Why This Bull Market May Continue to Surprise

Typically, a bull market ends with confidence and exuberance, not to mention rapid inflows. Surprisingly, neither of those conditions characterizes equity markets today. In October 2014 I shared a “Different Interpretation of Recent Market Signals” with you, laying out what we later learned to be true. Today, I would like to share my thoughts with you again.

EQUITIES CONTINUE TO CLIMB THE WALL OF WORRY

Equities continue to scale a massive wall of worry, suggesting that this bull market is firmly intact. By some measures and completely contrary to consensus views, it still is in early days. So far, it has powered through multiple crises, the latest being the showdown in Greece and a hard landing in China’s property sector, as well as debt defaults in Puerto Rico and Latin America. This week, China added another brick to the wall of worry with a devaluation of its currency. While it was, in our opinion, minor, the fear of more currency devaluations in China and capital flight jolted equities and commodities markets, giving bonds another lift. In our view, the devaluation is more a response to the dollar’s strength than a sign of China’s weakness: at the suggestion of the International Monetary Fund, Beijing has decided to “float” the yuan so that it can decouple from the dollar, earning its way as an independent currency into the IMF’s Special Drawing Rights (SDR’s). It is commonly observed that China’s ultimate goal is to turn the yuan into an international reserve currency.

WHAT WILL HAPPEN TO EQUITIES WHEN THE FED RAISES RATES?

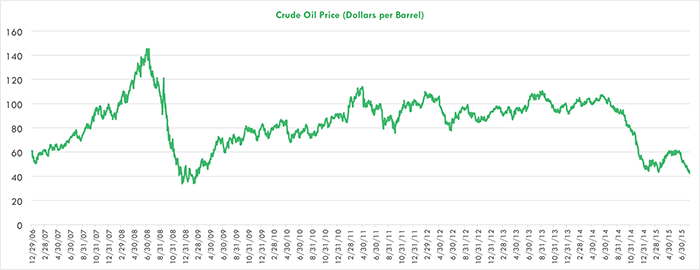

Chief among worries today is the high likelihood that the Fed will hike short-term interest rates, for the first time in nine years, before the end of the year. Many observers are alarmed by the recent relapse in commodity prices, especially oil, as shown below, and argue that the Fed should not tighten. They emphasize that the dollar has been strengthening, putting strains on US exporters and on emerging markets that have too much exposure to commodities and dollar denominated debt. China’s decision to devalue the yuan has exacerbated fears that it is heading into a downward spiral that could be contagious. Other observers attribute the drop in commodity prices to a natural unwinding of the super cycle in commodities that began in the early part of the last decade. This super cycle peaked as China was booming in the build-up to the financial crisis in 2008. These observers assert that the drop in commodity prices is a relative price shift, and will not trigger a broad based deflationary bust. Indeed, many believe it represents a form of increased purchasing power for most of the world’s population.

Crude Oil Price (Dollars per Barrel)

Source: Bloomberg

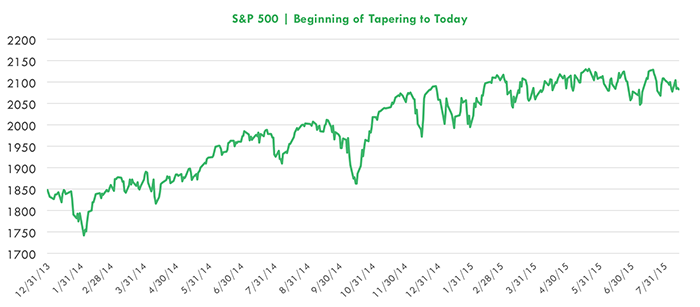

One clue that the more optimistic outlook is correct has been the response of both the equity and bond markets to the Fed’s “tapering” of quantitative easing (QE). Despite serious concerns that the end of QE would derail the bull market in equities, the S&P 500 has returned nearly 16%, albeit haltingly, since the Fed began to taper in January 2014, as shown below.

S&P 500 | Beginning of Tapering to Today  Source: Bloomberg

Source: Bloomberg

At the same time, perhaps confirming that the secular low point in interest rates is behind us, the ten year Treasury bond did not revisit the 1.4% yield, the low point that it hit during the European sovereign debt crisis in the summer of 2012. Indeed, despite the Greek showdown, the hard landing in Chinese infrastructure and commodities, and bouts of surprisingly low growth in the US, the ten year Treasury bond yield is up to 2.1%, as shown below.

10 Year Treasury Bond Yield

Source: Bloomberg

COULD INVESTORS BE CAUGHT SHORT?

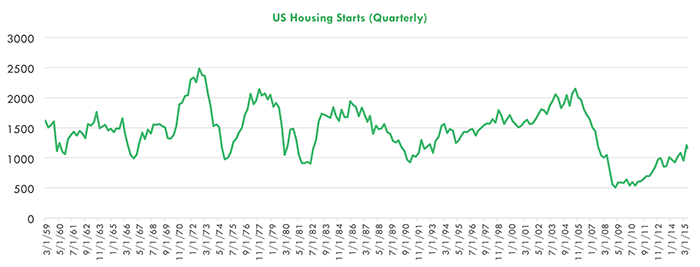

These signals suggest that, while anticipation of a Fed fund rate increase has caused the market some indigestion recently, equities could be poised to “buy the news”, or rally, once rates rise. During the taper, investors seemed reassured by the Fed’s confidence that the economy was healing sustainably. When it finally raises rates, the Fed will be signaling not only that the economy is on solid footing but also that the “markets” are ready and able to work once again, allocating capital efficiently and effectively. Many fence sitters, waiting for another economic setback and another leg down in rates, will have no more reason to wait. Consequently, growth and earnings should come out of their stupor, reaccelerating in response to the latent demand that has been brewing in housing (shown below) and other “early cycle” sectors for more than five years. Wouldn’t that be a surprise: seven years into an economic cycle, the “early cycle” stocks could be setting the market up for another multi-year rally! US Housing Starts (Quarterly)

US Housing Starts (Quarterly)

Source: Bloomberg

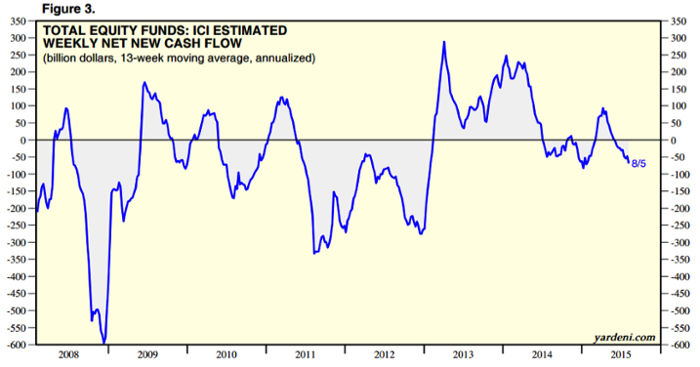

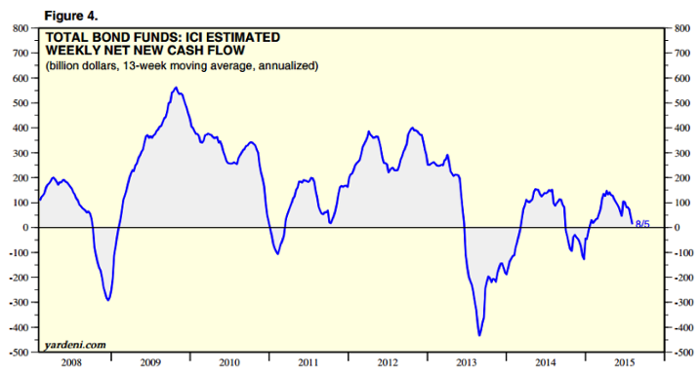

Investors could be caught “short” if GDP and earnings growth reaccelerate during the next few years. Since the beginning of the S&P’s resurgence in 2009, equities have experienced more outflows on balance than inflows. Recently, the flows have been negative. During the same time, bonds funds have enjoyed significant inflows on balance. Typically, bull markets end when investors are exuberant, clamoring to allocate more capital to the asset class in vogue. By this logic, the equity market is nowhere near its peak.

Total Equity & Bond Fund Flows

Source: Investment Company Institute & yardeni.com (US Mutual Funds: Weekly New Cash Flows)

Source: Investment Company Institute & yardeni.com (US Mutual Funds: Weekly New Cash Flows)

Source: Investment Company Institute & yardeni.com (US Mutual Funds: Weekly New Cash Flows)

Source: Investment Company Institute & yardeni.com (US Mutual Funds: Weekly New Cash Flows)

THE WALL OF WORRY CATALYZES DISRUPTIVE INNOVATION

During the past seven years, companies have responded in various ways to the pressures associated with the 2008 crash and one of the most anemic recoveries in post World War II experience. Some have catered to shareholders first and foremost, especially given the rise of the so-called activist investor. They have cut costs, preserving or enhancing margins and cash flow, in order to buy back shares and increase dividends. Others are trying to reinvent themselves in the face of profound technological shifts that are seeping into every sector, changing the way the world works. The constant for both kinds of companies has been change.

During tumultuous times, we believe disruptive innovation takes root more quickly and helps to accelerate the pace of change. It enables companies to cut costs, increase productivity, and create new products and services. ARK’s analysts would like to share with you some provocative examples.

- 3D printing is helping companies slash manufacturing costs and time to market. The Airbus A350 XWB contains more than 1,000 flight parts that are 3D printed on Stratasys’s FDM Production Systems. Airbus believes 3D printing could cut not only 50% of A350 weight but also 60-70% of total cost. The Airbus A350 XWB likely has millions of parts, many more of which presumably are slated for 3D printing (also known as additive manufacturing). (PDF Source: A380: The most efficient solution for 21st century growth)

- Robots are saving companies time and money while, counterintuitively, creating jobs. Trelleborg Sealing Solutions is a leader in engineered polymer solutions focused on a wide variety of industries. Trelleborg used no robots in producing millions of products until it discovered Universal Robots (UR), a division of Teradyne, a few years ago. Within two and a half years, Trelleborg installed 38 UR5 robots and four UR10 robots. UR’s “CoBots” caused “…swift gains in productivity, [and] orders have risen so sharply that 50 new employees were needed at the factory in Helsingør, Denmark.” (Read More)

- Digital advertising solves the age-old problem of not knowing “which half of an advertising budget is working”. Last year, independent fashion and lifestyle website, Refinery29, tested a new ad format on Facebook. Upon launch, it enjoyed a 56% increase in subscriptions relative to previous ad campaigns. (Read More)

- Data analytics are helping companies to anticipate problems in operations before they occur and either prevent them or fix them in a fraction of the time traditionally spent. The investment one financial services company made in Splunk’s technology paid for itself in the first month. Using the transparency that Splunk’s “Google for machine data” technology provides, the company decreased troubleshooting and therefore service outages by up to 80% (from 70 minutes to 15-20 minutes). Because service outages cost the company tens of thousands of dollars a minute, Splunk’s technology provided an annual ROI of $6 million. (Read More)

- Gene sequencing has led to therapies that cure previously deadly diseases, saving both lives and health care costs. Bluebird bio (BLUE) is working on a gene therapy that cures beta thalassemia, a disease which requires lifelong blood transfusions and, in severe cases, limits life expectancy to 17 years. Uniqure (QURE) has produced the first commercial gene therapy and cure for LPLD, a disease that causes severe pancreatitis. (Read More)

- Molecular diagnostics tests save costs. When diagnosing thyroid cancer, the results can be impossible to classify as malignant or benign. In such cases, the standard practice is to remove the thyroid and any related mass. Many of these surgeries are unnecessary in hindsight, as the tumors are benign. In fact, $500 million is spent annually on unnecessary thyroid surgery. Veracyte ($VCYT)’s Afirma test costs less than 25% of the lifetime cost of thyroid surgery and medication and informs doctors and patients with absolute surety whether or not they have thyroid cancer. (Read More)

CONCLUSION

The equity markets have powered through a number crises during the past six years, climbing the proverbial wall of worry. Now, the worries are focused around the impact of the Fed’s first interest rate hike in nine years. Corporations have responded by cutting costs and/or innovating and reinventing themselves. Based on recent clues from both the stock and bond markets, the response to a Fed rate hike during the next few years is likely to be on the high side of expectations, both for the economy and equities.

Sincerely,

Catherine D. Wood

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024