*Asset classes are represented by the following instruments: SPDR S&P 500 ETF Trust (SPY, equities), Vanguard Total Bond Market Index Fund Investor Shares (VBMFX, bonds), Vanguard Real Estate Market Index Fund Investor Shares (VGSIX, real estate), SPDR Gold Trust (GLD, gold), iShares S&P GSCI Commodity-Indexed Trust ETF (GSG, commodities), and Vanguard Emerging Markets Stock Index Fund Investor Shares (VEIEX, emerging markets). The performance used to represent each asset class reflects the net asset value (NAV) performance of each ETF/fund for the time periods shown. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

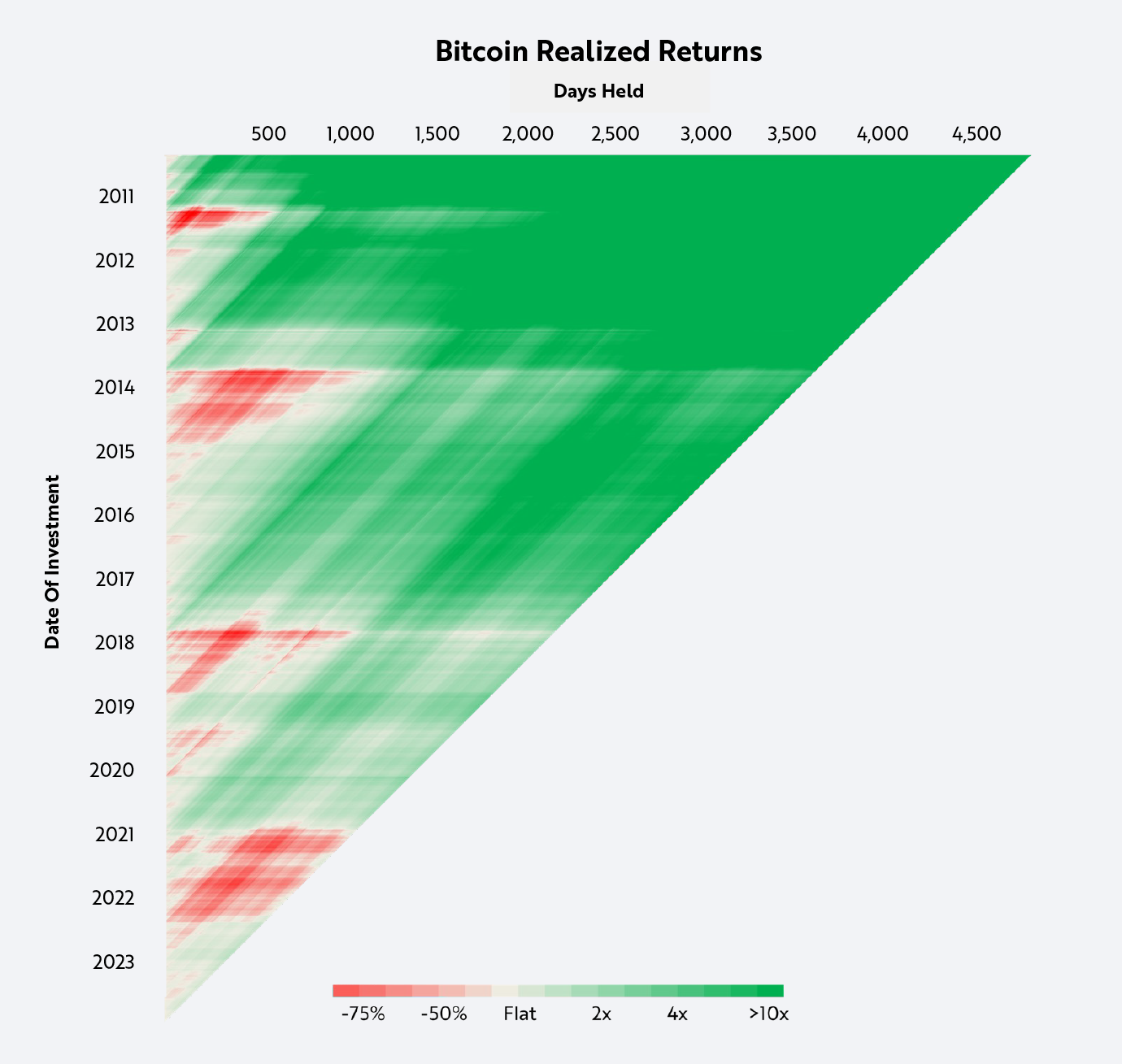

Importantly, since its inception, investors who bought and held bitcoin for 5 years have profited, regardless of the timing of their purchases, as shown below.

Source: ARK Investment Management LLC, 2024, based on data from Glassnode as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

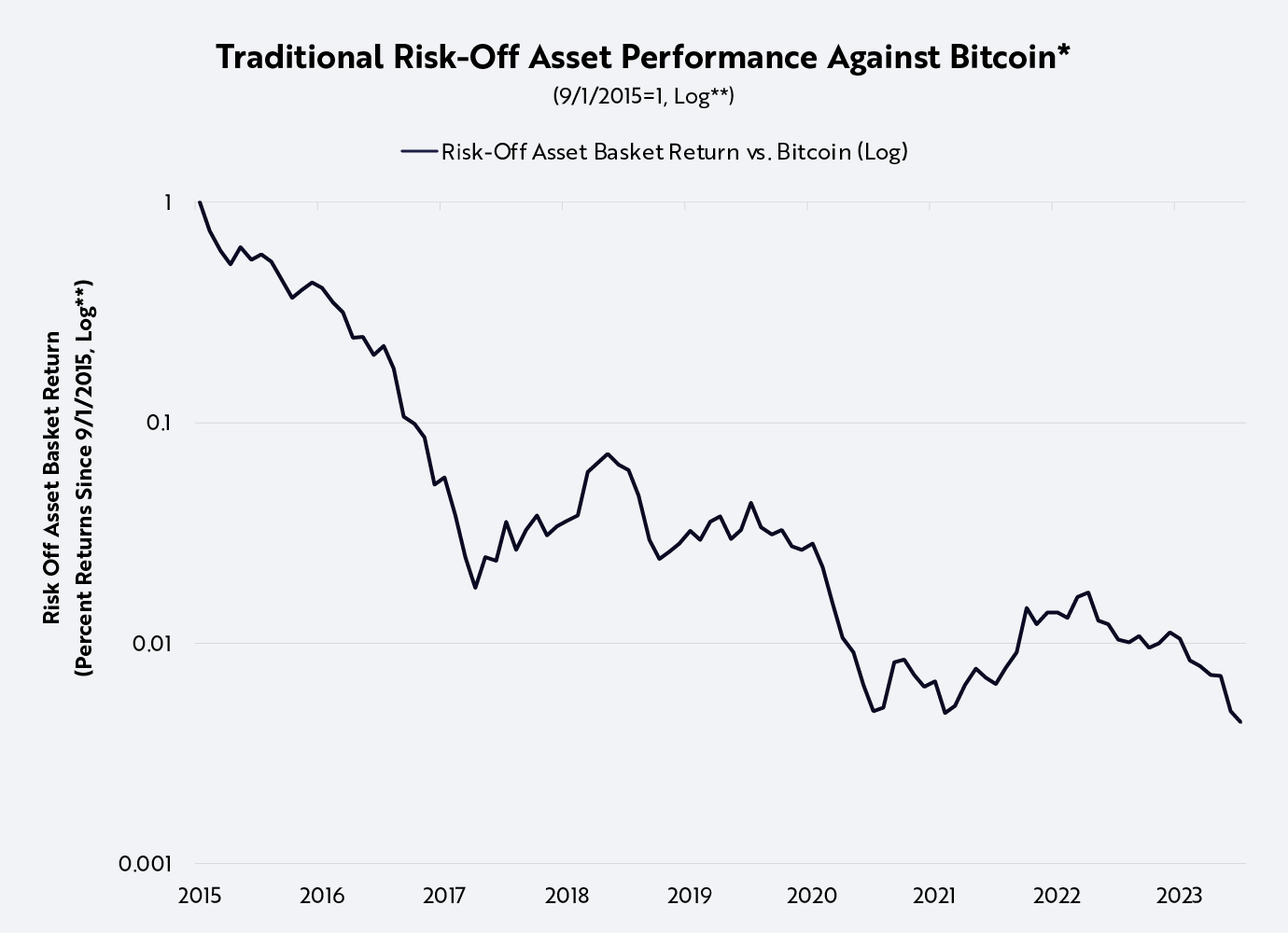

In contrast, relative to bitcoin, traditional risk-off assets like gold, bonds, and short-term U.S. Treasuries have lost 99% of their purchasing power over the last decade, as shown below.

*The risk-off asset basket herein is composed equal weights the Vanguard Total Bond Market Index Fund Investor Shares (VBMFX, bonds), the SPDR Gold Trust (GLD, gold), and the Vanguard Short-Term Treasury Fund Investor Shares (VFISX) . The returns used reflect the net asset value (NAV) performance that are applicable to each fund. In the case of bitcoin, performance does not reflect the deduction of any brokerage or trading fees that may apply. The basket returns are hypothetical and do not represent the performance of an actual portfolio. **Log: Refers to the logarithmic scale, a non-linear scale where each unit of length is a multiple of some base value raised to a power, and corresponds to the multiplication of the previous value in the scale by the base value (10 in this case). Source: ARK Investment Management LLC, 2024, based on data from PortfolioVisualizer and Glassnode as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Is Bitcoin Too Volatile To Qualify As An Asset That Preserves Capital?

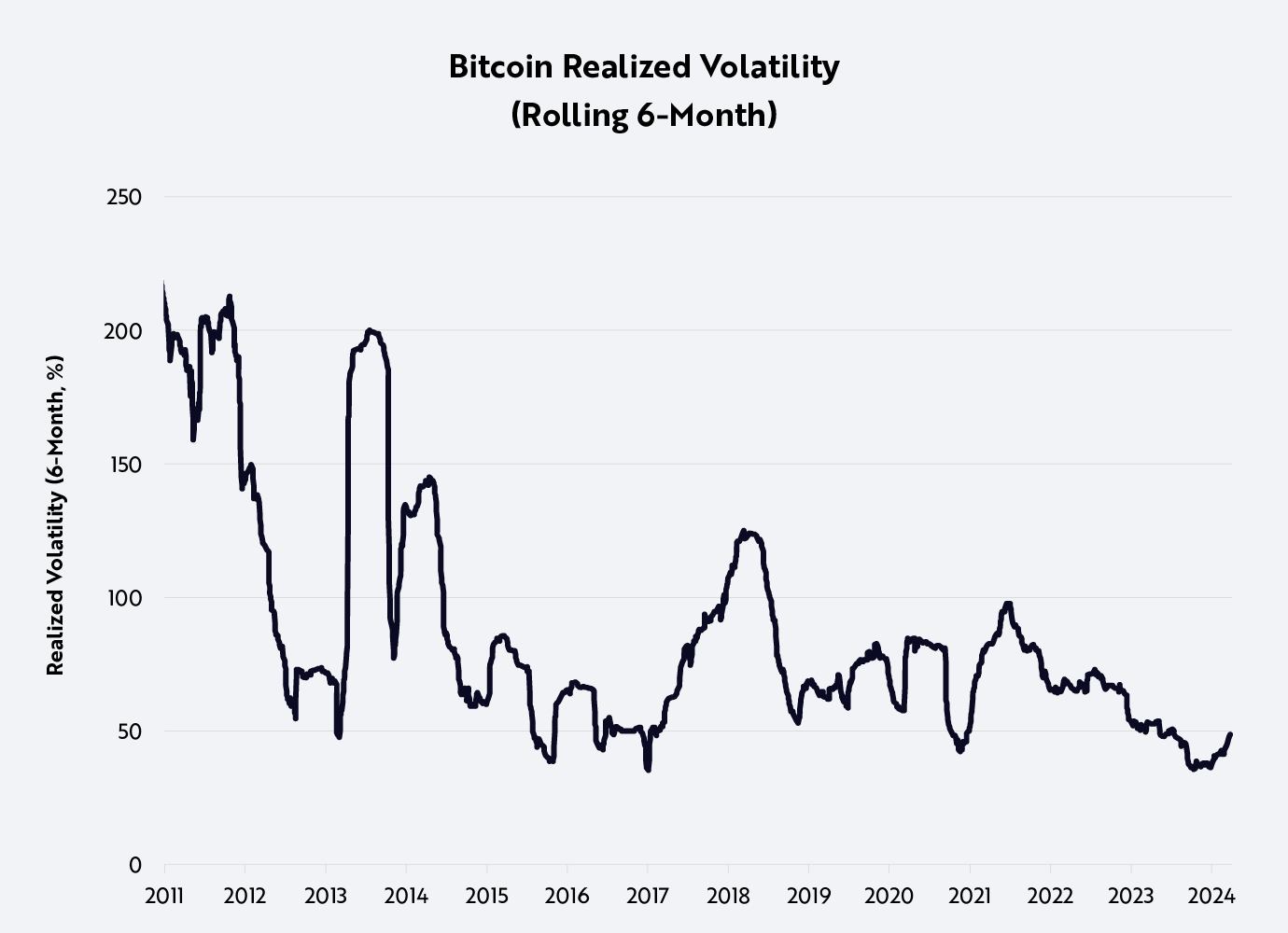

Paradoxically, bitcoin’s volatility is a function of Bitcoin’s monetary policy, highlighting its credibility as an independent monetary system. Unlike modern central banking, Bitcoin does not prioritize price or exchange-rate stability. Instead, by controlling bitcoin’s supply growth, the Bitcoin network prioritizes the free flow of capital. As a result, bitcoin’s price is a function of demand relative to its supply—explaining its volatility.

That said, bitcoin’s price volatility has diminished over time, as shown below:

Source: ARK Investment Management LLC, 2024, based on data from Glassnode as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Why has bitcoin’s price volatility declined over time? As its adoption has increased, the marginal demand for bitcoin has diminished relative to its total network value, lowering the magnitude of its price swings. All else equal, $1 billion in new demand on a network value of $10 billion should impact bitcoin’s price more significantly than $1 billion on a $1 trillion network value. Importantly, volatility in the context of a significant uptrend in price should not preclude bitcoin’s role as a store of value.

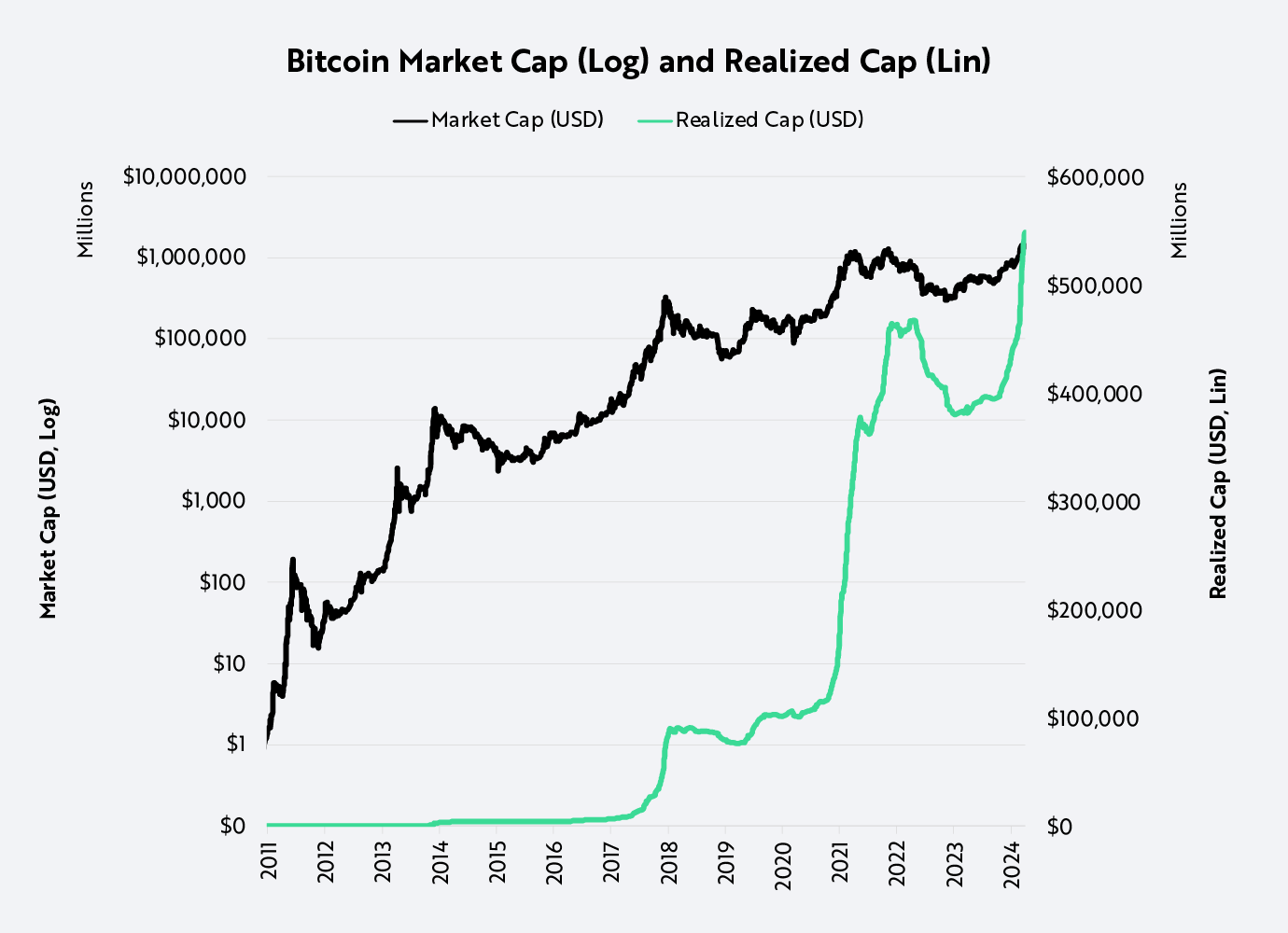

Perhaps a more relevant metric showcasing bitcoin’s role in preserving capital and purchasing power is its market cost basis. While market capitalization aggregates the value of all bitcoin in circulation at current prices, the market cost basis—or realized capitalization—values each bitcoin at the price of its last movement. The cost basis can be a more accurate measurement of changes in purchasing power. Fluctuations in the cost basis are less pronounced than fluctuations in price, as shown below. For example, while Bitcoin’s market capitalization drew down ~77% from November 2021 to November 2022, its cost basis drew down only 18.5%. Today, Bitcoin’s cost basis is trading at an all-time high, 20% above its market peak in 2021.

Source: ARK Investment Management LLC, 2024, based on data from Glassnode as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Bitcoin’s Independence From Other Asset Classes

Low Correlations

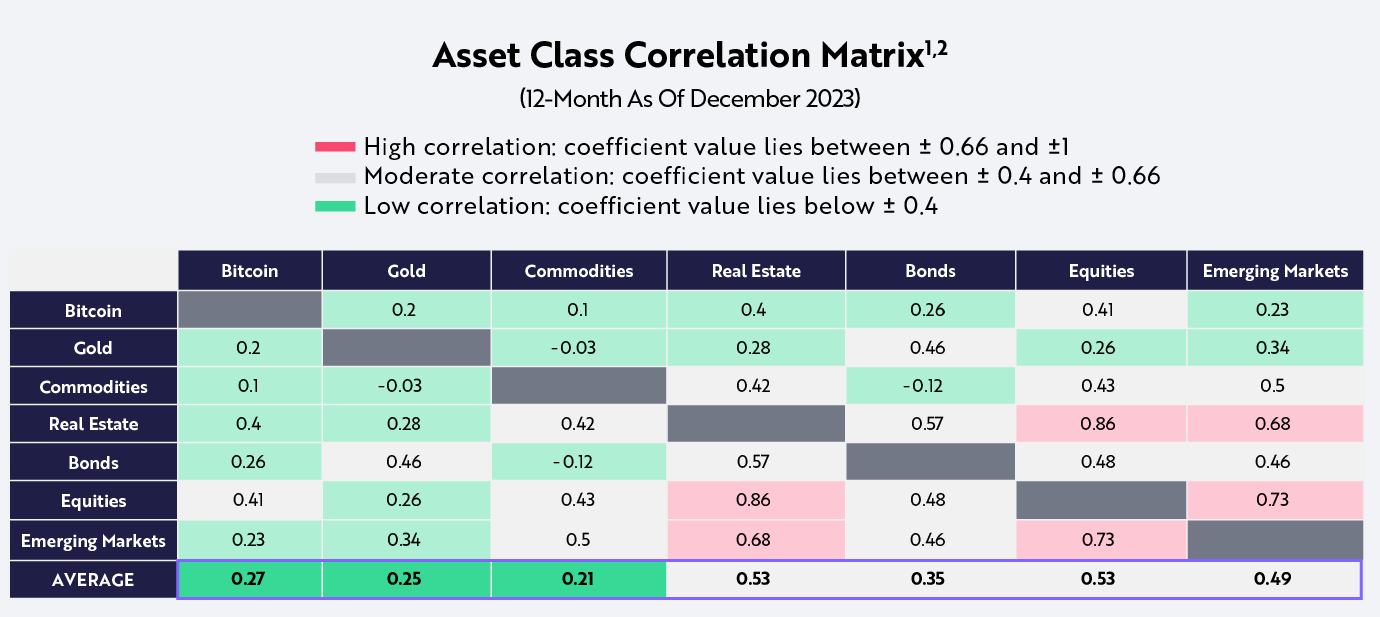

Another indication of bitcoin’s suitability as a risk-off asset is the low correlation of its returns to those of other asset classes. Bitcoin is one of the few assets with consistently low correlations, as shown below. Between 2018 and 2023, the correlation of bitcoin’s returns relative to traditional asset classes has averaged only 0.27. Importantly, the correlation between bonds and gold— traditionally considered defensive asset classes—is relatively high at 0.46, while the correlation of bitcoin’s returns to those of gold and bonds are 0.2 and 0.26, respectively.

1A correlation of 1 denotes that assets move in tandem perfectly; A correlation of 0 denotes that the movement of two variables is completely independent; A correlation of -1denotes that two variables move in opposite directions. 2Asset classes are represented by the following instruments: SPDR S&P 500 ETF Trust (SPY, equities), Vanguard Total Bond Market Index Fund Investor Shares (VBMFX, bonds), Vanguard Real Estate Market Index Fund Investor Shares (VGSIX, real estate), SPDR Gold Trust (GLD, gold), iShares S&P GSCI Commodity-Indexed Trust ETF (GSG, commodities), and Vanguard Emerging Markets Stock Index Fund Investor Shares (VEIEX, emerging markets). The performance used to represent each asset class reflects the net asset value (NAV) performance of each ETF/fund for the time periods shown. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Resilience To Changing Interest Rate Regimes

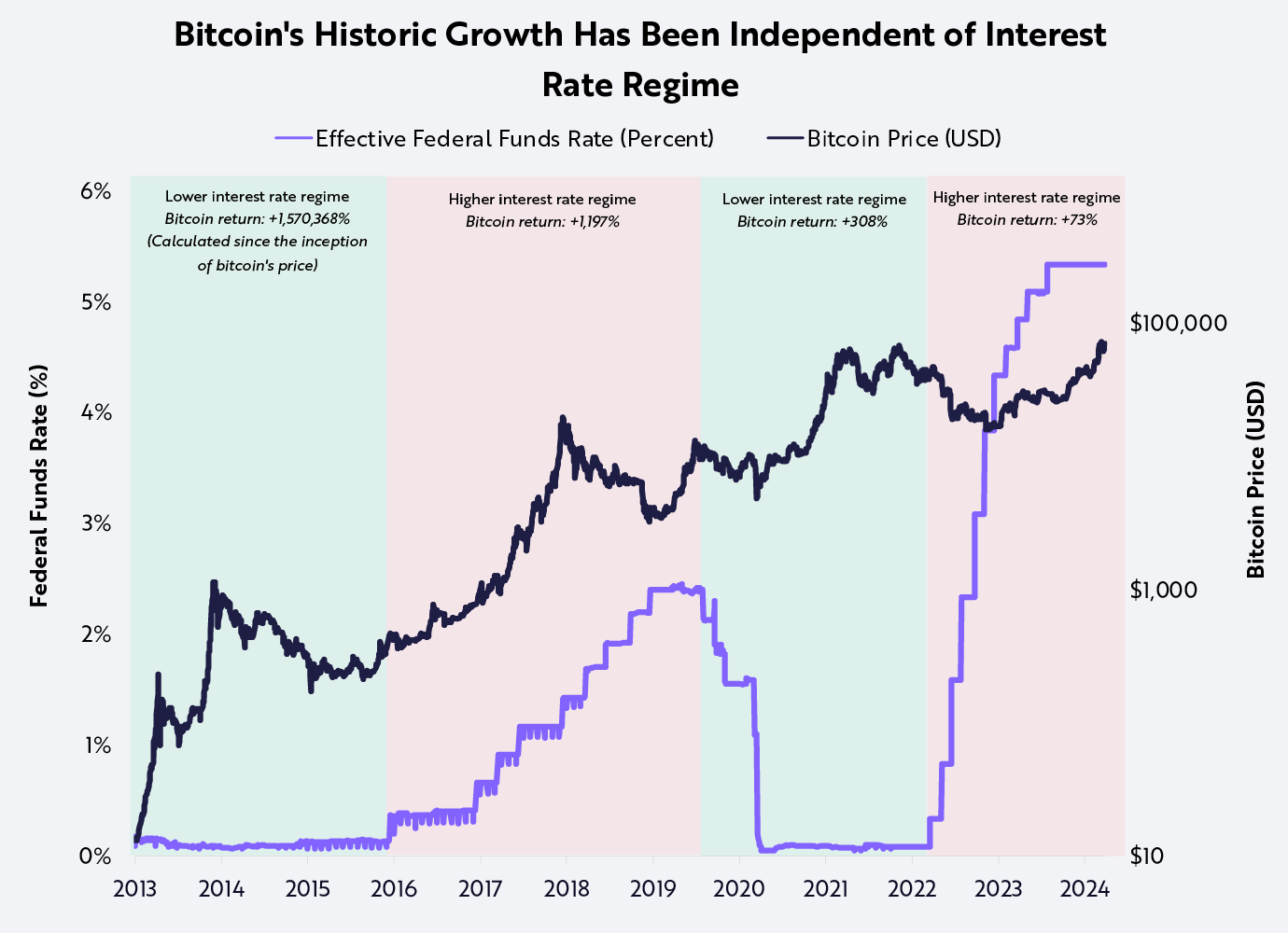

Moreover, a comparison of bitcoin’s price with the Fed Funds Rate3 illustrates its resilience in different interest rate and economic environments, as shown below. Importantly, in both high and low interest rate regimes, bitcoin’s price has appreciated significantly, as shown below.

Source: ARK Investment Management LLC, 2024, based on data from FRED and Glassnode as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

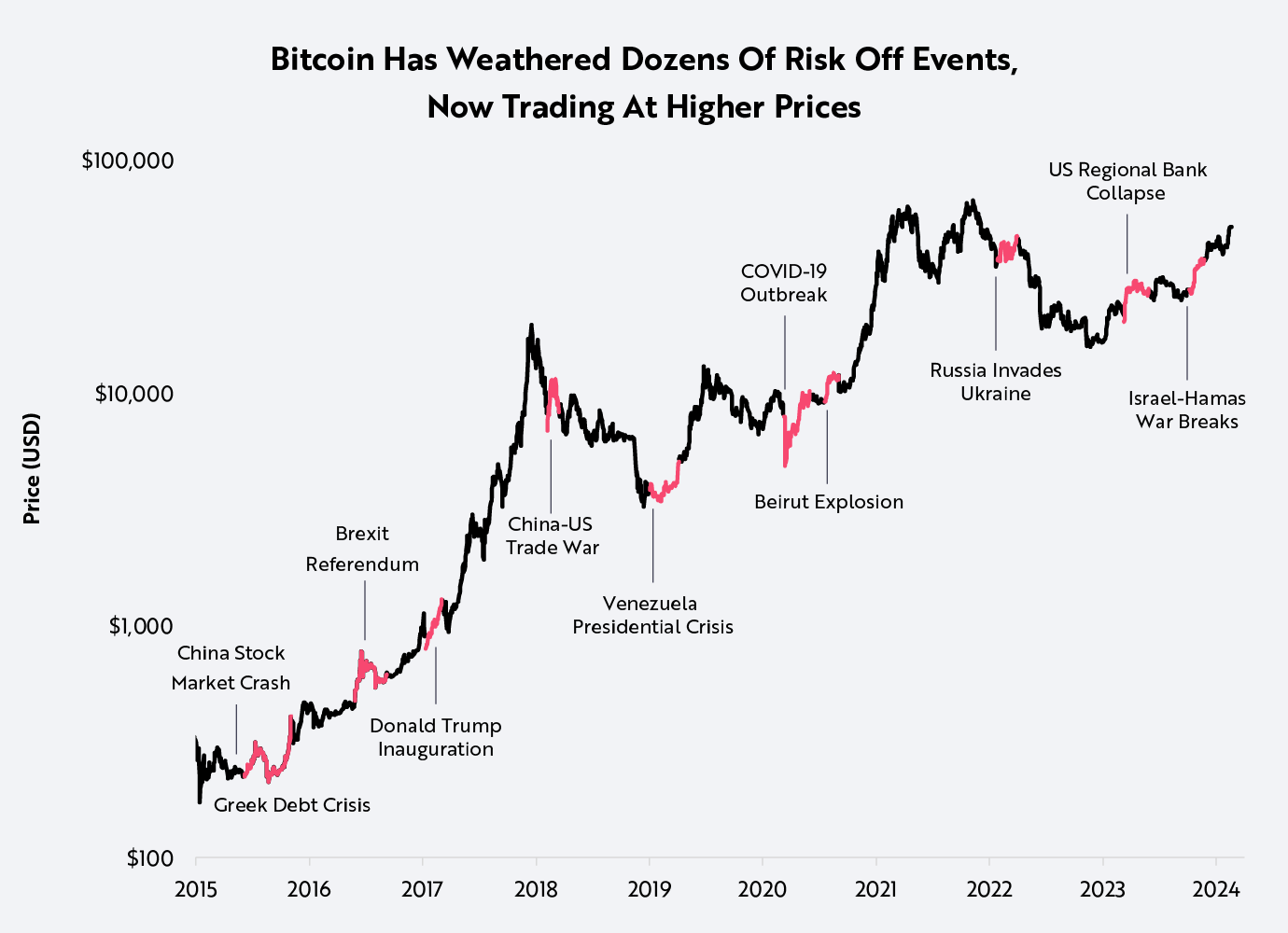

During the past ten years, the price of bitcoin has held up well during risk-off periods. As of this writing, its price is higher now than at every one of those risk-off events, as shown below.

Source: ARK Investment Management LLC, 2024, based on data from Glassnode as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

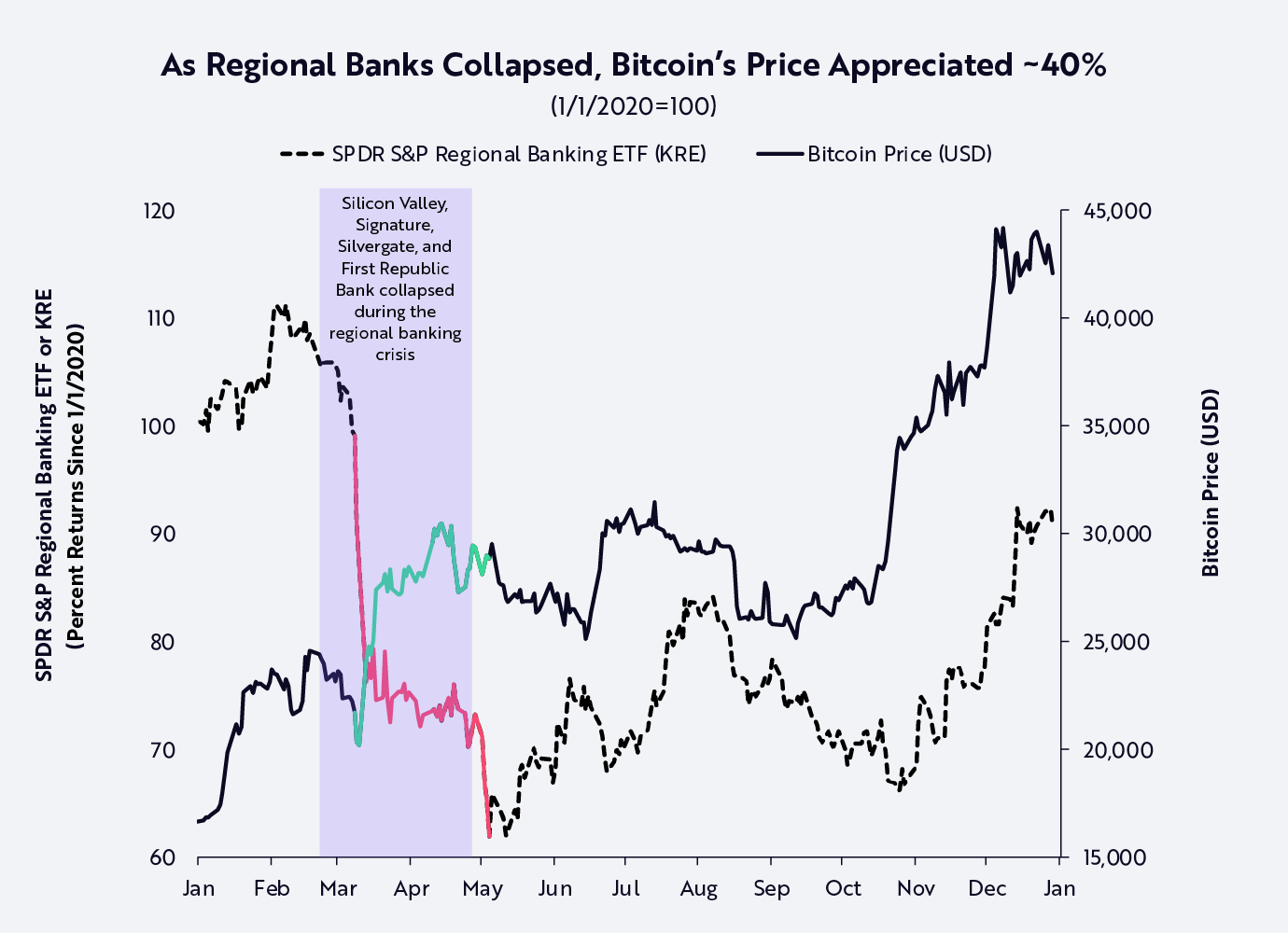

Bitcoin’s response to the regional bank crisis is a notable example. In early 2023, during the historic collapse of US regional banks, bitcoin’s price appreciated more than 40%, highlighting its role as a hedge against counterparty risk, as shown below.

Sources: ARK Investment Management LLC, 2024, based on data from Bloomberg and Glassnode as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

While bitcoin has suffered drawdowns, its notable setbacks have been industry-specific, or idiosyncratic. Among them were the Mt. Gox exchange hacks in 2014, the leveraged initial coin offering (ICO) bubble in 2017, and the fraud-related collapse of FTX in 2022. Through each of those cyclical drawdowns, bitcoin proved its antifragility with resilience and a price resolution to the upside.

Looking Ahead

In its short history, bitcoin has earned important but underappreciated stripes as a risk-off asset. As the global economy continues to shift from physical toward digital activity, the use of Bitcoin’s global decentralized monetary system should continue to increase, potentially setting bitcoin up to rival traditional risk-off assets. Increasing the odds are recent events like the approval of spot Bitcoin ETFs in the US, the adoption of bitcoin as legal tender in nation-states like El Salvador, and allocations to bitcoin in corporate treasuries like Block, Microstrategy, and Tesla. With bitcoin at ~$1.3 trillion and fixed-income assets at $130 trillion, global risk-off assets seem ripe for disruption.

Global M2: Estimate of the total money supply, including all cash on hand, as well as money deposited in checking accounts, savings accounts, and other short-term saving vehicles such as certificates of deposit (CDs). Source: ARK Investment Management LLC, 2024, based on data from Glassnode, VisualCapitalist, Statista, Macromicro.me, and Companiesmarketcap.com, as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

We hope you've found this research blog insightful. Please take one minute to share your feedback with us.

Important Information

Bitcoin is a relatively new asset class, and the market for bitcoin is subject to rapid changes and uncertainty. Bitcoin is largely unregulated and bitcoin investments may be more susceptible to fraud and manipulation than more regulated investments. Bitcoin is subject to unique and substantial risks, including significant price volatility and lack of liquidity, and theft.

Bitcoin is subject to rapid price swings, including as a result of actions and statements by influencers and the media, changes in the supply of and demand for bitcoin, and other factors. There is no assurance that bitcoin will maintain its value over the long term.

This material does not constitute, either explicitly or implicitly, any provision of services or products by ARK, and investors should determine for themselves whether a particular investment management service is suitable for their investment needs. ARK strongly encourages any investor considering an investment in bitcoin or any other digital asset to consult with a financial professional before investing. All statements made regarding bitcoin are strictly beliefs and points of view held by ARK and are not recommendations by ARK to buy, sell or hold bitcoin. Historical results are not indications of future results.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024