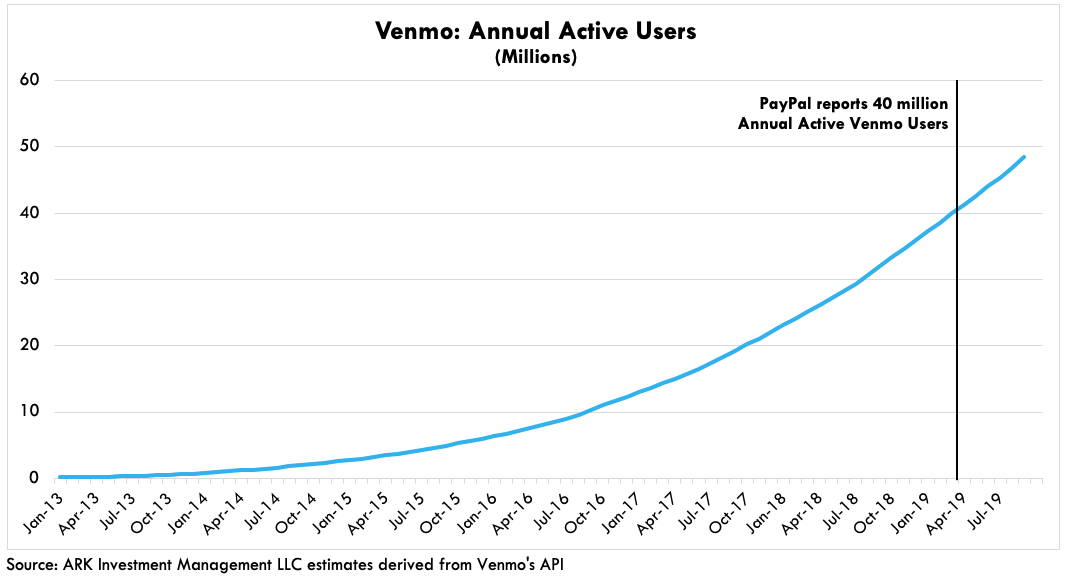

We believe that after adding more than 8 million annual active users during the six months ended September 30, 2019, Venmo is on track to surpass 50 million annual active users by the end of October, as shown below. As a result, it probably hosted more deposit account customers than any other bank in the US at the end of last quarter.

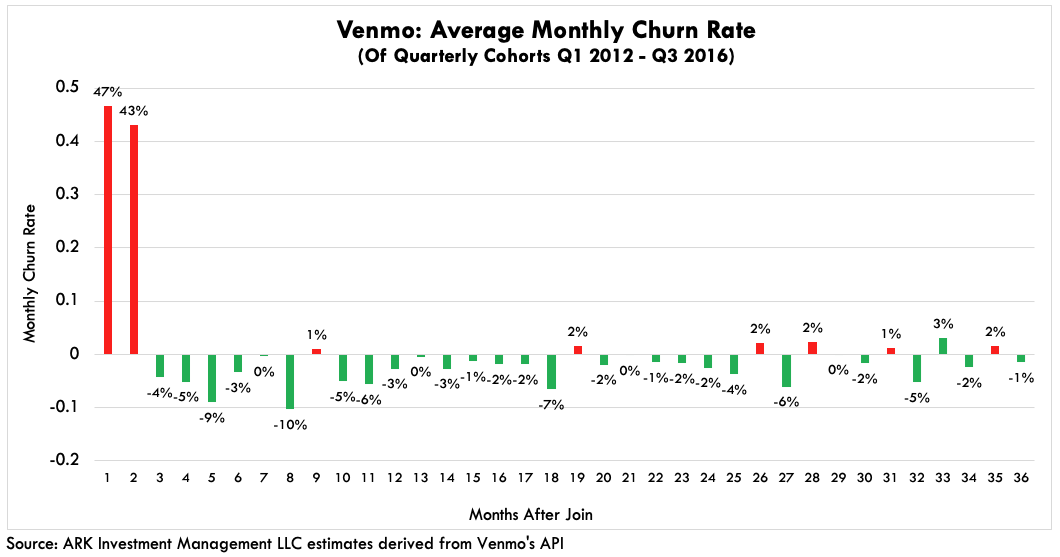

Venmo’s retention of core peer-to-peer users seems to compare favorably with that of traditional financial institutions. Particularly notable is its ability to win back customers who, after initially signing up, disengage and then return, as shown below, suggesting strong network effects. As an example, although our Director of Research, Brett Winton, switched his digital allegiance from PayPal’s Venmo to Square’s Cash App during the past year, his babysitter has forced him to maintain his Venmo account if he wants to pay for her services digitally.

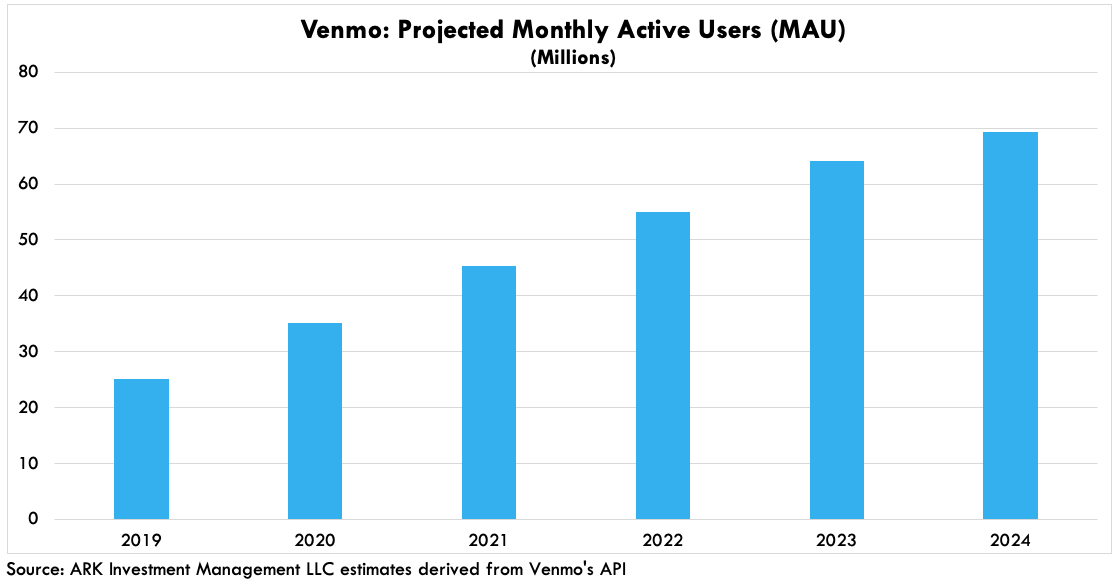

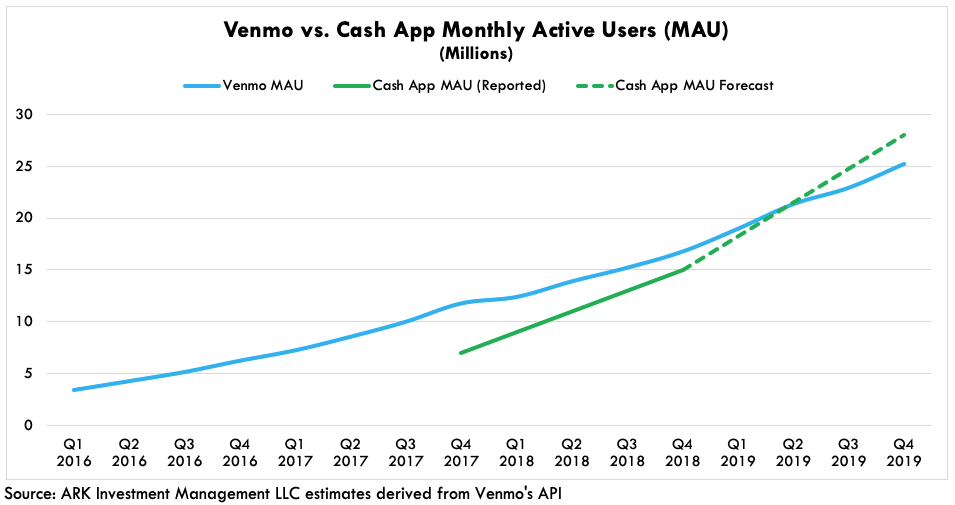

Based on the growth in its user base and robust retention rates, Venmo is likely to eclipse 60 million monthly active users (MAUs) by 2023, as shown below and in line with our previous forecast.[1] Consequently, we believe digital wallets are likely to go mainstream for most adults during the next five years.

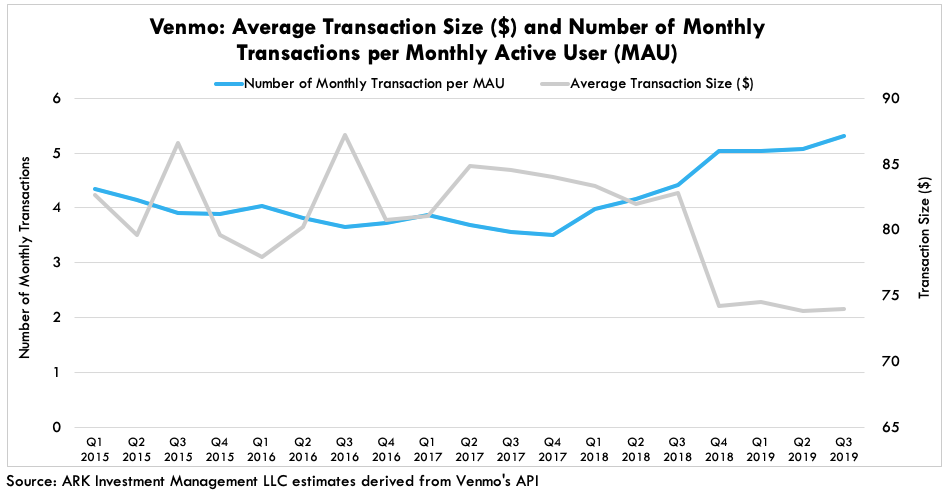

Despite its elevated churn in 2017 and 2018 – likely the result of Square Cash App’s competitive incursions – Venmo’s new users seem to be engaging robustly on its platform. According to our analysis, during the third quarter transactions on Venmo’s platform increased 62% from $16.7 billion last year to $27 billion this year. At the same time, based on the activity of its 23 million monthly active users [2] and the 5 transactions they made per month on average last quarter, the average transaction size on Venmo’s peer to peer network was roughly $74, as shown below.

Venmo’s average transaction size declined abruptly by more than 10% sequentially on a quarter-to-quarter basis during the fourth quarter of last year as its transactions soared by 26%.[3] The steady growth in the volume of monthly transactions during recent quarters matches our analysis of Venmo cohorts.

Despite its robust growth, according to our estimates the number of Venmo’s monthly active users is trailing that of Square’s Cash App, as shown below. Not necessarily an indictment of Venmo, this divergence seems to be a testimony to Square’s savvy marketing strategy which initially targeted and still targets the underserved with rapid product innovation and then aligned with key influential customer segments. That said, both services are successful because they are satisfying consumer demand for frictionless and free financial services.

Certain metrics and projections are based on ARK’s preliminary analysis of publicly available information. A more extensive report will be available in the near future. Certain of the statements contained in this item may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024