Lowe’s [LOW] recently announced that robots will help customers locate merchandise in select stores. Retail robots reduce costs and improve the efficiency of customer service by performing menial sales tasks, freeing employees to assist customers with higher value interactions.

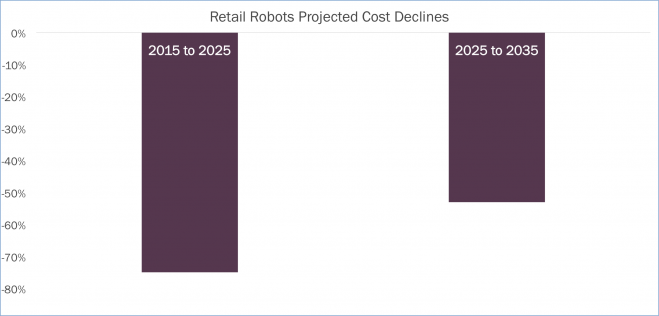

To avoid paying employee salaries and benefits over the life of a retail sales robot, a company should be willing to pay roughly $210,000 for a robot. The average retail sales position earns roughly $25,000 per year, or about $12 per hour. Lowe’s Oshbot costs roughly $50,000, and is economical at today’s price if it provides only ten hours of employee-equivalent work per week. As their sensors decline in cost and their volume scales, retail sales robot prices should drop by 75% over the next ten years, followed by another 50% from 2025 to 2035, as shown below. As employee salary and benefit costs increase, the return on invested capital associated with robots should increase measurably over time.

Robots should provide a better customer service experience on balance. Unlike an employee, a robot always will know if an item is in stock, and where it is located. Robots will have instant access to pricing information, and will respond to algorithms directing them to offer customer specific discounts, reviews, and other purchase related suggestions.

Robots are not likely to replace entire sales staffs, but will make workforces more productive. Help planning a project, advice on fit and finish for goods, and cost comparisons across brands are examples of employee assistance that will set a store apart from its competitors. Investing in robots will allow more in-store interactions between employees and customers, and will allow brick and mortar retailers to defend themselves more effectively against the competitive prowess of Amazon [AMZN] and other e-commerce sites.

Lowe’s may carve out a near term competitive advantage by using retail robots in its stores, but the long term winners are likely to be the companies that manufacture robots and their components. Among them are Adept Technology [ADEP], iRobot [IRBT], Fanuc [FANUY], Kuka [KUKAY], Cognex [CGNX], Faro [FARO], Ambarella [AMBA], and Qualcomm [QCOM]. The ultimate winner will be the consumer. In-store experiences will be quicker, sales staff interactions more helpful, and prices lower as robots proliferate.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024