Today Tesla’s [TSLA] electric vehicles (EV) barely register as a percent of the luxury car market, let alone the overall car market. Because growth in the EV market has barely begun, Tesla has lots of room to run, especially if it increases market share.

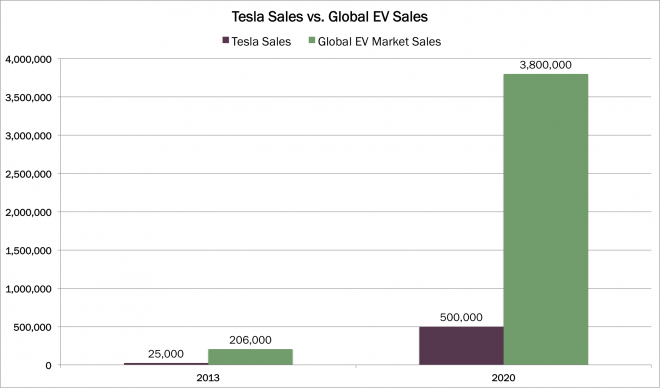

We predict that the EV market will grow rapidly as technological advances reduce costs and increase battery life. The market has already shown signs of growth. From a fledgling 45,000 EVs sold globally in 2011, they totaled 206,000 in 2013 and are likely to exceed 400,000 in 2014 if trends continue. According to Pike Research,the number of EVs sold annually will increase to 3.8 million in 2020, suggesting a compound annual rate of growth of over 50% from 2013.

Tesla’s share of the growing EV market is relatively small. As shown below, in 2013 it sold 25,000, accounting for 12% of the EV market. Pike Researchprojects 3.8 million EV’s will be sold in 2020. At this volume Tesla only needs to increase its market share of the EV market by 1% in order to meet their 2020 sales target of 500,000 units.

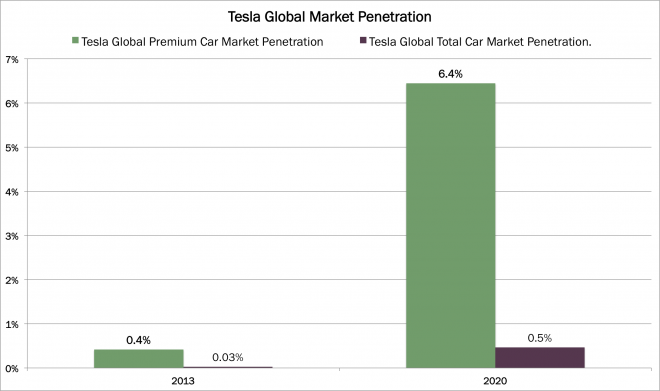

In 2013, Tesla’s Model S represented 0.4% of the six million in global luxury cars sold that year, as shown below. Compared to the 82.8 million in total sales, Tesla’s barely registered. Capacity constrained, Tesla will sell roughly 35,000 EVs in 2014, but with the Nevada GigaFactory in full swing by 2020 it projects sales of 500,000. By that time, the global luxury car market will approach 7.75 million vehicles and the overall market 107 million. Consequently, Tesla’s penetration of the premium car market will hit 6.5% and 0.5% of the overall market, not a heroic assumption for the best EV in the marketplace as rated by Consumer Reports.

Tesla plans to expand its product range with a less expensive Model 3 in 2017 and the Model X in 2015. [1] It plans to address the broader consumer market with lower prices and more efficient batteries, reducing the costs of the lithium-ion battery by more than 30% as the GigaFactory ramps to scale.

While many pundits believe that Tesla’s stock is in bubble territory, it has no competitors with similar battery systems, and current estimates suggest that even with 500,000 sales in 2020, it won’t need to gain much share from its current 12.5% of the growing EV market. If Consumer Reports continues to designate it as the best EV in the market, that assumption is probably much too low. If it is able to gain share of a rapidly growing market, Tesla has plenty of room to run.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024