Dear Elon and Tesla’s Board of Directors,

As Chief Investment Officer of ARK Invest, a Tesla shareholder, I am writing to express some of our views about its outlook and investment potential. We believe that Tesla should remain a public company.

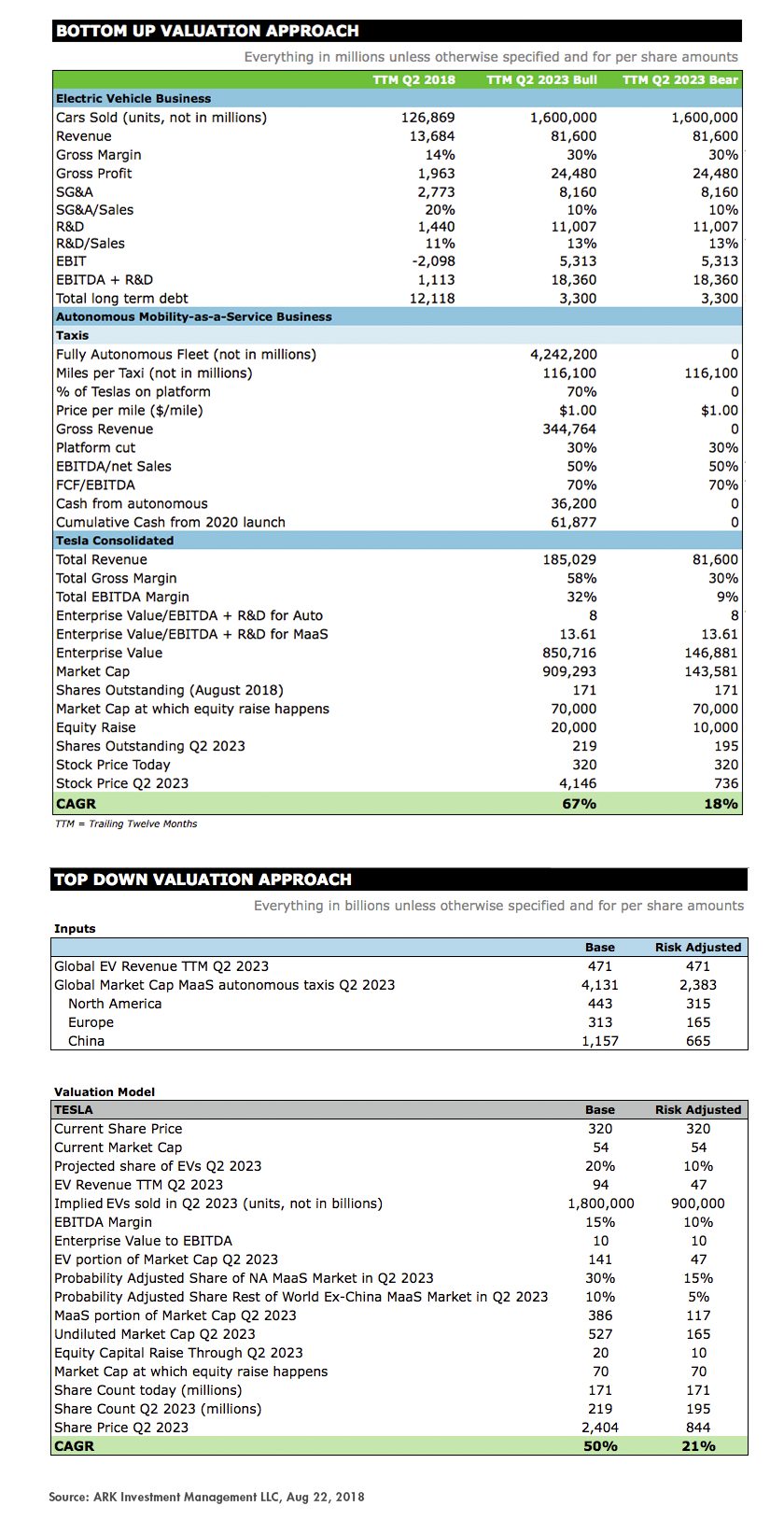

According to ARK Invest’s research, Tesla should be valued somewhere between $700 and $4,000 per share in five years.[1] Taking Tesla private today at $420 per share would undervalue it greatly, depriving many investors of the opportunity to participate in its success. In our view, given the right investment time horizon, TSLA is a deep value stock today.

Our $4,000 price target assumes that Tesla evolves from a hardware manufacturer with 19% gross margins to a company generating most of its profits from Mobility-as-a-Service (MaaS), a business that we believe will enjoy 80% gross margins. In the $4,000 scenario, our assumptions are conservative: we incorporate profits only from cars and certain autonomous taxi networks, not from trucks, drones, utility scale energy storage, or the MaaS opportunity in China. Further, we incorporate the roughly $20 billion in dilution that might be necessary to penetrate and scale the latter four markets. Clearly, most asset managers in the public markets do not agree with us, which is why I’m writing to you now.

Because many investors find ARK’s Tesla projections difficult to believe, I am providing some of our top-down and bottom-up models and assumptions. See Model Below. Led by our Director of Research, Brett Winton, our Industrial Innovation analysts, Tasha Keeney and Sam Korus, have been evolving for more than four years what I believe are the most comprehensive models of MaaS in the financial markets today. Their modeling spans autonomous taxi networks, autonomous truck platoons, electric vehicles (EVs) and energy storage, as well as air taxis and other drones.

Because of the short-term investment time horizon of investors in the public markets and inflated valuations in the private markets today, I understand why you may want to take Tesla private, but I must try to dissuade you. First, as a private company, Tesla will be unable to capitalize on its competitive advantages as rapidly and dramatically as it would as a public company, an important consideration given the network effects and natural geographic monopolies to which autonomous taxi and truck networks will submit. Second, in the private market, Tesla would lose the free publicity associated with your role as the CEO of the public company not only with the bestselling mid-sized premium sedan in the US, but also arguably in the best position to launch a completely autonomous taxi network nationwide in the next few years. Just ask Michael Dell: he wants to lead a public company once again for a reason. Third, you will deprive most of your individual investors of a security to bet on you and your strategy, ceding that opportunity to high net worth and institutional investors. Finally, if you do not take Tesla private, you will be surprised and gratified at investor reaction once they realize and understand the scope and ramifications of your long-term vision and strategies. With time, I believe that truth always wins out in the public markets, as has been the case for Apple, Amazon, Netflix, Salesforce, and other companies with visionary leaders.

As public equity markets continue to go passive, I believe we are witnessing a massive misallocation of capital, with innovation the most inefficiently priced part of the market. Tesla epitomizes this capital allocation problem and, when the market understands it, your stock should enjoy significant upside, serving as a valuable lesson for public market investors to reconsider their short-sighted ways. I believe firmly that you, your employees, your public shareholders and the world will be rewarded justly in the public markets over time.

The biggest surprise to me since founding ARK Invest is the lack of first principles research, particularly in the private markets, on truly disruptive innovation. ARK Invest designed its research and investment management process to mirror that of open-source software collaboration, giving us the intellectual resources to dig into first principles. We share our research, our applicable trades, and our discussions with the various communities in which we serve and invest.

Please do not let the short-term thinking of professional public equity investors persuade you to take Tesla private. I believe you will be on a much shorter leash in the private markets and will deprive a broad and loyal investor base of one of the most important investment opportunities of their lifetimes.

With great respect and admiration,

Cathie

ARK’s top-down and bottom-up assumptions:

- Our bottom-up model’s bear case assumes that Tesla fails to create a fully autonomous car.

- Our top-down model’s risk-adjusted market forecast assumes that autonomous driving commercializes in 2022, three years later than our base assumption, and that its adoption takes twice as long as our base case.

- For the year 2018, we project that Tesla’s market share of EVs globally will be 17%.

- Our assumption is that if the need arises, Tesla will tap the equity markets to shore up its balance sheet or to invest in growth internationally.

- We assume that all cash flow from the EV business will be reinvested into the company.

- Though autonomous Mobility-as-a-Service could cost as little as $0.35 per mile, ARK believes the service will not be priced at that level until the market saturates. If Tesla were to launch the Tesla Network in the next 1-2 years, it could charge premium rates while autonomous taxi production is supply constrained.

- Please see additional assumptions and models in ARK’s Mobility-as-a-Service white paper.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024