Tesla is going to need a Gigafactory to meet growing electric vehicle demand. Tesla [TSLA] plans to produce 500,000 cars in 2020 and announced it will build a $5 billion Gigafactory to supply it with lithium-ion batteries. As production scales, the cost of the battery packs should drop “by more than 30%,” according to Tesla.

By building the Gigafactory, Tesla will vertically integrate the lithium-ion battery supply chain. Higher production volume, combined with manufacturing innovations, perhaps robotics and 3D printing, should lower battery costs per unit.

Estimates for current prices of lithium-ion batteries vary widely, ranging from $200 to $500 per kWh. If Elon Musk’s projections are correct, Tesla will drive down the cost of lithium-ion batteries by more than 30%, possibly to under $150 per kWh.

Others are skeptical. If Tesla cannot achieve scale, then assembling batteries may prove more expensive than working with existing manufacturers. For example, Volkswagen [VLKAY] asserts there are already more than enough battery suppliers to meet vehicle demand. Initially thinking the same, Panasonic [PCRFY], which currently supplies battery cells to Tesla, did not commit to investing in the Gigafactory. Since then, however, it has announced plans to invest $200 to $300 million, [1] and now is the leading outside investor in the Gigafactory. Interestingly, Daimler AG [DAI] which owns 4% of Tesla, plans to compete as well. Recently it announced plans to acquire Li-Tec, a lithium battery cell producer, from Evonik Industries [EVK] surpassing LG Electronics’ bid.

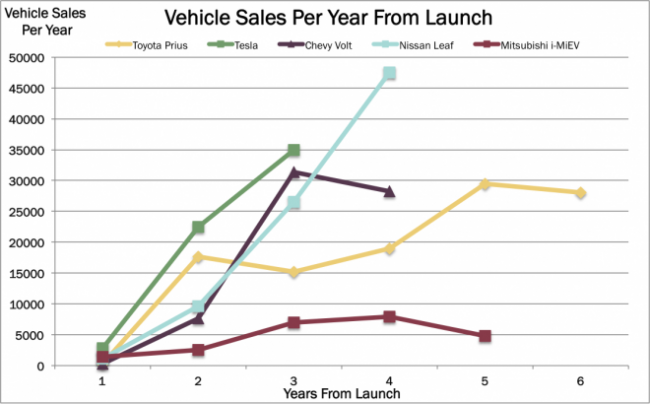

Tesla will need at least 500,000 units from the Gigafactory in 2020. Indeed production may have trouble keeping up with demand. Globally, in the past two years EV sales have more than quadrupled from 45,000 in 2011 to 206,000 units in 2013. Tesla accounted for roughly 12% of the EV market in 2013. As shown in the graph, electric vehicles have increased faster than that for the Prius in its early days, with Tesla’s Model S breaking all previous records.

Although EV sales have increased significantly, they still represent just 0.25% of total vehicle sales. [2] Pike Research estimates that in 2020, 3.8 million electric vehicles will be sold out of approximately 107 million vehicles in total. [3] In other words, EV sales will represent only 3.5% penetration. If that assumption is correct, then Tesla’s 500,000 unit sales goal will only increase in its EV market share from 12% now, to 13%.

Contrary to the sound of it, the Gigafactory will supply batteries for only 13% of the electric vehicle market in 2020 if Tesla executes according to plan. Given this perspective, Tesla’s projection of more than 50% growth in production per year through 2020 may sound ambitious, but it actually seems reasonable.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024