Bubbles and Bowling: How to Identify a Transformative Technology and Avoid the Automatic Pinsetter

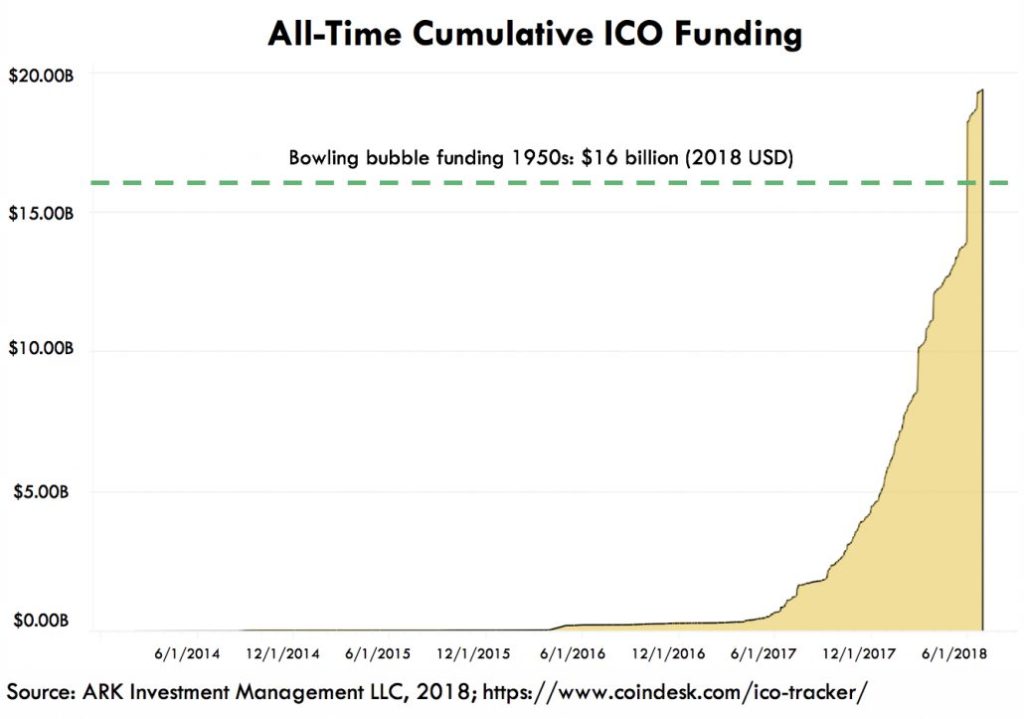

June of this year marked an important milestone: capital raised to fund the decentralized web—now $20 billion—finally surpassed the $16 billion inflation-adjusted dollars raised during the bowling bubble of the late 1950s.[1]

Yes, Wall Street was very, very excited by bowling.

Brunswick Corporation, a bowling equipment manufacturing company, rallied almost 1,600% in four years as analyst expectations spiraled out of control. Forecasts implied that bowling demand would grow to 12 billion matches per year which was no problem so long as every man, woman, and child bowled three times per week.

Brunswick Corporation, a bowling equipment manufacturing company, rallied almost 1,600% in four years as analyst expectations spiraled out of control. Forecasts implied that bowling demand would grow to 12 billion matches per year which was no problem so long as every man, woman, and child bowled three times per week.

As is often the case, the mania was catalyzed by a legitimately interesting technological innovation: the automatic pinsetter.

The automatic pinsetter dramatically reduced the time and cost to bowl. Prior to the invention, a pinboy would run (or walk) back and forth between lanes to reset the pins and return the ball manually. Sometimes bowlers would be required to do it themselves.

The improved experience resulted in a predictable surge in demand. In New York City, 50 lane alleys were past capacity at 1am. A whole subculture developed where “action bowlers” were betting $10,000+ (in 2018 USD) on single games while league players more than doubled to 7 million nationwide.

In hindsight, as always, the speculative bubble didn’t merit either the attention or the capital. The stocks fell 80% from their peaks and, not surprisingly, the number of bowling centers today is lower than it was prior to the bubble. Hindsight seems so easy.

One of the critical questions when investing in innovation is “how do we separate the iPods from the Automatic Pinsetters?”. How do investors distinguish the innovation that will change the way the world works from that which will reset a narrow slice of the play space, like gloss wood 3.5’ by 60’?

At ARK we use three qualifying criteria to filter transformative technology wheat from automatic pinsetter chaff. We believe transformative technologies:

- Experience dramatic cost declines and trigger key unit economic thresholds.

Crossing certain cost/performance thresholds can widen and diversify end-use addressable markets dramatically. We believe many investors don’t do the work to understand these unit-economic thresholds and misunderstand the potential scope of a transformative technology. - Cut across sectors and geographies.

An innovation that can proliferate across multiple industries and countries can enjoy dramatic addressable market increases as applications are “discovered” by different business sectors. Spanning across sectors also provides the opportunity for better product-market fits, insulates the innovation against business cycle risk, and garners attention from multiple disciplines, accelerating the innovation’s mutation rate. In an increasingly siloed Wall Street, with specialists for every subsector and a focus on short term dynamics, a cross-sector transformative technology is exceedingly difficult to understand. Thus, we believe traditional Wall Street may miss the bulk of the investment opportunity. - Serve as platforms atop which additional innovations can be built.

A platform upon which other innovations can be built may expand the potential use-case in ways that are almost impossible to imagine. The innovations, business models, and cultures that develop atop these innovation platforms help to weave them into society’s fabric. Innovation spawning platforms are typically underestimated over expansive time horizons because successful forecasts require that an analyst anticipate the scope of new products and services that they will spawn.

When combined, these criteria can increase the odds that a technology will have a profound impact and can decrease the odds that incumbent companies and investors will anticipate the technology’s ultimate impact.

As should be obvious, the automatic pinsetter would have failed on the last two criteria. Its application-set was limited to a single sector, indeed a 3.5 foot strip of maple, and it did not spawn more innovation. Yes, the technology delivered a dramatic cost decline, but not much else. With our screening methodology, we’d like to think that we would have stood apart from the mania.

(…which is not to say that we don’t roll the occasional gutterball).

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024