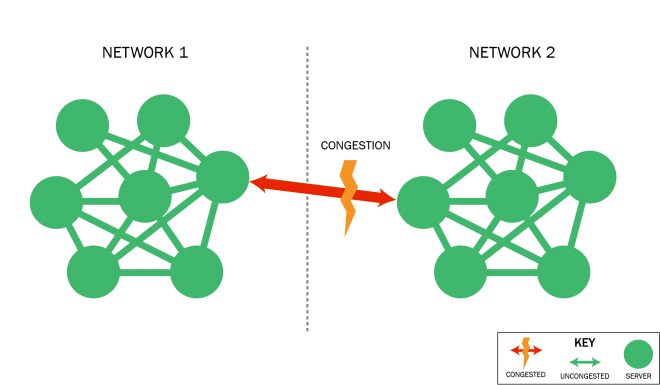

How does Netflix’s [NFLX] streaming distribution work? The internet is a network of interconnected networks, each operated by a different entity. Interconnections between networks are potential bottlenecks because upgrades require agreements among the counterparties. Typically, investment in the gateways lags investment in the individual networks. As a result, traffic flowing from one network to another, crossing multiple interconnects to its destination, can face significant delays.

An apt analogy is two rooms separated by a doorway. If the rooms’ owners were to renovate, adding floor space, each room could accommodate more people comfortably. In the absence of an agreement to add doorways, however, the migration of people between the rooms would become congested, as shown above. Multiple rooms would compound the problem significantly, as shown below.

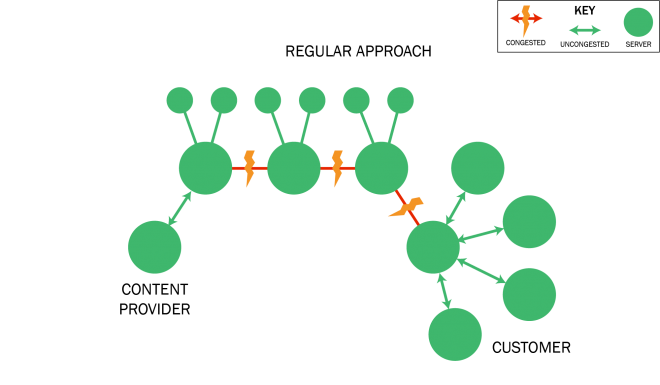

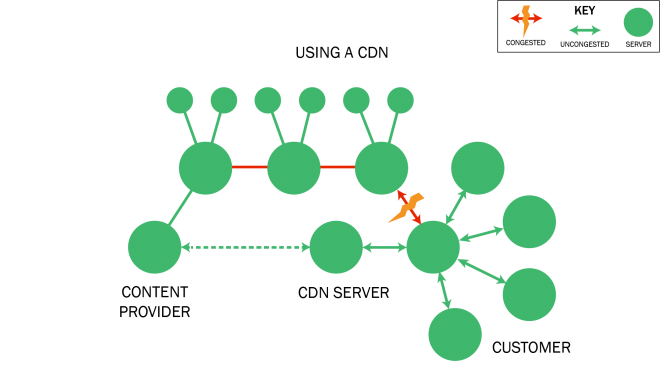

Now imagine that gigabytes instead of people were to occupy the rooms to get a sense of the challenge that Netflix faces. Netflix accounts for 35% of the total internet traffic volume, 20% more than second highest volume producer, YouTube [GOOG]. It sends data across multiple internet service providers (ISPs) in order to reach viewers. To deliver information quickly, Netflix has depended upon Akami [AKAM] to act as a trusted intermediary, caching and then serving its most popular programs on-demand. These content delivery networks (CDNs) are servers on the edges of the network, as shown below. As Akamai’s CEO explains, “the worst place in the world to serve your content from is a data center.”

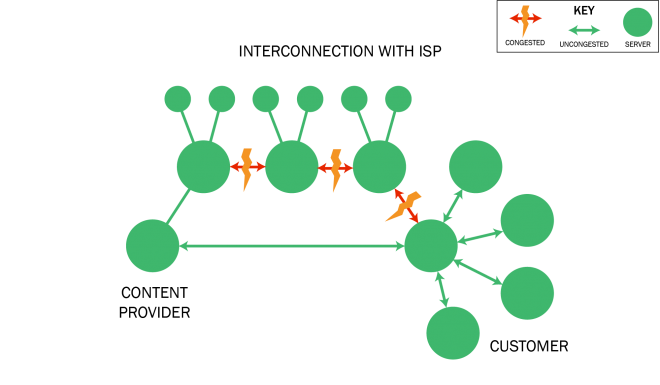

Companies such as Netflix [NFLX], Amazon [AMZN], and Apple [AAPL] are large enough to deploy their own CDNs instead of relying solely on third party services. Simultaneously, they enter into negotiations with ISPs for direct interconnections between their networks, meaning direct access via an exclusive route, bypassing intermediary networks and ISPs. Direct interconnections provide faster service, and also reduce congestion in general, as the company’s data no longer clogs regular routes, as shown below. By directly interconnecting with ISPs, Netflix bypasses commercial CDNs to reach the edge of the network.

In reality, Netflix uses multiple options to route the voluminous traffic it generates, shifting to lower cost options as they become viable. While Netflix originally sent most of its traffic through commercial CDNs such as Akamai and Level 3, it shifted to its own CDN– Open Connect- negotiating peering agreements with smaller ISPs and deploying caching devices in their networks. Having less bargaining power with large ISP networks and unable to deploy Open Connect in their networks, Netflix has bypassed the commercial CDNs and interconnected directly with the ISPs. Netflix must pay for those connections.

At posted commercial rates, Netflix would have to pay roughly $500 million per year to deliver its content around the world. Netflix does not pay this, likely far less with individually negotiated contracts. Its ability to pay lower distribution fees than $0.02 per GB to deliver its $3 billion worth of content via commercial CDNs gives Netflix a competitive advantage. Netflix likely pays per Mbps sustained, rather than per GB total. Otherwise it would pay $0.75 per customer per month for the 1.5 average hours of viewing per user each day. Instead, Netflix has invested $100 million in Open Connect, improving its negotiating power with ISPs and third party CDNs and benefitting from economies of scale.

When ISPs do not allow peering and do not allow caching inside their networks, Netflix can negotiate paid interconnection deals with them to avoid paying for commercial CDNs. While Open Connect caches sit inside some ISP last miles, others want to reduce the transit costs they would have to buy. For now, Netflix could commercially reserve sufficient capacity for its traffic via direct interconnections for $80 million per year at publicly available rates, or roughly $0.12 per customer per month.[1] It most likely pays a lower average price, due to its size and market power. However, when ultra high definition ‘4K’ content proliferates, it will require five times the bandwidth and, in the absence of CDNs, another layer of infrastructure costs and interconnection fees.

Netflix must carefully weigh how much it is willing to pay to route its traffic across networks in order to deliver a quality stream to its customers. Some of its streams traverse through commercial CDNs, some over its own CDN, and others through direct interconnections.

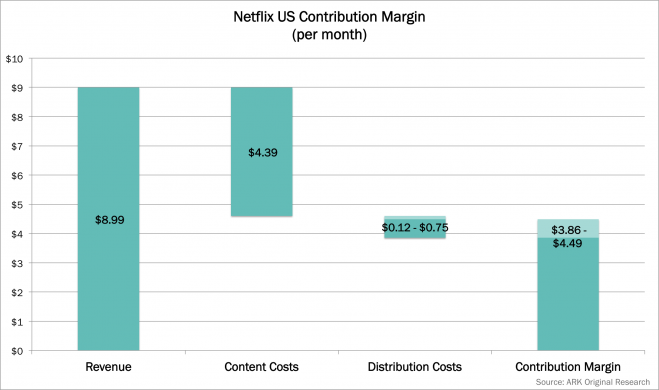

Almost half of Netflix’s revenue per user is spent on content acquisition and production, $4.39 on average per user per month, and more than $3 billion annually. Distribution costs range from $0.12 for interconnects (not accounting for infrastructure costs) to $.75 for commercial CDNs, as shown below. As a result, Netflix’s contribution margin ranges from $3.86 to $4.49, or 42% to 49%. Its ability to command lower distribution costs than commercially available, provides an important competitive advantage.

Peer-to-peer (P2P) offers the potential of a more efficient distribution strategy. As end-users share content residing on their devices with other users, they reduce the amount of data crossing the length of the network. While conceptually appealing, P2P faces extremely challenging technical hurdles. As with BitTorrent, this approach could expose the real bottleneck in the ISP network, the last-mile. A majority of Netflix traffic goes to mobile devices, which are more difficult to reach with peering solutions. Additionally, Netflix does not have permission from rights holders to legally store content on end devices.

Netflix has a strong incentive to balance its distribution options between cost and quality of service and, pending legal challenges, should be a prime beneficiary of net neutrality in the future. Ultimately, who should be responsible for network congestion, and pay the attributed costs? ISPs build and own the infrastructure, while content companies generate traffic and profit from the infrastructure. Content consumers pay for both. Thus far, large ISPs have attempted to leverage their control over the end-user, imposing costs on Netflix and peers in order to generate a return on investment and continue technological improvements in their networks. The proposed merger between two of the largest ISPs, Time Warner Cable [TWC] and Comcast [CMCSA], would add to ISP concentration, if allowed. On February 26th, the Federal Communications Commission (FCC) voted in favor of net neutrality, setting the stage for years of legal wrangling.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024