Electric vehicles (EVs) [1] generally, and Tesla specifically, seem to be breaking the “s-curve” adoption mold. According to our research, EV growth is stealing the march from the traditional auto industry, and Tesla is leading the charge, so to speak.

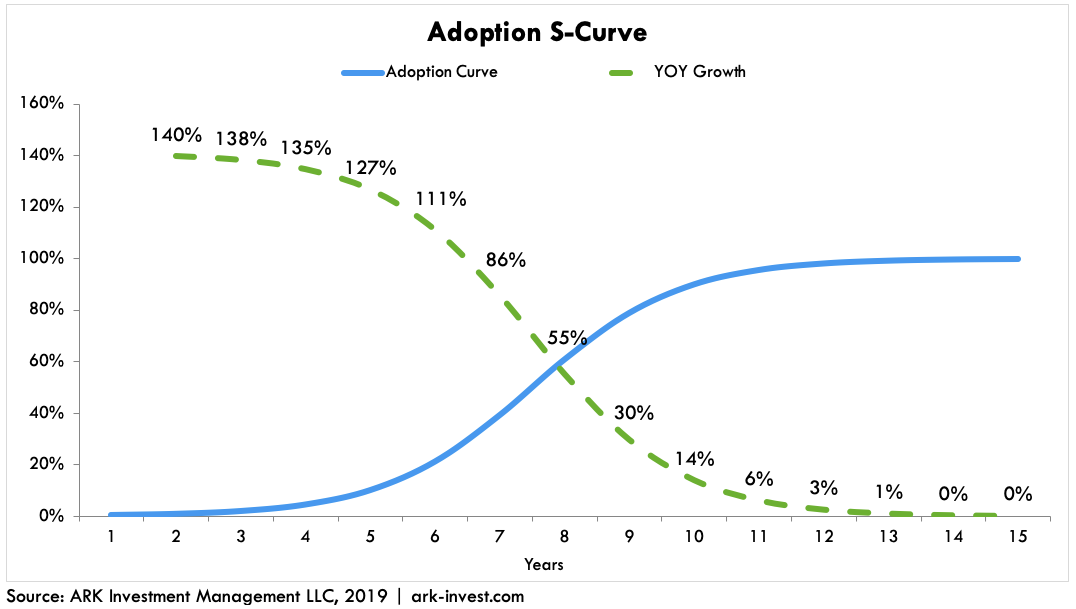

In a typical s-curve adoption cycle, growth decelerates as a new technology penetrates its addressable market, as shown below.

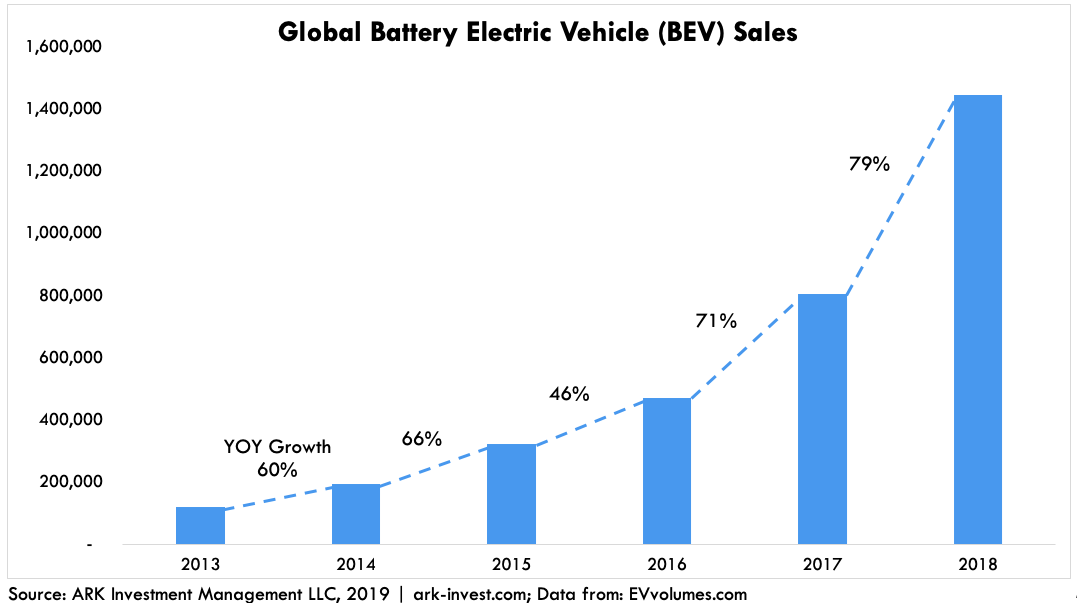

In contrast to a typical s-curve adoption cycle, the growth in EV sales has accelerated from 60% in 2013 to 79% in 2018, suggesting that EVs are expanding the addressable market, as shown below.

The rapid growth of the EV market has caught many analysts flat footed. Four years ago, the Energy Industry Administration (EIA) among other forecasting agencies estimated that EV sales would total a few hundred thousand units in the early 2020s. After they hit 1.45 million units in 2018, the same agencies now forecast that EV sales will increase to roughly 4-4.5 million in 2023, suggesting that their growth will decelerate from 79% last year to 25% at an annual rate during the next five years. Based on Wright’s Law, ARK’s forecast for EV sales in 2023 is 26 million units, roughly six-fold higher than the consensus estimate, with growth compounding at at a 78% annual rate.

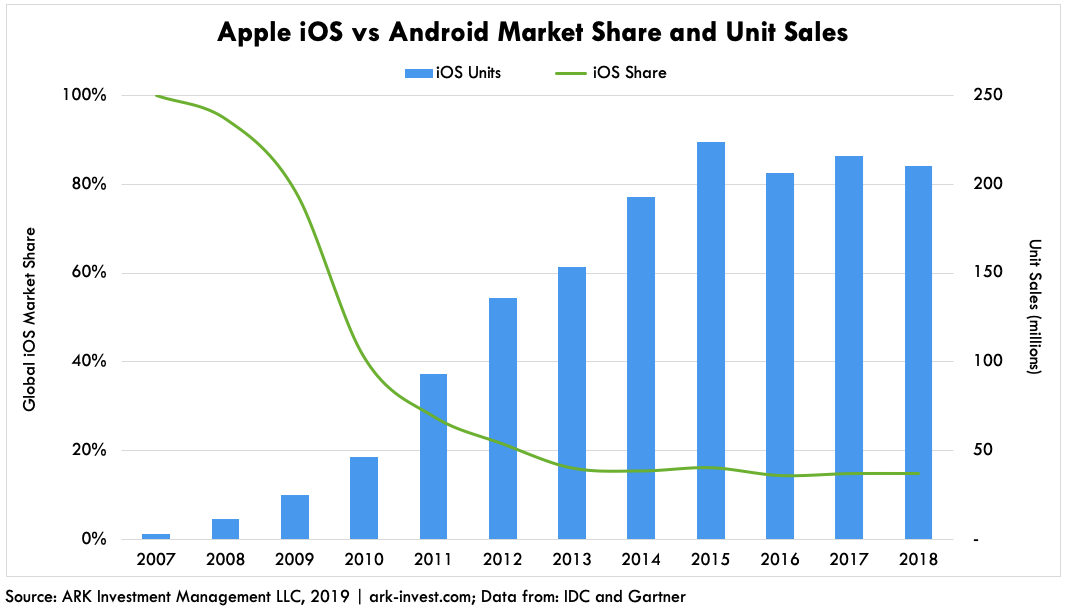

ARK’s thesis for the evolution of the market is that automakers will transition to EV production as battery costs fall, enabling sticker price parity with like-for-like gas powered cars. Interestingly, in rapidly expanding markets companies can sustain sales growth and lose share simultaneously. Apple lost more than 80% of its market share on the way to becoming the most profitable smartphone manufacturer in the world, as shown below.

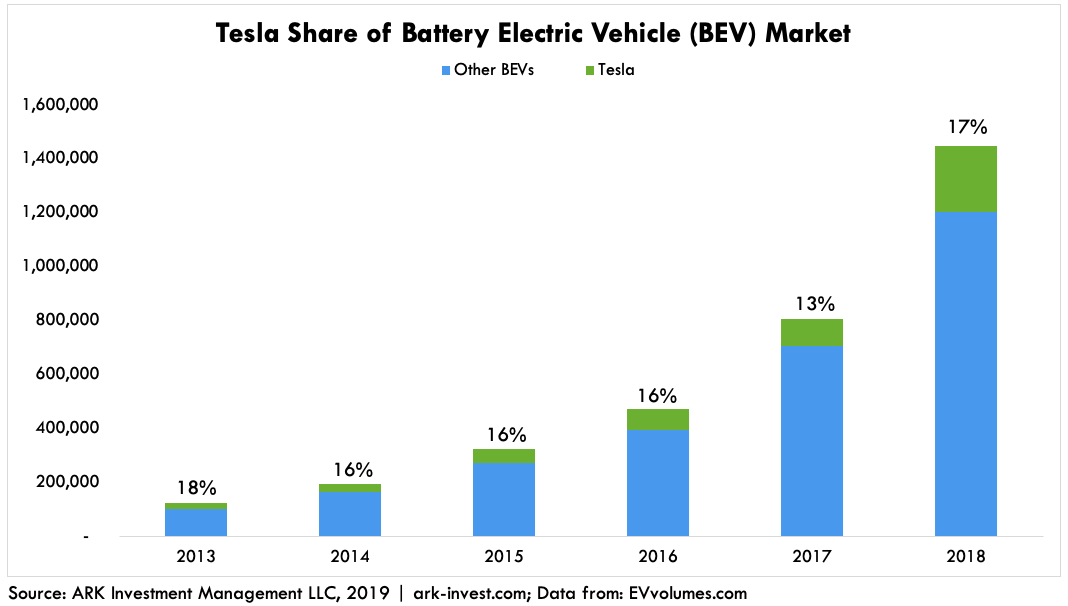

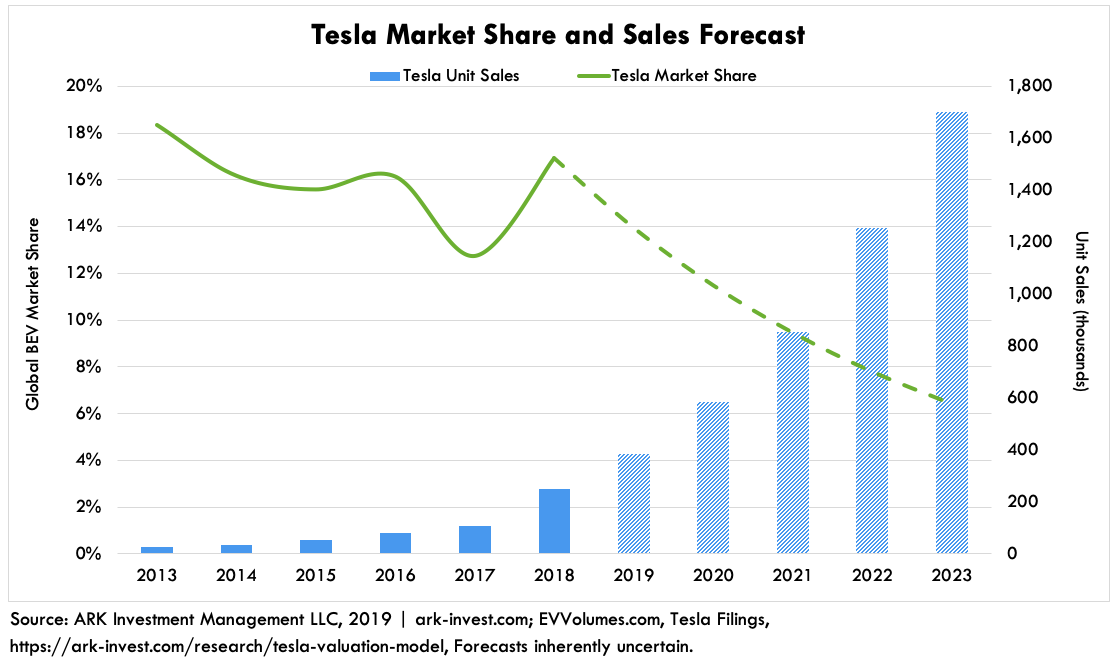

To date, Tesla has been an outlier in an already exceptional market. The EV market has grown more than 11-fold since 2013 and, for the most part, Tesla has maintained its market share, as shown below.

That said, ARK expects Tesla to follow in Apple’s footsteps, losing share as it continues to dominate the high end of the market. In our bear case, during the next five years Tesla could lose two-thirds of its market share, dropping from 17% share to 6%, while its sales increase 47% at a compound annual rate from 245,000 in 2018 to 1.7 million in 2023, as shown below. In our bull case, Tesla’s market share will drop from 17% to 11%, while its sales increase 65% at an annual rate to 3.0 million units.

Given the current trends in the EV industry, ARK believes the market on the whole could be supply constrained as companies attempt to scale battery pack production. It’s also worth noting how top down and bottom up models interact. If supply constraints limit the size of the overall market, that does not necessarily limit a specific company to the same size slice of a smaller pie. In the US, where EV competition has been limited, Tesla continued to scale production and grew its market share from 38% of EVs in 2013 to 80% in 2018. A supply constrained environment could lead to fewer players with larger market share than one would expect in the auto industry. There’s also the compounding factor that vehicles are becoming more and more software driven, which could lead to significant market consolidation.

Increased competition could be a boon to Tesla. Traditional car companies aiming to sell them first must convince customers that EVs are superior to gas powered cars, with benefits ranging from performance, total cost of ownership, and over-the-air software updates that improve the car regularly. Once committed to EVs, customers then can compare among EV offerings, giving Tesla what we believe is a competitive advantage.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024