Caveat Emptor — Beware of Direct-to-Consumer Genetic Testing

The Human Genome Project in 2003 inspired the dream of precision medicine and turned DNA into mainstream conversation. It also gave rise to next-generation DNA sequencing (NGS), one of the most transformative technology platforms in history. Despite the growing clinical utility of sequencing, most people still associate genetic analysis more with ancestry services than with the diagnosis of disease which, in a way, is good news. In our view, the healthcare data that many direct-to-consumer genetic testing companies offer is badly flawed and irresponsibly delivered. Within five years, we believe that consumer genomics firms will lose the healthcare side of their businesses to companies that harness NGS to discern mutations, the earliest manifestations of disease.

For years, geneticists have used a technique called genotyping to surface mutations within DNA. Genotyping arrays are apt at identifying common, well-known genetic variants and linkages to ancestry. They also are cheap and form the backbone of direct-to-consumer (DTC) testing services like 23andMe and AncestryDNA.

Recently, growing consumer demand has prompted DTC firms to add premium genotyping services to gauge the risk of inheriting various diseases. Overwhelmingly, clinicians have panned these DTC health reports.

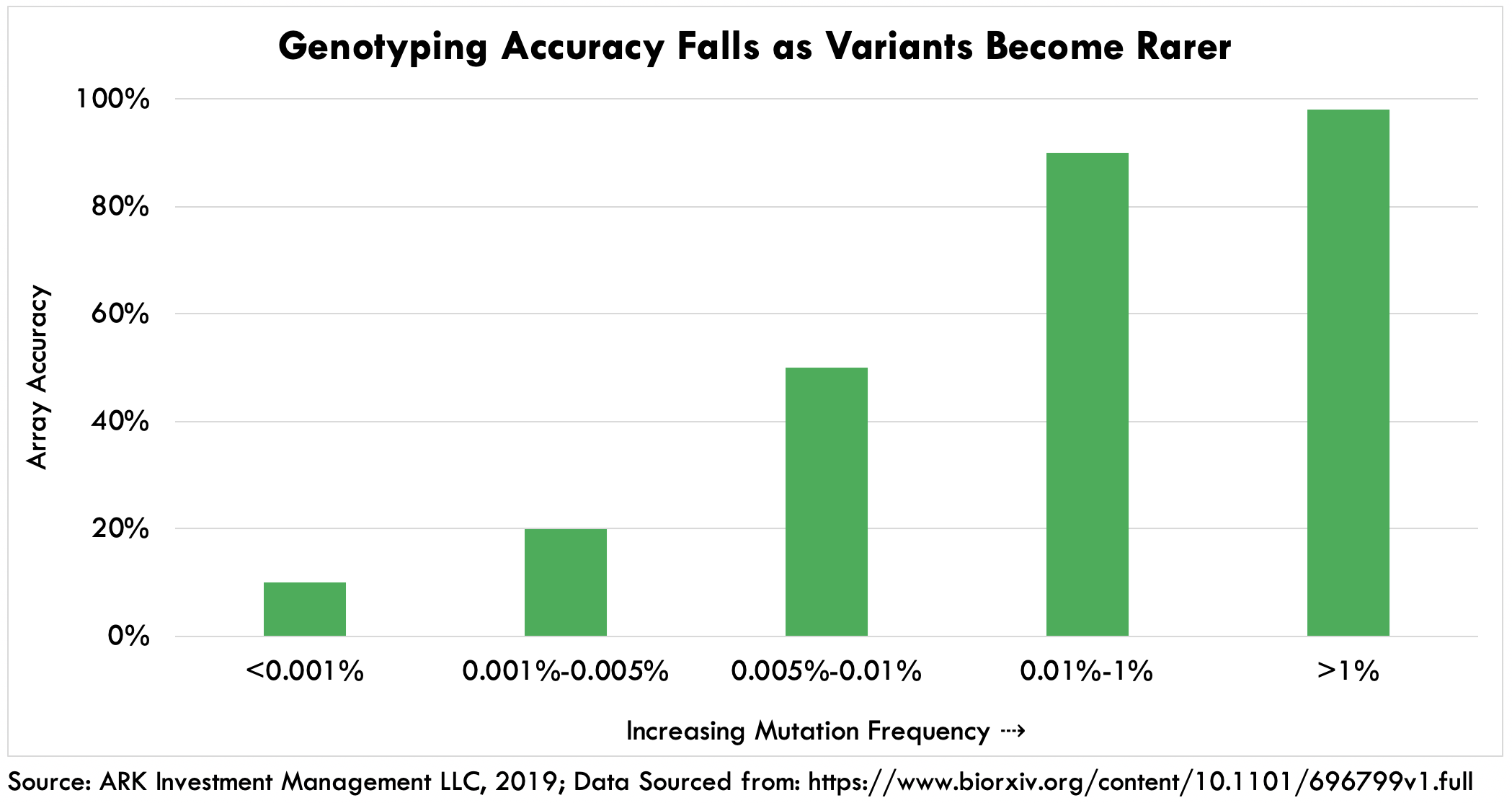

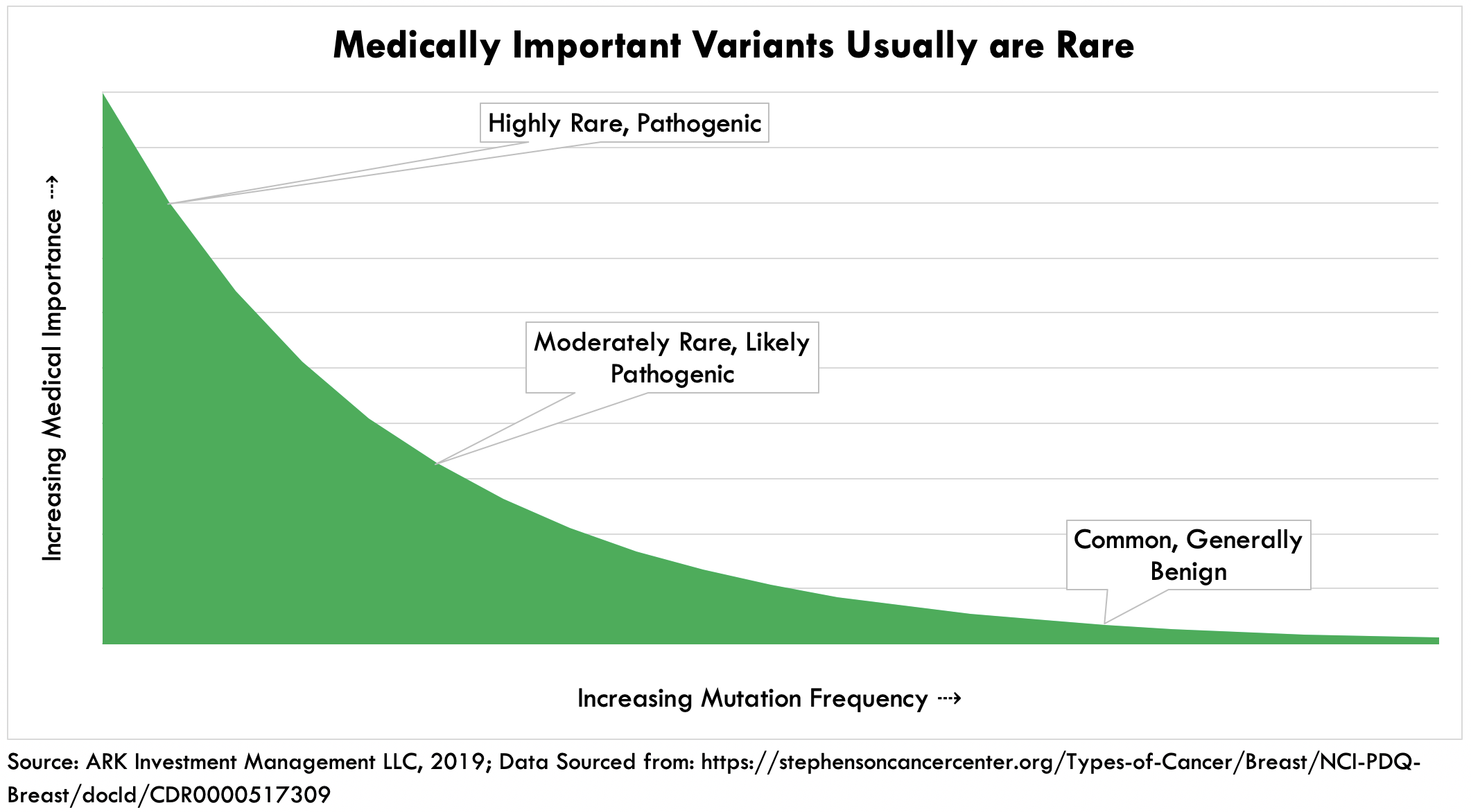

DTC health tests based on genotyping can detect common genetic variants associated with chronic conditions such as cancer and Alzheimer’s disease. They report only common, well-researched variants because the accuracy of genotyping falls with rarer variants as shown in the first chart below. Because of the dearth of data on rare variants, genotyping algorithms struggle to classify them. Importantly, the medical usefulness of a genetic variant is tied to its rarity, as shown in the second chart below and, while not all rare variants are medically useful, virtually all medically useful variants are rare.

Concern about accuracy explains the FDA’s recent decision to allow DTC firms to report on only three out of more than 1,000 known mutations within BRCA1/2, two genes involved in hereditary breast and ovarian cancer (HBOC). Given such a constrained mutation set, DTC health tests offer little in the way of predictive value. In a 2018 study of more than 100,000 undiagnosed patients with HBOC variants, for example, 88% of the DTC tests would have delivered false negatives.

Issues with testing accuracy also extend to the subset of variants that DTC companies do test. Several studies have exposed false positive rates in the range of 40% to 50% which have led to invasive tests and surgical procedures that have been unnecessary. Some DTC firms combat false positives with secondary tests like NGS to confirm pathogenic variants, but many do not.

Many DTC firms absolve themselves of responsibility by claiming in fine print that a third party must confirm test results. As a result, up to 62% of recipients take their raw, non-quality-controlled data file to analytics engines, such as Promethease, even though clever bioinformatics cannot scrub away the raw data errors produced during the genotyping process. Worse still, consumers are caught in a tug-of-war between the DTC firms and analytics engines, neither of whom claims responsibility for inaccurate data or offers genetic counseling.

These issues do not apply to NGS, a technology platform that combines state of the art advances in biochemistry, optics, and parallel computing in a precise, highly scalable, and cost-effective manner. NGS can detect virtually all variants including novel variants, mutations discovered for the first time. While genotyping is equivalent to reading one word from a novel, whole genome sequencing is like reading the entire book dozens of times, generating enough data to harness AI engines that can optimize the interpretation of genetic variants. In other words, the gap between DTC companies using genotyping and medical-grade companies using NGS is widening: training data refines and improves test accuracy, suggesting that DTC firms are years behind companies fed by NGS.

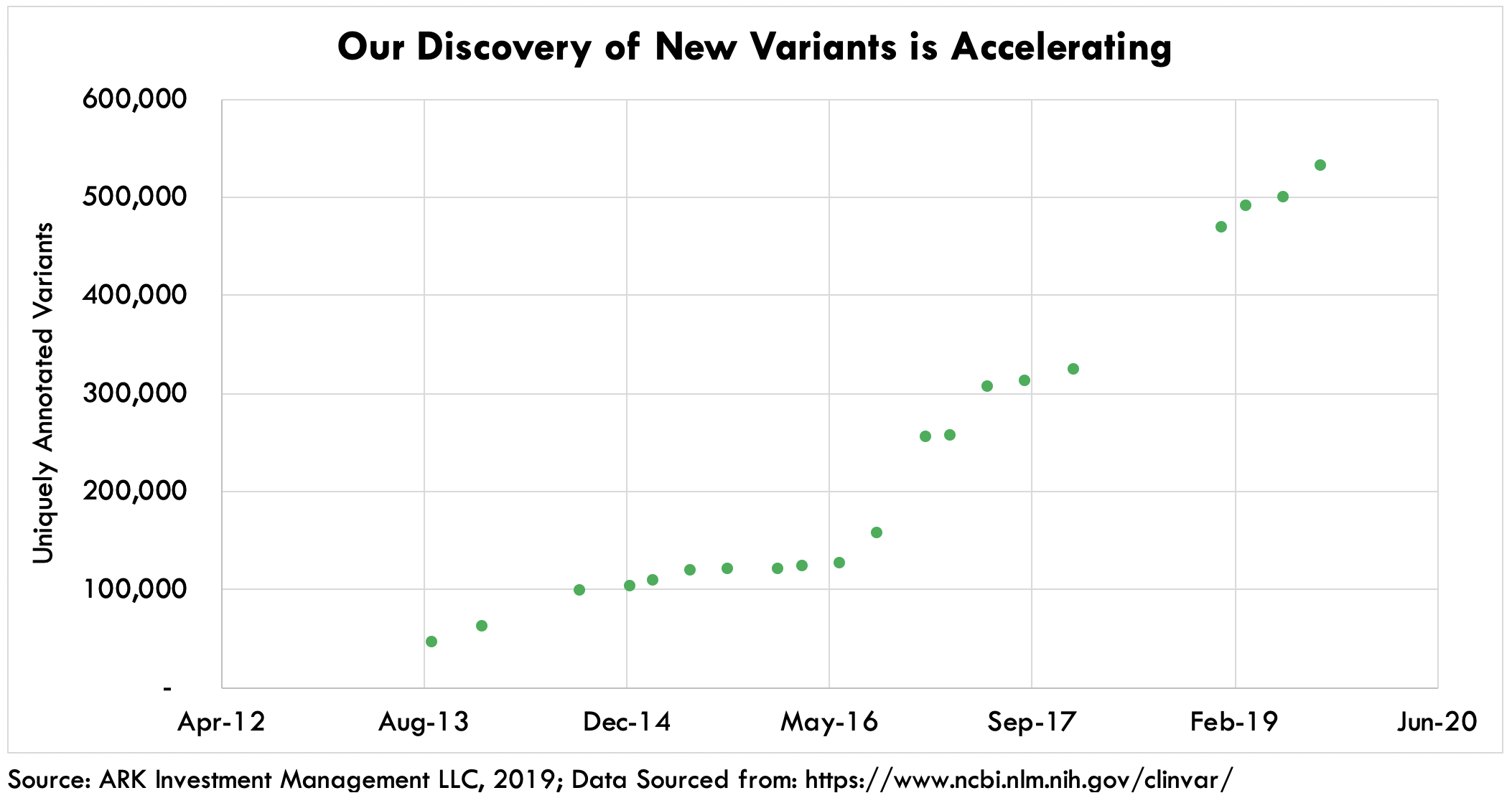

Moreover, the importance of data in genetic testing should increase as the scientific community discovers new genetic mutations. Consumers may have greater utility since their NGS data can be digitally reassessed. Variants of unknown medical significance today could become actionable tomorrow. Already today, NGS-powered companies like Veritas Genetics update and provide genetic counseling to test patients if one of their variants is reclassified. Given the rapid rate at which researchers are discovering new variants, as shown below, enhancing our understanding of the biology of disease, medical-grade genetic testing should increase concomitantly.

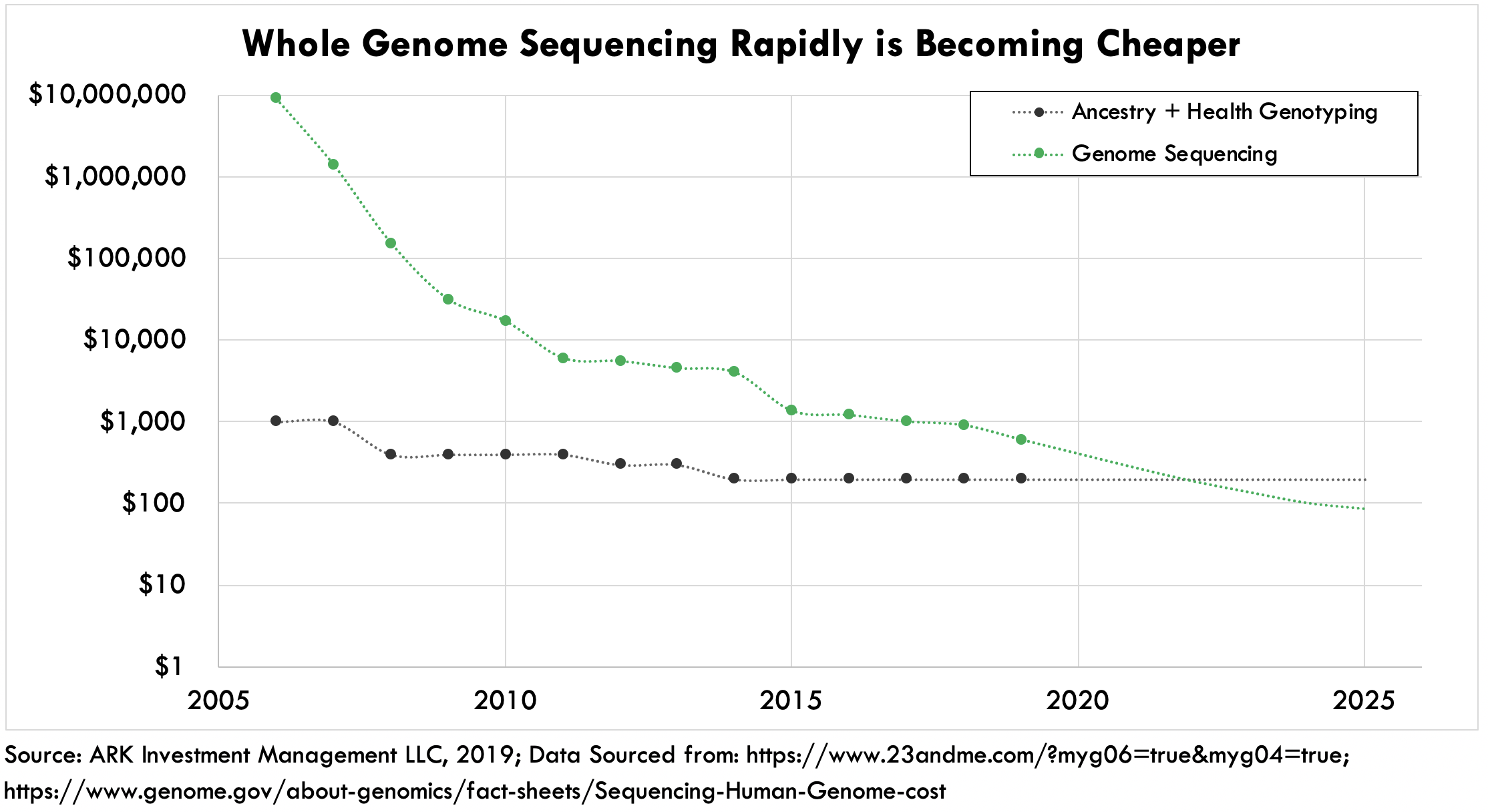

When 23andMe began offering genetic tests in 2006, the cost to sequence a whole genome was prohibitively expensive at roughly $10 million, giving the lower cost but unexhaustive genotyping solution an opening to capitalize on the consumer’s intense desire to learn more about individual health and disease. Since then, swift innovation on both the hardware and software sides of NGS have pushed whole human genome sequencing costs down to less than $1,000 and, according to Wright’s Law, should continue to push them down to $100 by 2023. Already today, Veritas Genetics offers whole genome sequencing and variant interpretation for $599.

In our view, NGS is the best solution for genetic testing, given its superior accuracy, cost-effectiveness, and soon—affordability. While DTC ancestry and trait tests could continue to serve as stocking stuffers, NGS based tests are likely to dominate the healthcare market, democratizing accurate genetic testing, and improving patient outcomes dramatically.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024