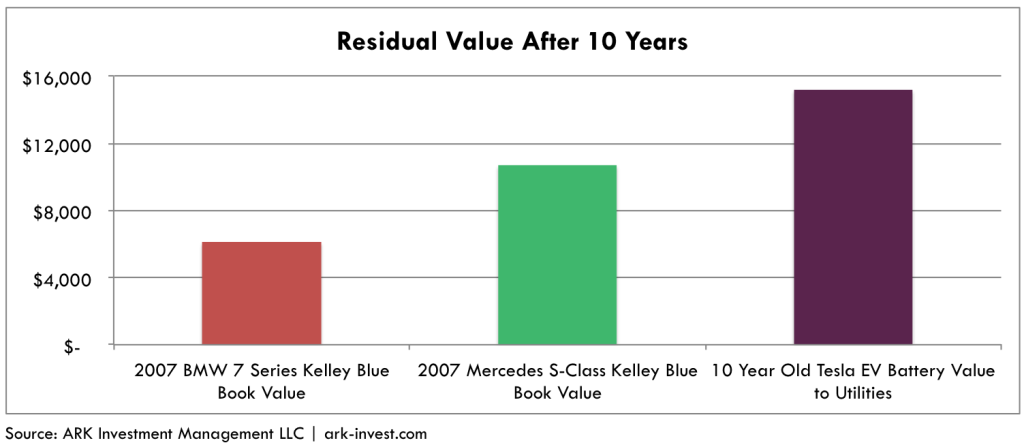

One of the chief concerns about Electric Vehicles (EVs) – battery degradation – seems to be misplaced: ARK’s research suggests that EV batteries will retain substantial value after reaching the end of their in-vehicle lives. Utilities are in constant demand for energy storage products. In fact, if electric utilities were to pay $15,000 per battery, the battery alone in a 10-year-old Tesla [TSLA] would retain more value than an entire vehicle powered by an internal combustion engine (ICE).

While few EVs have been around for more than a decade, as they mature and retire from the electric fleet, their battery packs may retain surprising value. While battery cells could degrade enough to impede a car’s performance over the span of ten years, the battery cells from a 10-year-old Tesla Model S 85 could be worth roughly $15,000 if sold to the utility, PJM.[1] In comparison, the Kelley Blue Book Value of a BMW 7 Series [BMW3.DE] and a Mercedes-Benz S-Class [DAI.DE], with the same number of miles, would be worth only 40 – 75% of just the battery’s value, as shown below.

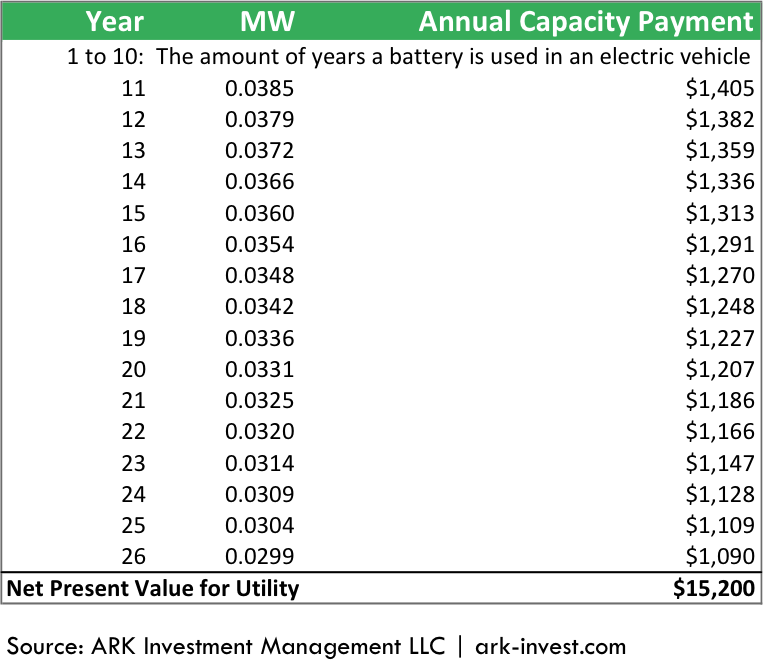

Why might EV batteries be so valuable to utilities? Among the most important reasons is the intermittent but critical need for “peaking power,” or the capacity to handle peak loads even if they occur just a few times a year. Satisfying peak power needs is so important that regional transmission organizations and independent system operators pay power generators for available electricity capacity independent of the cost to produce it. The price they pay typically is set through an auction process that guarantees future capacity. For the fiscal year 2020, for example, PJM currently is pricing each megawatt per day (MW-day) of capacity at $100. In other words, PJM will pay a power producer $100 per day for each megawatt (MW) of capacity it has set aside to generate electricity for peaking power. In total, PJM is paying more that $6 billion to guarantee capacity in 2020.

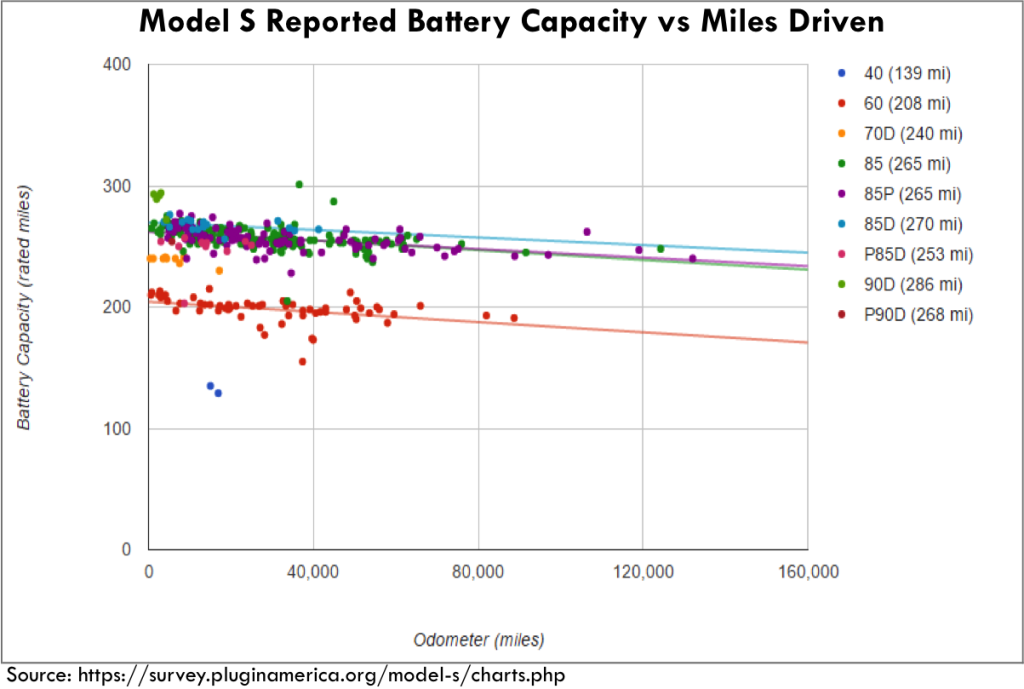

Because batteries lose capacity with each charging cycle, they cannot spend their entire lifespans in a car. Rapid discharging from accelerating quickly can shorten their lifespans in a car even more so. In the chart below, the battery degradation in various Tesla Model S models is clear as miles traveled increases. While an EV owner places a high priority on performance and range, a utility prioritizes the reliability and capacity of a battery. In other words, an EV with only 80% of its original range might be unacceptable to a car owner but at the right price will provide fair value to a utility.

If a 85 kWh battery used in an EV for 10 years were configured to store enough energy to generate electricity for 2 hours, its capacity would be 42.5 kw. Given its capacity loss over time in an EV and continued degradation in a utility, the net present value of the used battery to a utility like PJM would be roughly $15,000, as shown below.[2]

While the rate of EV battery degradation over a 10-year life is an issue, other considerations should mitigate or obviate the risk. First, the hardware in an EV should be modular, allowing for swap outs that could lengthen the vehicle’s life. Second, as illustrated above, the residual value of a 10-year old Tesla battery could be twice that of an entire ICE vehicle. Third, utilities should be ready buyers for EV batteries to satisfy peaking power needs. Finally, because Tesla is enhancing battery performance constantly, it should be able to recycle the raw materials from the battery cells and use them in newer generation cars.

While the focus on EVs typically revolves around energy cost savings and the environment, the economic benefit described above is not well understood and should be a pleasant surprise. Generally, EVs will not depreciate as rapidly as vehicles powered by the internal combustion engine. The result? The residual value of EVs should be much higher than traditional cars in the medium to long term.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024