From 2007 to 2018, Apple’s revenue and market capitalization grew roughly tenfold[1]—making it the most celebrated technology growth story of the 21st century. Apple’s growth was fueled by the most productive period in the company’s history with the release of the iPhone, iPad, Apple Watch, and App Store—each generating sales on par with a Fortune 500 company. Despite selling what is widely regarded as a commodity—computers—Apple’s unique strategy of vertical integration and consumer focus allowed it to build superior products, charge higher prices, and command fanatical customer loyalty. As we look at Tesla in 2018, we see the outlines of another Apple in the making. Tesla resembles Apple in three key areas: a strategy of vertical integration, an imminent product inflection, and a business model transitioning from hardware to services.

Tesla Resembles Apple: Vertical Integration

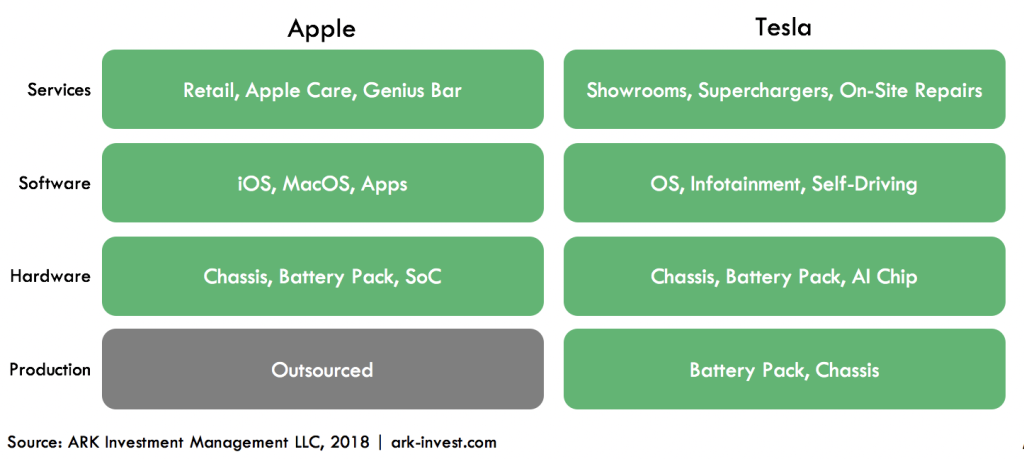

At the core of Apple’s success is its strategy of vertically integrating hardware, software, services, and retail, as shown below, in contrast to its competitors which specialize only in one layer of the stack. Vertical integration allowed Apple to achieve a number of first launches in the industry: the first multi-touch smartphone, the first 64-bit mobile processor and OS, and the first watch with EKG functionality.

Tesla picks up on Apple’s vertical integration strategy but takes it further. In addition to hardware, software, and retail, Tesla also owns and operates manufacturing facilities as well as a global supercharger network. Vertically integrating battery pack production at its Gigafactory is why Tesla is the only high volume EV manufacturer today. Had Tesla waited for the supply chain to catch up, it wouldn’t have been able to launch and scale the Model 3 for years. In our view, this is a key reason why no auto maker has released a viable competitor to the Model 3 thus far and why no company will be able to do so until 2020 at the earliest.

Vertical integration allows companies to create compelling use cases instead of speeds and feeds. In the 1980s, Apple designed and sold its own printer—the LaserWriter—to complement its newly released Macintosh. With both the Mac and the LaserWriter, graphics designers were able to create, preview, and print digital content—a feat that could not be matched by any PC OEM (original equipment manufacturer). Apple’s unusual decision to vertically integrate “printing” made the Mac the de facto platform for digital desktop publishing for more than two decades.

Likewise, Tesla’s decision to vertically integrate charging creates compelling use cases that other OEMs cannot match. By owning the charger network, Tesla is selling not just an electric vehicle (EV) but the promise of long-distance travel. Without charging infrastructure, its competitors can sell only specs like “range”. While third party charging stations may attempt to bridge the gap, the user experience is inconsistent. Tesla not only integrates the location of its chargers into its own mapping software but it also provides live data on availability and wait times. By vertically integrating end-to-end, Tesla sells not just specs but enables compelling real-world use cases.

Tesla Resembles Apple: Product Inflection

Apple’s meteoric rise from 2007 to 2012 was driven by the release of the iPhone, iPad, and the App Store in rapid succession. While for much of its history the available technology often lagged Apple’s vision of computing, microprocessor and battery performance finally reached a point, around 2007, where it became viable to build a high-performance, handheld computer in the form of a phone or tablet. Having built up decades of software and hardware expertise, Apple was positioned to seize this opportunity and create the blueprint for modern mobile computing.

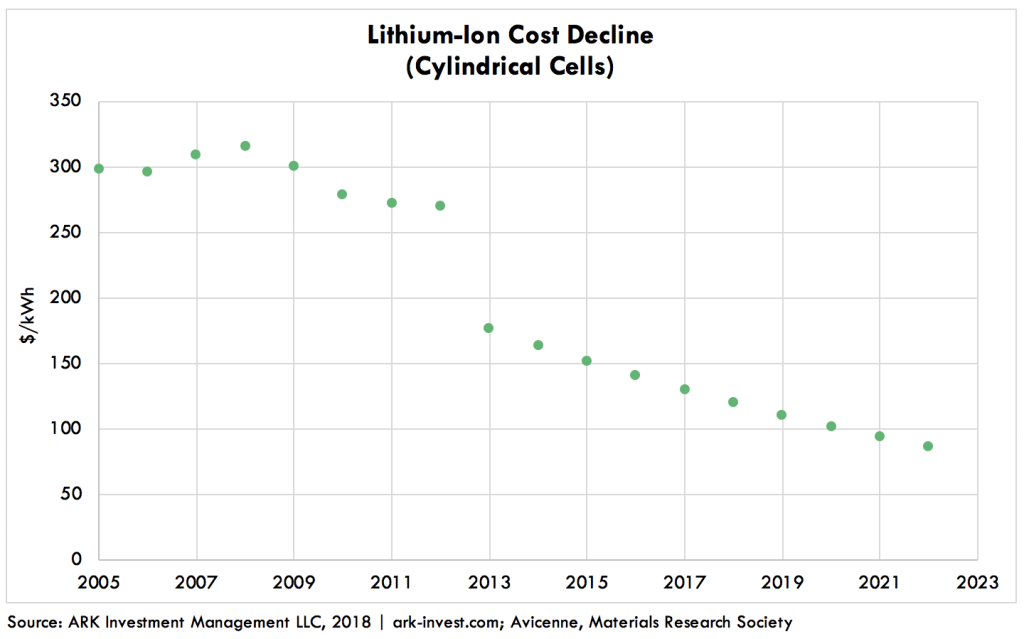

Not surprisingly, Tesla has yet to break into the mainstream—like the Mac line from the early 90s, its cars are simply too expensive. Just as central processing units (CPUs) and memory prices were too high for the mainstream in the 90s, battery costs today are too high relative to the mature internal combustion engine. According to our research, however, the cost of lithium ion batteries will fall below $100/kWh, achieving cost parity with gasoline cars by 2022, as shown below. Interesting to note, Elon Musk stated that by the end of 2018, Tesla likely will be at $100/kWh, placing it roughly three years ahead of competition.

It’s hard to overstate the significance of this cost decline. Returning to the Apple analogy, the transition to mobile computing destroyed the moat around the PC ecosystem that had been built over decades—what mattered was, “Who is best at mobile?” Likewise, the transition to EVs obsoletes decades of gasoline power technology—the key question becomes, “Who has the best electric platform?”

Tesla has spent more than a decade preparing for this moment and, in our view, has the most compelling EV pipeline of any company. The Tesla Model 3 and Model Y (a crossover SUV) have the potential to catapult EVs into the mainstream, much like the one-two punch from the iPhone and iPad in mobile computing. In the U.S. the Model 3 competes in a price category that has three times the addressable market of the Model S, and the price category where the Model Y is likely to compete has an addressable market eight times larger than the Model X. Scaled globally, if the Model 3 and Model Y are as successful as the S and X in their respective segments, Tesla should be able to generate on the order of $65 billion sustainably, even on a distribution footprint that constrains it from selling in 26 states and imposes severe price penalties on its imports into China—the world’s largest EV market. Follow-on products, such as the pickup, the semi-truck, and the Roadster, will pave the way for at least a decade of rapid growth.

Tesla Resembles Apple: Hardware to Services

Because each of its cars is a connected computer able to receive software updates, Tesla is the only auto company with complete visibility and control over its installed base. While each GM vehicle sold leaves the dealership and disappears into the wild, each Tesla sold joins a fleet of vehicles in constant communication with its manufacturer.

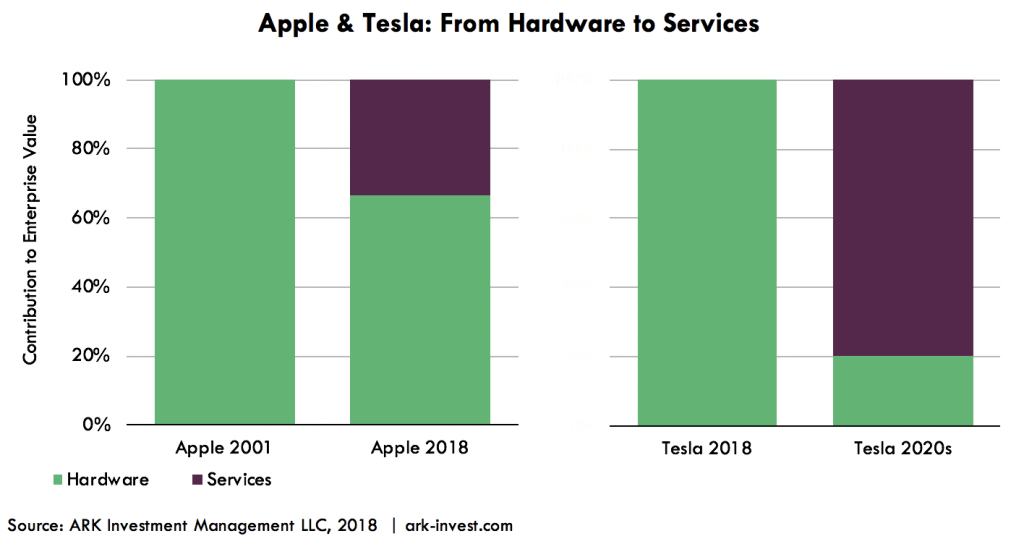

Owning the customer relationship and building services on top of an installed base creates many advantages and monetization opportunities. Once again, Apple serves as the best example. In the 2000s, Apple’s iPod + iTunes combination created a dual revenue stream from hardware and music. Today, thanks to its massive installed base of iPhones, Apple offers a range of services spanning music subscriptions, cloud storage, and app sales that generates $36 billion annually [2] and account for roughly a third of Apple’s market cap.[3] In contrast, competitors like Samsung that do not control the customer relationship generate no material revenue from services.

With an installed base of cars and control of the customer relationship, Tesla will enjoy different opportunities which could prove more lucrative. In the near term, we believe the most valuable asset that Tesla’s installed base generates is data. The automotive industry is in a race to create an artificial intelligence (AI) ecosystem capable of autonomous driving. As with any AI problem, the primary determinant of success will be gathering large quantities of high-quality data. On this metric, Tesla has no peer, thanks to its advanced sensor suite installed across roughly 400 thousand vehicles gathering roughly 4.5 billion miles of data per year. In contrast, Waymo’s data collection currently annualizes at roughly 12 million miles per year. Other auto manufacturers such as GM, Ford, and VW have no such installed base to draw upon, relying instead on a small fleet of test vehicles for data gathering. Tesla’s customers are providing Tesla’s AI department with its competitive advantage at no additional cost. We believe the scale of its fleet and data gathering gives Tesla a serious shot at becoming the first company to deploy fully autonomous driving at scale.

Autonomous capability sets Tesla up for Part II of the Master Plan it laid out in July 2016—the transition from hardware to transportation on-demand:

When true self-driving is approved by regulators, it will mean that you will be able to summon your Tesla from pretty much anywhere…You will also be able to add your car to the Tesla shared fleet just by tapping a button on the Tesla phone app and have it generate income for you while you’re at work or on vacation, significantly offsetting and at times potentially exceeding the monthly loan or lease cost…In cities where demand exceeds the supply of customer-owned cars, Tesla will operate its own fleet, ensuring you can always hail a ride from us no matter where you are.

In such a scenario, Tesla would play a role similar to Uber today, likely taking a 30% cut of revenue generated on a per mile basis. We estimate that the global market for point-to-point transport is currently 10 trillion miles per year. Assuming Tesla’s vehicles are cost-competitive with personally owned vehicles at $0.70 all-in per mile, then capturing 10% of the transportation market would generate $200 billion in services revenue annually. Further, this revenue stream should be high margin and recurring, which would support a software-like valuation, as shown in comparison to Apple below.

In fact, services could have a bigger impact on Tesla’s valuation than the app economy has had on Apple. Based on aggregate per-mile economics, the autonomous transportation market should be much larger than annual vehicle sales. If it succeeds, Tesla’s Mobility-as-a-Service (MaaS) network could contribute roughly 80% to Tesla’s enterprise value.

Tesla Differs from Apple

While Tesla’s and Apple’s product strategy and business models share many similarities, their financial pictures could not be further apart. Apple had $9 billion in cash in 2007, while Tesla has $12 billion of long-term debt today. Apple’s gross margins were approaching 40%, while Tesla’s are 14%, and Apple spent 6% of its revenues on capital expenditure compared to Tesla’s 26%.[4] In other words, Tesla’s business today is less profitable and more capital intensive than was Apple’s in 2007, a seemingly inferior model made more questionable by its substantial debt load and meager cash flows.

Clearly, Tesla must execute and overcome its near-term hurdles before it can scale and transform into a Mobility-as-a-Service (MaaS) company. Specifically, Tesla must ramp Model 3 deliveries, improve margins, and generate positive cash flow over the next few quarters. We do not share the view that Tesla will not be able to raise new capital or restructure its debt. With Tencent, sovereign wealth funds, and the public markets, we believe Tesla has many avenues to raise new capital and fund its product pipeline.

Critics of the Apple-Tesla analogy seem to forget that Apple was once on the verge of financial ruin, as epitomized by this 1997 Wired cover.

At the time Apple sold low margin hardware, faced swarming competition, and was running out of cash. Apple’s next twenty years showed how new products and services can change a company’s balance sheet and margin structure. Tesla’s financials may appear grim today, but it would be a mistake to extrapolate them far into the future.

Conclusion

Tesla and Apple share a remarkably similar narrative. Both companies sell hardware differentiated by a unique user experience made possible by deep vertical integration. Both companies thrived under the leadership of an uncompromising and often unpredictable CEO. Both have been ridiculed for being different, have been put on “death watch”, and have attracted the scrutiny of the SEC. Yet both companies have delivered when it matters most—making products that competitors can’t match and that customers camp out overnight to buy.

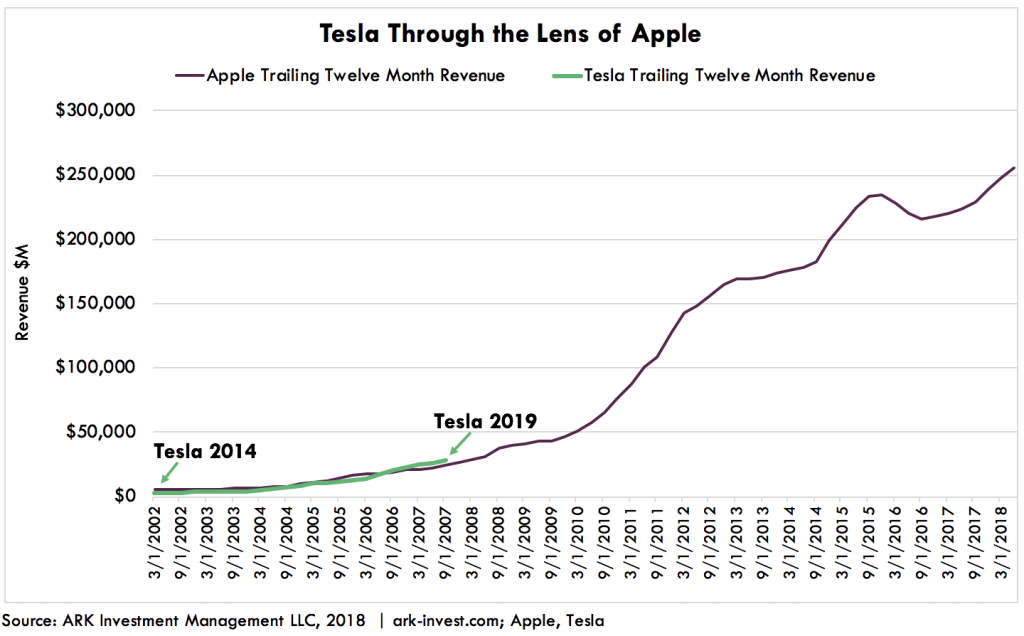

Every successful growth company goes through a golden era when its organizational competencies, its product lineup, and market conditions align, resulting in years of rapid revenue growth. For Apple, that time was from 2007 to 2012. For Tesla, we believe the golden era is just beginning. As shown above, Tesla’s revenue growth is tracking closely to Apple’s from the mid 2000s. The Model 3 production ramp and a rich product pipeline could be signaling the beginning of a growth inflection for Tesla.

Elon Musk once outlined why he believes Tesla will become as valuable as Apple. Given the similarities between the two companies, perhaps it’s not so absurd after all.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024