The information presented reflects the views and assumptions of the authors at the time of publication. Please note that this research is at least one year old and the authors’ current views may materially differ from those presented without notice. The results will not be updated as ARK’s internal models change, or any information upon which ARK relies upon changes.

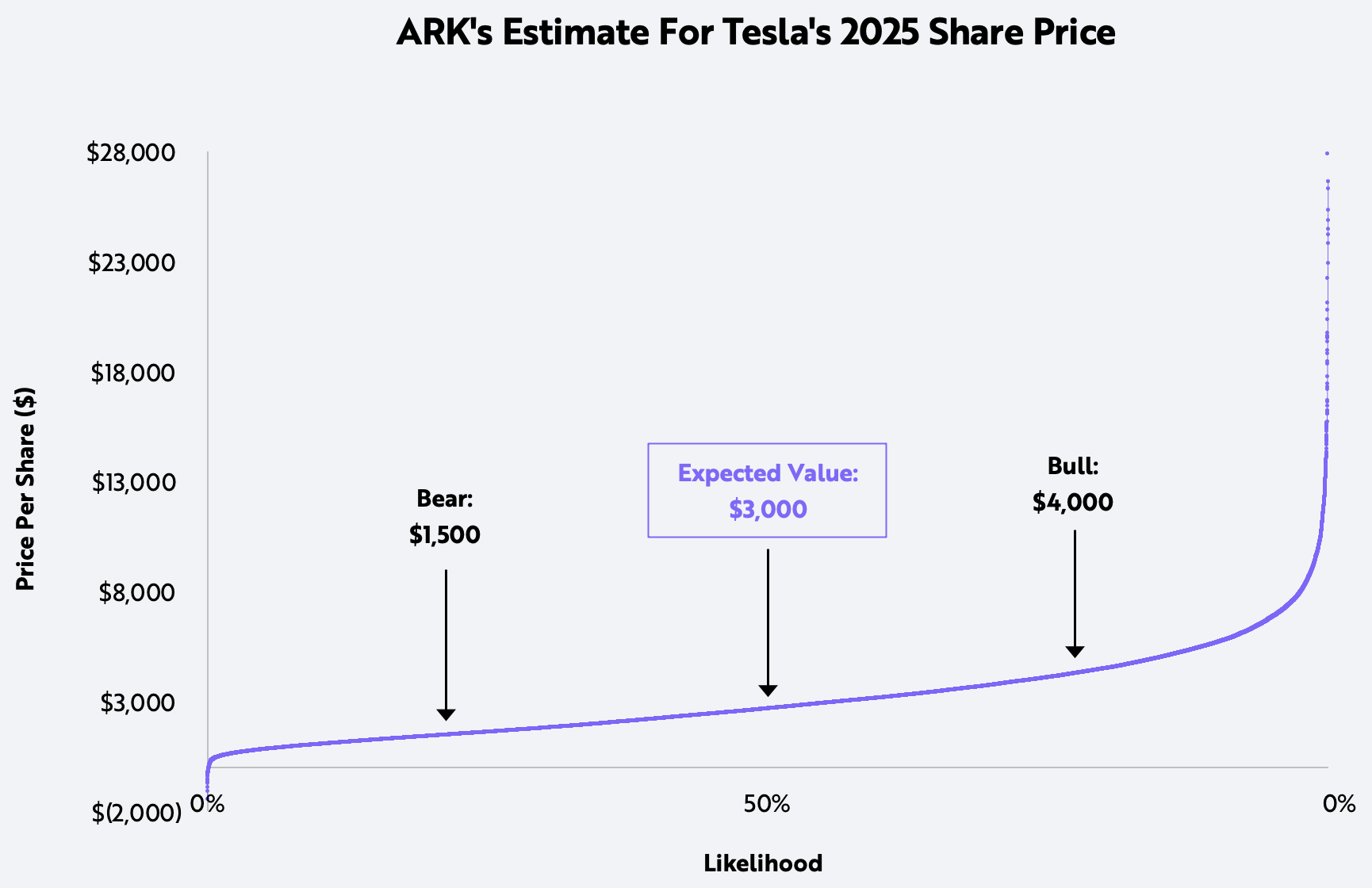

Last year, ARK estimated that in 2024 Tesla’s share price would hit $7,000 per share, or $1,400 adjusted for its five for one stock split. Based on our updated research, we now estimate that it could approach $3,000 in 2025.

To arrive at this forecast, ARK used a Monte Carlo model with 34 inputs, the high and low forecasts incorporating 40,000 possible simulations. Our bull and bear price targets are the top and bottom quartile outcomes from the simulations, as shown below:

| ARK’s Predicted Scenarios | 2025 Price Target | Significance |

|---|---|---|

| Expected Value | $3,000 | This projection is our base case for TSLA’s stock price in 2025 based on our Monte Carlo analysis. |

| Bear Case | $1,500 | We believe that there is a 25% probability that Tesla could be worth $1,500 per share or less in 2025. |

| Bull Case | $4,000 | We believe that there is a 25% probability that Tesla could be worth $4,000 per share or more in 2025. |

Note: Numbers for 2025 Price Target are rounded for simplicity and consistent with reasonable variance in the forecast.

Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security.

With no single bear and bull case from our 40,000 simulations, we have selected what we believe to be a plausible case for each one, as shown below.[1]

Estimated Values in Bull and Bear Example Cases

| 2020 | Example Bear Case 2025 | Example Bull Case 2025 | |

|---|---|---|---|

| Cars Sold (millions) | 0.5 | 5 | 10 |

| Average Selling Price (ASP) | $50,000 | $45,000 | $36,000 |

| Electric Vehicle Revenue (billions) | $26 | $234 | $367 |

| Insurance Revenue (billions) | Not Disclosed | $23 | $6 |

| Human-Driven Ride-Hail Revenue (net, billions) | $0 | $42 | $0 |

| Autonomous Ride-Hail Revenue (net, billions) | $0 | $0 | $327 |

| Electric Vehicle Gross Margin (ex-credits) | 21% | 40% | 25% |

| Total Gross Margin | 21% | 43% | 50% |

| Total EBITDA Margin* | 14% | 31% | 30% |

| Enterprise Value/EBITDA | 162 | 14 | 18 |

| Market Cap (billions) | 673 | $1,500 | $4,000 |

| Share Price** | $700 | $1,500 | $4,000 |

| Free Cash Flow Yield | 0.4% | 5% | 4.2% |

Note: Figures are rounded for simplicity and consistent with reasonable variance in the forecast. 2020 total gross margin includes services, energy storage, and other. 2020 automotive gross margin including credits was 26% according to: https://www.sec.gov/Archives/edgar/data/1318605/000156459021004599/tsla-10k_20201231.htm#ITEM_6_SELECTED_CONSOLIDATED_FINANCIAL_D. *In the bear case, Tesla doesn’t scale as aggressively and can stay at a higher price point for longer, which benefits its margins. **As of March 17th, 2021.

Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security.

Key Assumptions for the Bull and Bear Case Examples Reflected Above

| Example Bear | Example Bull | |

|---|---|---|

| Using Wright’s Law,* Electric Vehicle Gross Margins Never Exceed | 40% | 25% |

| Capital Efficiency (gross capex per car) | $8,000 | $6,000 |

| Maximum Annual Production Increase** | 65% | 90% |

| Percent of All Teslas on Autonomous Platform in 2025 | 0% | 60% |

| Percent of Cars Sold into Human-Driven Ride-Hail | 40% | 40% |

*Wright’s Law: https://ark-invest.com/wrights-law/. ** The simulation drives production as a function of available cashflow for investment in EV manufacturing plants but imposes a fixed scaling constraint on Tesla’s ability to grow, reflective of likely raw material and battery production bottlenecks that the company might encounter.

Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security.

Key updates to our model:

- We pushed our forecast price target forward one year to 2025.[2]

- We refined our estimates for Tesla’s capital efficiency.

- We added Tesla’s insurance business to our model.

- We added assumptions for a human-driven ride-hail service.

- We increased the probability of Tesla achieving fully autonomous driving within five years.

Electric Vehicles

Since our 2024 analysis, we have increased our assumptions for Tesla’s capital efficiency. Previously we estimated that Tesla would spend $11,000-$16,000 per incremental unit of capacity in 2024. In 2019, Tesla spent $1.33 billion on capital expenditures (capex) and produced 509,737 vehicles, an increase of 144,505 vehicles from the previous year, suggesting that its capex per incremental vehicle produced was roughly $9,200. In 2020, Tesla spent $3.16 billion on capex, putting capital efficiency in 2021 at $10,330 assuming a 60%[3] increase in vehicle production. Note that this math probably overstates the capital required for an incremental vehicle because a portion of capex is for long-dated projects like autonomous data centers and Tesla’s vertically integrated cell factory. At Battery Day, Tesla announced that its updated cell chemistry and manufacturing process would reduce investment costs by 75% over time. To give Tesla credit for what we believe is its superior capital efficiency, we lowered gross capital expenditure per car in our latest model. Given these updated estimates, along with an additional year of growth added to our model, our forecast for Tesla’s unit sales is between 5 and 10 million vehicles in 2025.

Insurance

ARK estimates that Tesla could achieve better than average margins on insurance thanks to the highly detailed driving data it collects from customer vehicles. Partnering with underwriters, Tesla introduced its insurance product in August 2019. Currently, it is available only in California. ARK believes that in the next few years Tesla could roll out its insurance offering to more states, underwriting its own insurance policies. Because its vehicles have better than average safety profiles, Tesla should be able to use real-time data to offer insurance in its vehicles, pricing it dynamically, lowering customer acquisition costs, and increasing margins. Relative to Progressive’s 13% EBIT margin in 2019, ARK estimates that Tesla could achieve margins close to 40%. If it were to sell 40% of vehicles with its own insurance offering by 2025, Tesla’s insurance revenues could approach $23 billion annually in our bear case.[4] In our bull case, ARK estimates that, as robotaxis ramp, Tesla’s insurance revenues will be incorporated into a platform fee. Insurance boosts our price target by roughly $60 in 2025.

Human-Driven Ride-Hail

ARK’s bear case now includes Tesla’s opportunity to launch a human-driven ride-hail service. Previously, ARK detailed that a Tesla human-driven ride-hail service would have a lower cost structure than that of incumbent companies, laying the foundation for a fully autonomous ride-hail network. In our bear case example, ride-hail could add an additional $20 billion to Tesla’s operating profit by 2025, increasing our price target by about $500.[5] In preparation for its robotaxi service, Tesla could launch a human-driven ride-hail network first, delivering a highly profitable recurring revenue stream and limiting the downside of a failed autonomous service. A human-driven ride-hail service could boost Tesla’s price target in ARK’s bear case significantly.

Fully Autonomous Ride-Hail

In our last valuation model, ARK assumed that Tesla had a 30% chance of delivering fully autonomous driving in the five years ended 2024. Now, ARK estimates that the probability is 50% by 2025. Since our last forecast, neural networks have solved many complex problems previously considered unsolvable, increasing the probability that robotaxis are viable.[6] ARK estimates that Tesla’s vehicle fleet gives it access to 30-40 million miles of data per day, up from 20 million per day last year. If successful, Tesla could scale its robotaxi service rapidly, allocating the additional cash in turn to manufacturing capacity serving its autonomous network. If 60% of its vehicles equipped with Autopilot were to serve as robotaxis, Tesla could generate an additional $160 billion in EBITDA in 2025.[7] In our bull case, ride-hail would account for the majority of Tesla’s enterprise value in 2025.

Note that autonomous driving pushes the distribution of our expected price targets up significantly, as shown below. The first chart represents the likely distribution of all possible price targets from our Monte Carlo analysis, while the second chart shows which scenarios occur within the ranges of price targets across our distribution.

Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security.

Source: ARK Investment Management LLC, 2021

In many of the low-end cases we modeled, production constraints limit Tesla to fewer than 4 million units produced per year, while technological and logistical bottlenecks prevent the launch of both human-driven and autonomous ride-hail networks, as shown in gray. When production is not constrained, a human-driven ride-hail network increases the expected price target range, as shown in green (less than 20% of Tesla vehicles sold into ride-hail in 2025) and navy (20-70% of Tesla vehicles sold into ride-hail in 2025). Finally, in purple, the high-end price targets incorporate the assumption that Tesla launches a robotaxi service.

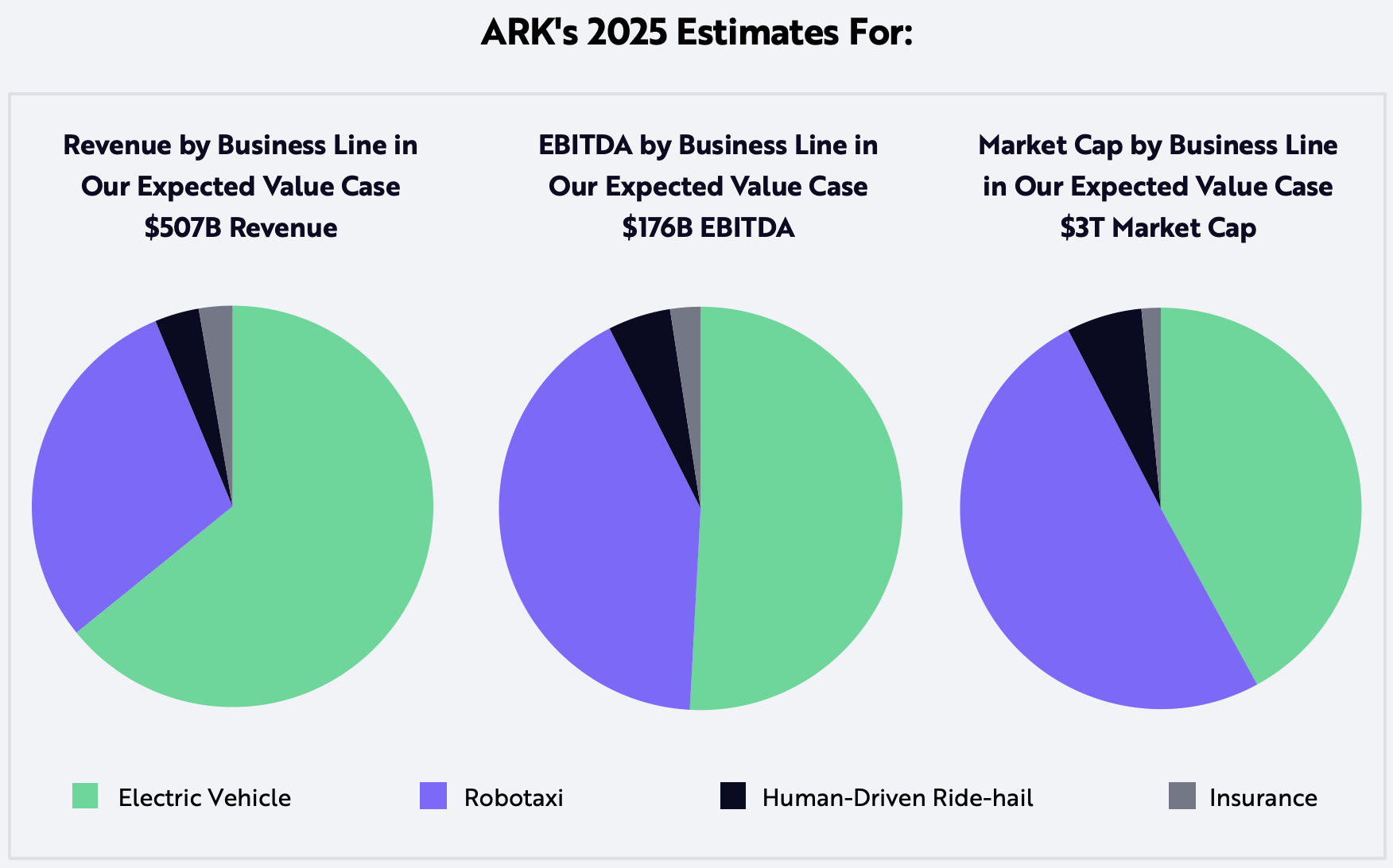

In ARK’s Tesla price target, please note that electric vehicle and robotaxi business lines generate roughly 40% and 50% of Tesla’s expected market cap, the average values from our Monte Carlo simulation, respectively, in 2025, as shown below.

Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security.

Source: ARK Investment Management LLC, 2021

Conclusion

Given the updates outlined in this blog, ARK’s 2025 price target for Tesla is $3,000. ARK’s bear and bull case suggest that Tesla could be worth roughly $1,500 and $4,000 per share, respectively. We published our model on Github and invite you to test your own assumptions and/or craft visualizations from the simulation outputs for our assumptions.

Note: We do not model Tesla’s utility energy storage or solar business in our models. We also have not modeled bitcoin assumptions in our model. For ARK’s work on bitcoin as corporate cash, please download our latest Big Ideas presentation.

*While ARK’s current assessment of the subject company may be positive, please note that it may be necessary for ARK to liquidate or reduce position sizes prior to the company attaining any indicated valuation prices due to a variety of conditions including, but not limited to, client specific guidelines, changing market conditions, investor activity, fundamental changes in the company’s business model and competitive landscape, headline risk, and government/regulatory activity. Additionally, ARK does not have investment banking, consulting, or any type of fee-paying relationship with the subject company.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024