In the past two years cobalt prices have more than tripled from roughly $25,000 per metric ton to more than $79,000 in response to supply constraints anticipated as electric vehicles (EVs) continue to gain traction. In 2017, the Congo accounted for 58% of global cobalt production, explaining the fear that geopolitical instability will cause shortages. In ARK’s view, however, the combination of higher prices and new battery chemistries will encourage mining in other countries while battery manufacturers lower their exposure to cobalt.

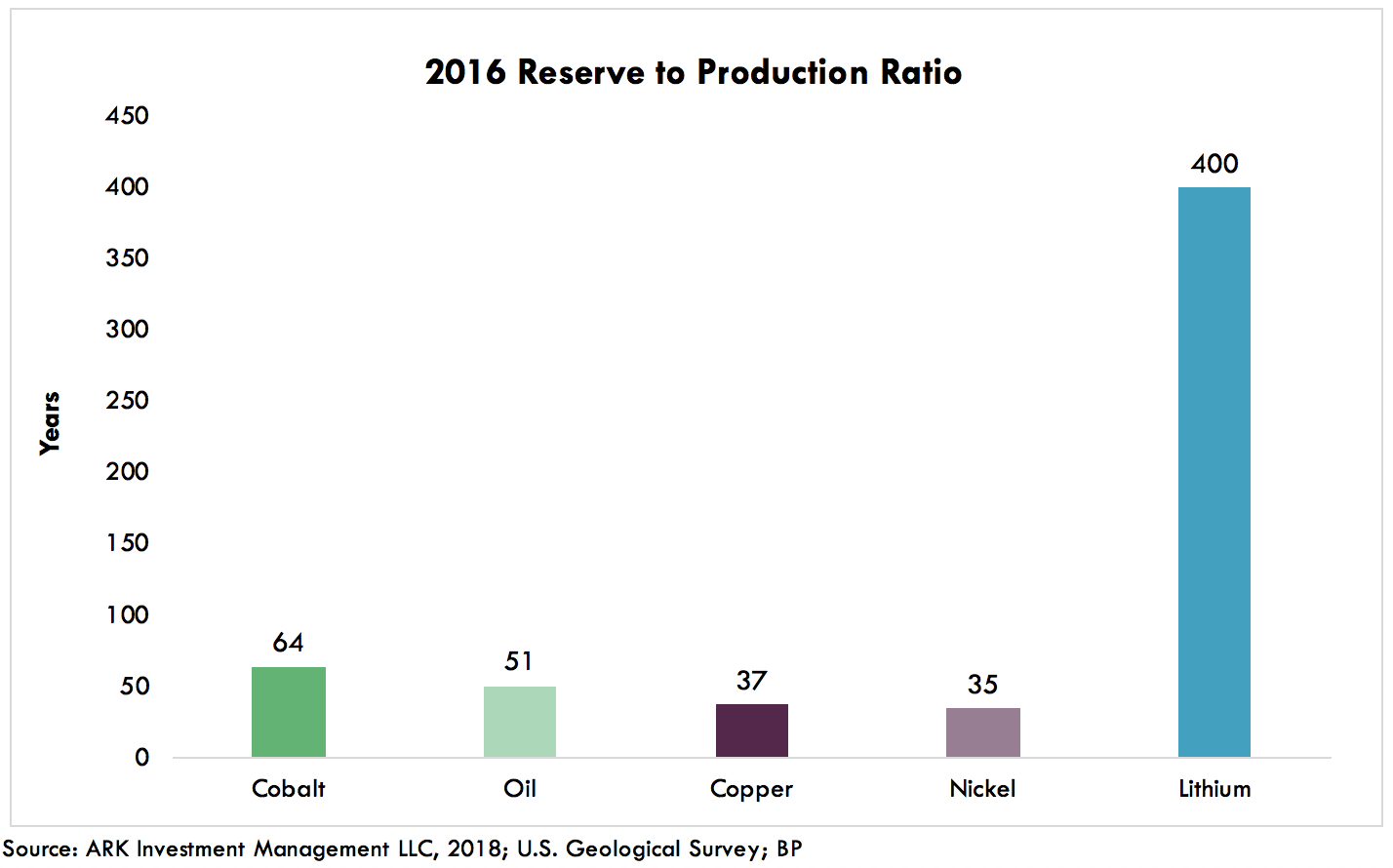

Since 2001, cobalt production has tripled from nearly 37,000 to 110,000 metric tons while reserves have remained fairly flat at roughly 7,000,000 metric tons. At today’s production levels, cobalt reserves should last for 64 years, longer than most commodities with the exception of lithium, as shown below. Given the recent price spike, the exploration for cobalt should increase meaningfully, adding to its reserve life for the first time in nearly 20 years.

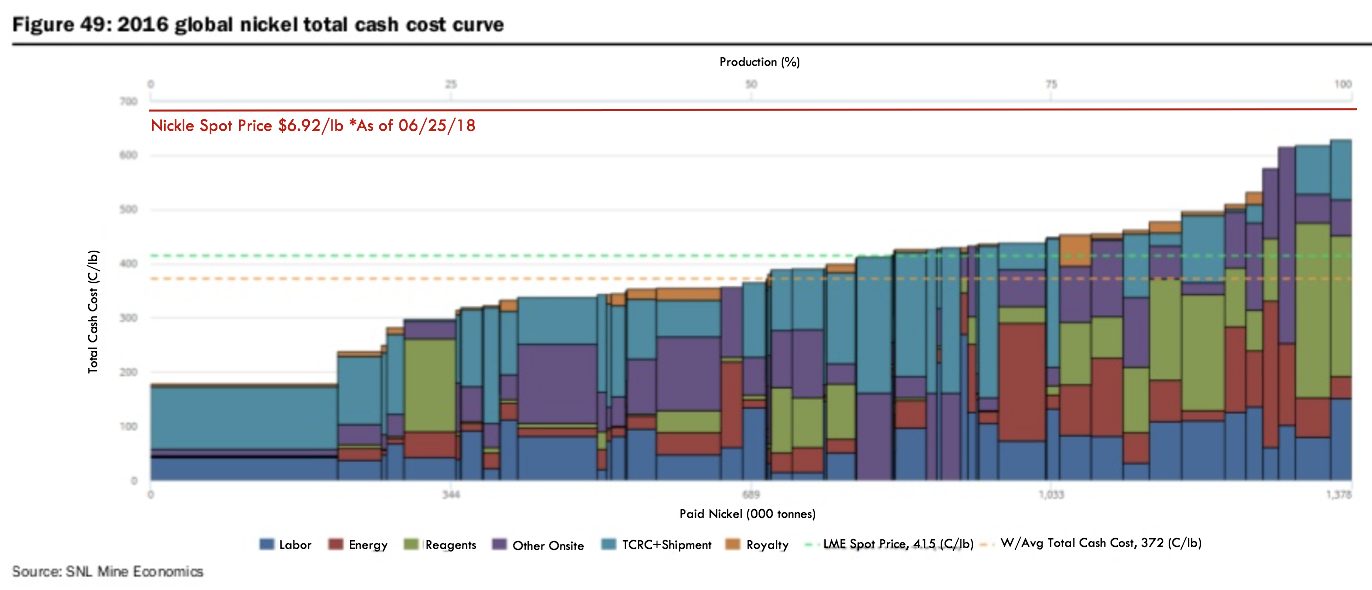

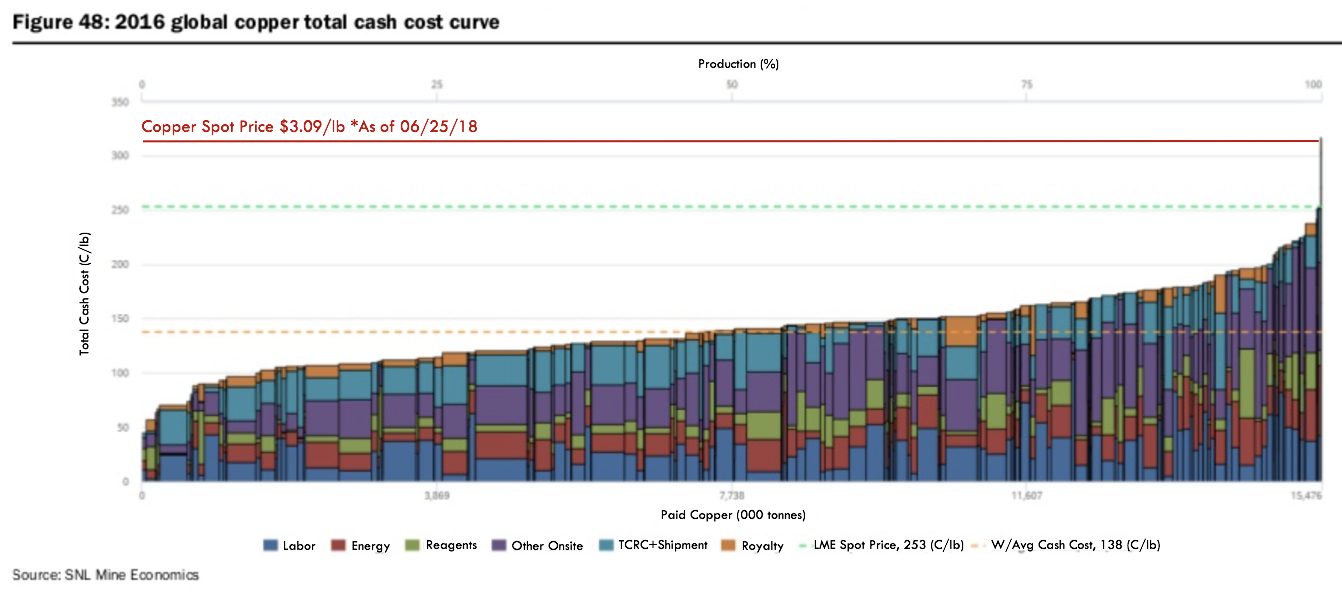

Unlike lithium, cobalt is a by-product of the mining for nickel and copper. As a result, its production and reserves are tied more to the price of those primary metals than that of cobalt. Since 2016, spot prices of both nickel and copper have increased significantly, as show below, which should stimulate investment in new mines and projects.

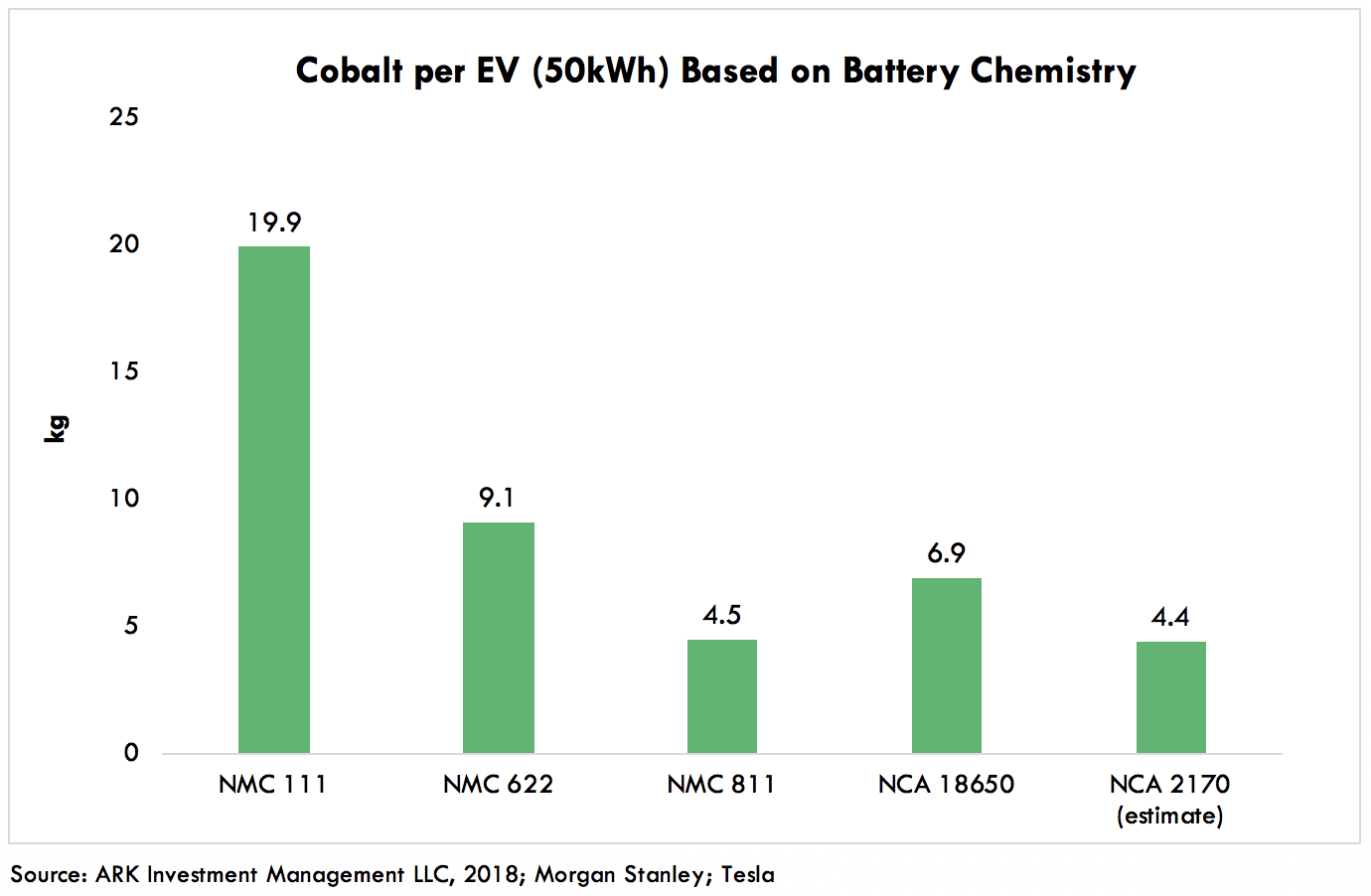

Even if the prices and production of copper and nickel were to disappoint during the next few years, newer batteries are becoming less dependent on cobalt. As shown below, new chemistries could reduce the cobalt content in a 50 kWh car by roughly 75%, from 19.9kg to less than 4.5kg. For context, GM [GM] designed the original Chevy Bolt with nickel manganese cobalt (NMC 111) batteries, the cobalt content of which is nearly three times that in Tesla’s Model 3 nickel cobalt aluminum (NCA) batteries. NMC 622 and NMC 811, which are on their way to being commercialized at scale, also require less cobalt.

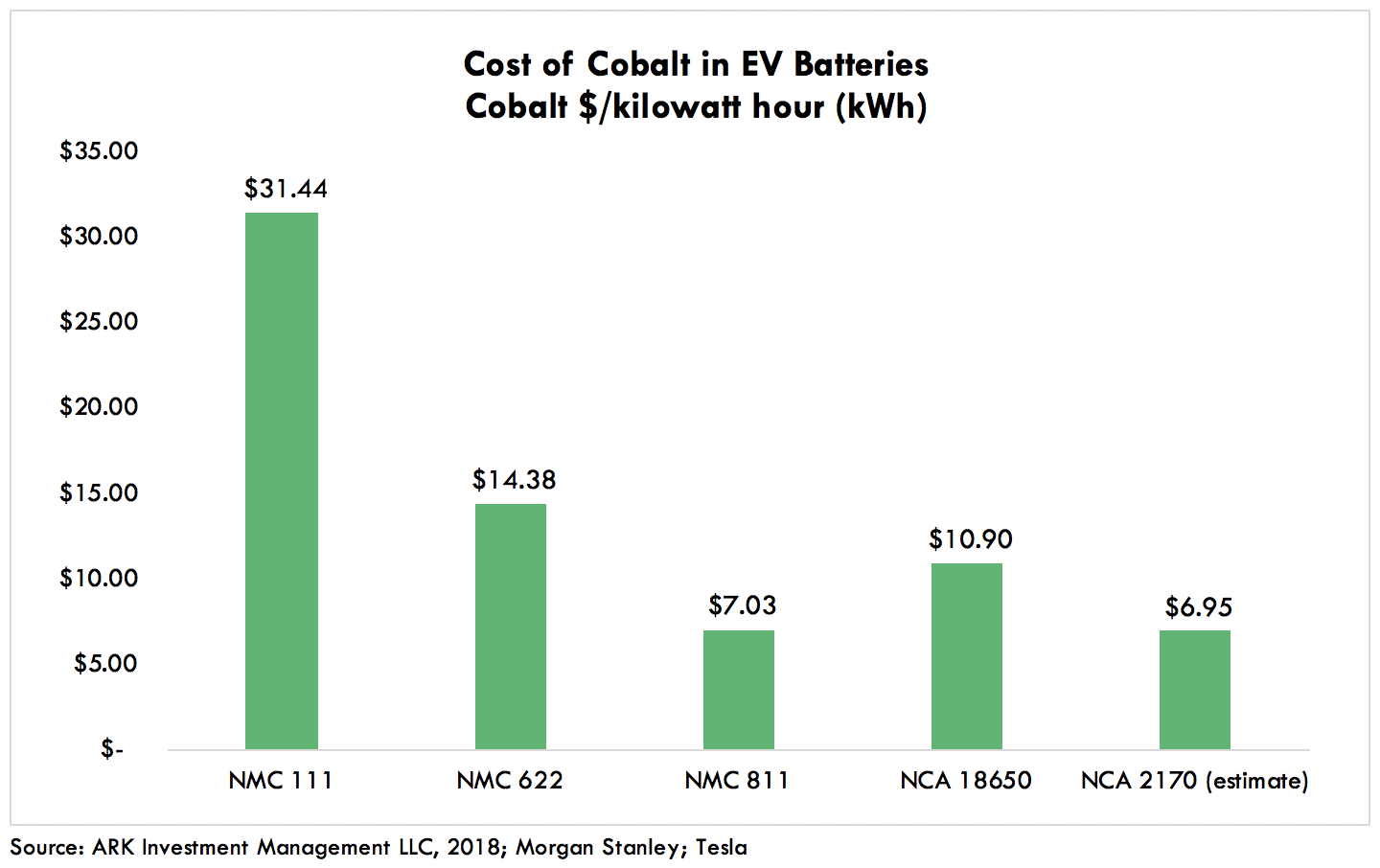

Lower consumption of cobalt per kilowatt hour (kWh) will cut the material costs of a battery significantly. At its current spot price of ~$79,000 per metric ton, cobalt’s cost per kWh is $31.44 for NMC 111 batteries and $6.95 for NCA batteries, a material difference in the context of the $100 per kWh total battery cost which Elon Musk expects Tesla [TSLA] to reach by the end of this year. The cost will drop further as batteries become more cobalt-efficient at the same time that new mines open up in response to its price spike during the past three years.

ARK forecasts that EV sales will scale more than ten-fold to 17 million globally during the next four to five years, increasing the demand for cobalt by 75,000 to 338,000 metric tons depending on which battery chemistries EV manufacturers choose. In the context of the 110,000 metric tons of cobalt production in 2017, the incremental demand could be overwhelming in the absence of new production and increased efficiencies in battery chemistry. Mining is a capital intensive, low margin, high risk business that enjoys booms and suffers through cyclical busts. Soaring prices typical overexcite an industry, causing poor capital deployment decisions. While cobalt probably will remain an important part of the EV supply chain, fears that supply constraints and high prices will impede the growth of EVs seem misplaced.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024