ARK estimates that Netflix’s [NFLX] subscriber base will more than double in the next five years, growing to 175 million by 2020, up from 75 million in 2015. This growth will be fueled by aggressive international expansion of its streaming service, increasing numbers of broadband subscribers, and a growing library of content that caters to different audiences across the world. In this article, we’ll walk through the key assumptions and potential pitfalls in our model while sharing our data set in the spirit of open research and collaboration.

Sizing The Opportunity

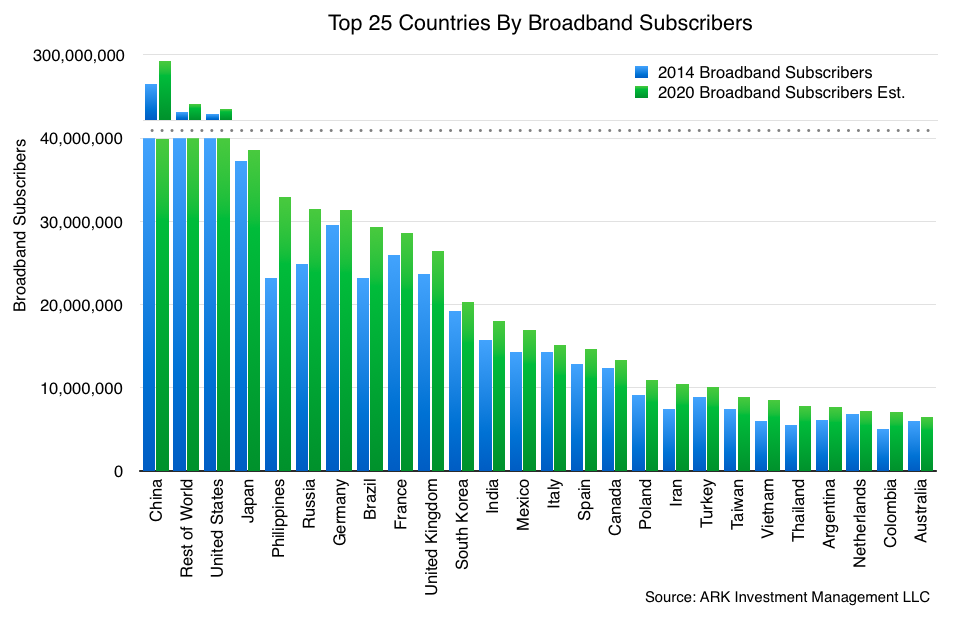

In January, Netflix expanded its streaming service to cover 190 countries world wide. With the exception of China, Netflix essentially covers the whole globe. Netflix’s addressable market is best measured by the number broadband connections. In 2014, there were 750 million fixed-line broadband subscribers globally. ARK estimates broadband subscribers could reach roughly 925 million by 2020 [1] (See chart below). The primary drivers will be growth in China and other developing countries.

In the series of charts below, we show broadband subscribers in the top 25 countries. The “Rest of world” category denotes all other countries not included in the top 25.

Given 926 million broadband connections worldwide, what level of penetration could Netflix achieve? The answer depends on two factors: the level of interest and the ability to pay for the service.

Who Wants Netflix?

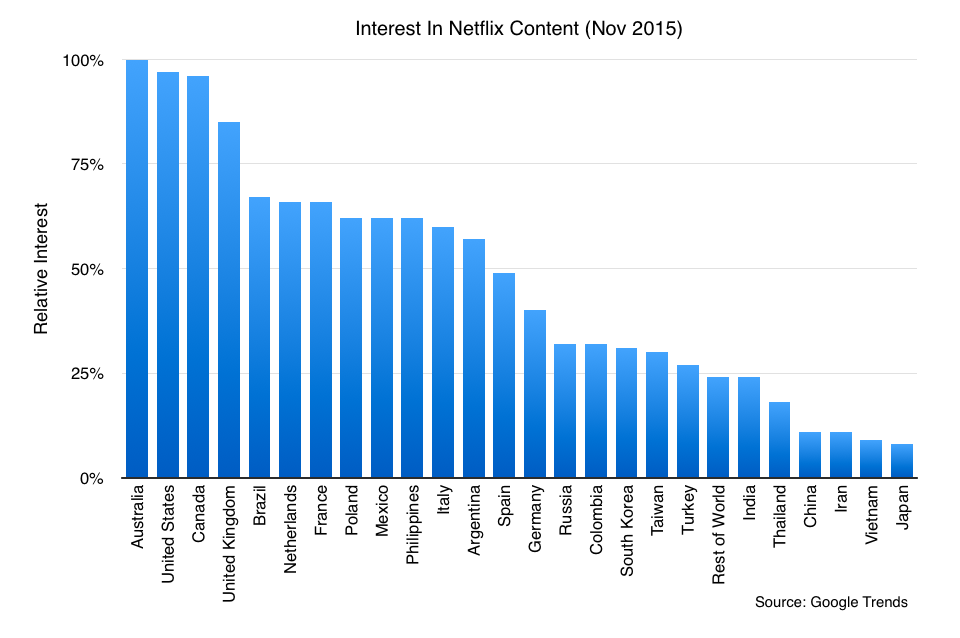

To assess interest in Netflix, we looked at worldwide Google Trends data [2] for four popular pieces of content: House of Cards, Orange Is the New Black, Daredevil, and Finding Nemo. We used the first three to measure interest in Netflix’s current flagship content. We used Finding Nemo as a rough proxy for future Disney and Pixar films that fall under an exclusive licensing deal with Disney (such as the sequel Finding Dory) in the US. We also assumed that over time Netflix would gain access to Disney content in international markets.

In the chart above, the Google Trends data for the four shows are summed and normalized to the country showing the highest interest (Australia). Despite the modest sample size, this interest data revealed some interesting insights. Australia topped the list, correlating with recent government survey data indicating rapid adoption of Netflix since its Australia launch. Interest was much higher in France than in Germany, reflecting Germany’s cultural aversion to pay TV. Finally, the results did not measure interested based on Netflix availability—The Philippines and Poland stood out with strong interest despite not being currently served.

Who Can Afford Netflix?

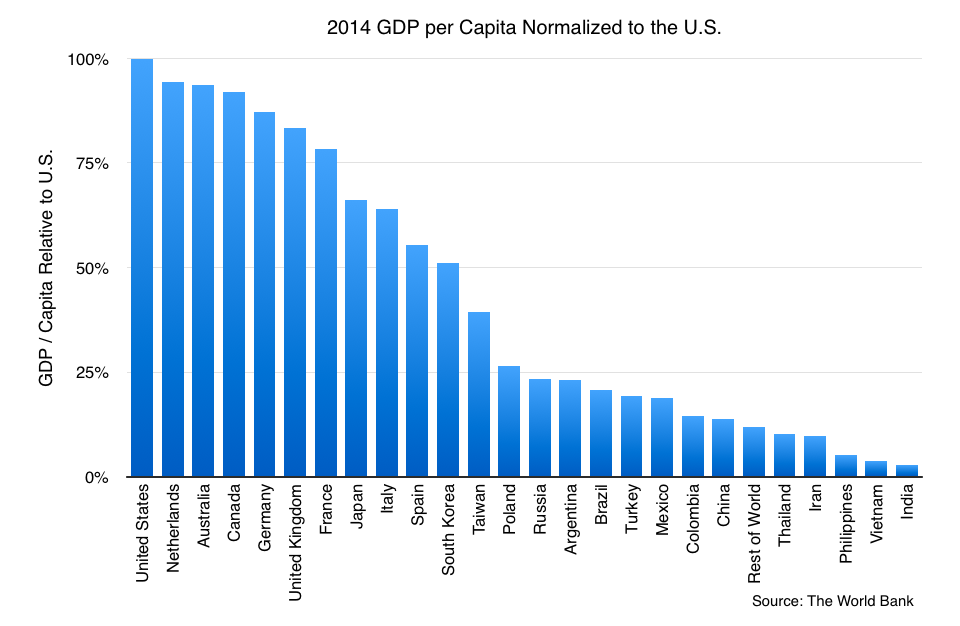

The interest data answers the question of who might want Netflix. To answer the second question—who has the means to pay for Netflix, we took GDP per capita for each country and normalized it to the United States, which has the highest per capita GDP. The results, shown below, are not surprising—developed countries led the group while developing countries trailed.

Combining The Results

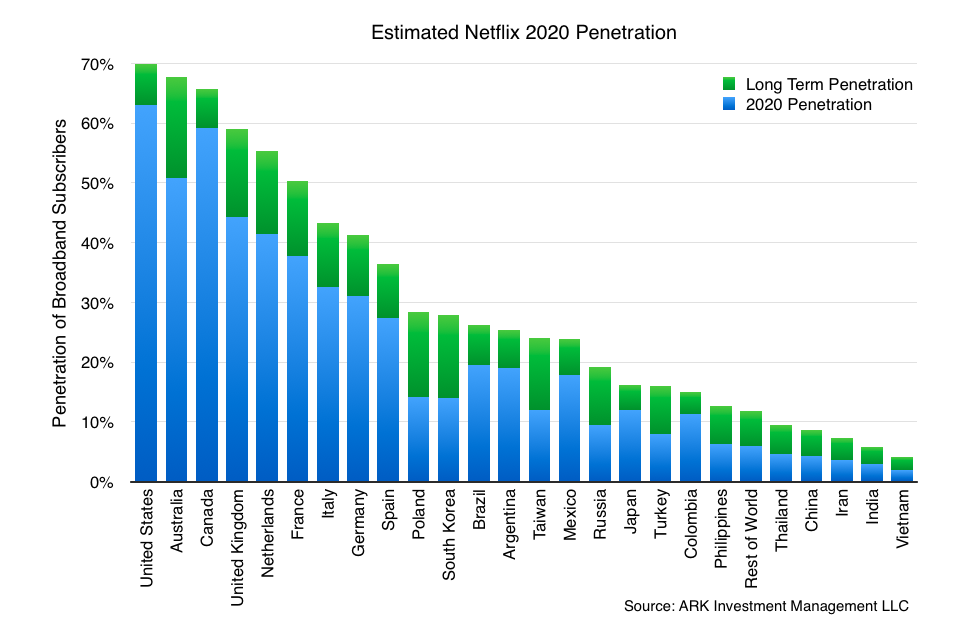

To estimate Netflix’s long term broadband subscriber penetration potential, we took the geometric mean of the interest data and GDP per capita data and normalized it to 70%—management’s guidance for long term US penetration.[3] The chart below shows the combined results, with 2020 and long term penetration estimates. Note that these results are basely purely on fixed-line broadband penetration; affordable data plans for video over LTE would greatly expand Netflix’s addressable market.

This penetration model, though far from perfect, makes a few predictions that correspond well to empirical data. With no manual adjustments or access to survey data, this model anticipates the United States will be the country with the highest penetration, which is true today and likely will remain so. It predicts Australia, Canada, and the UK will be the leading large countries outside the US, which fits well with survey results. Finally, it predicts modest penetration for Japan and China, which aligns with management guidance in earnings calls. That said, if Netflix successfully partners with a local Chinese operator, their penetration could increase substantially.

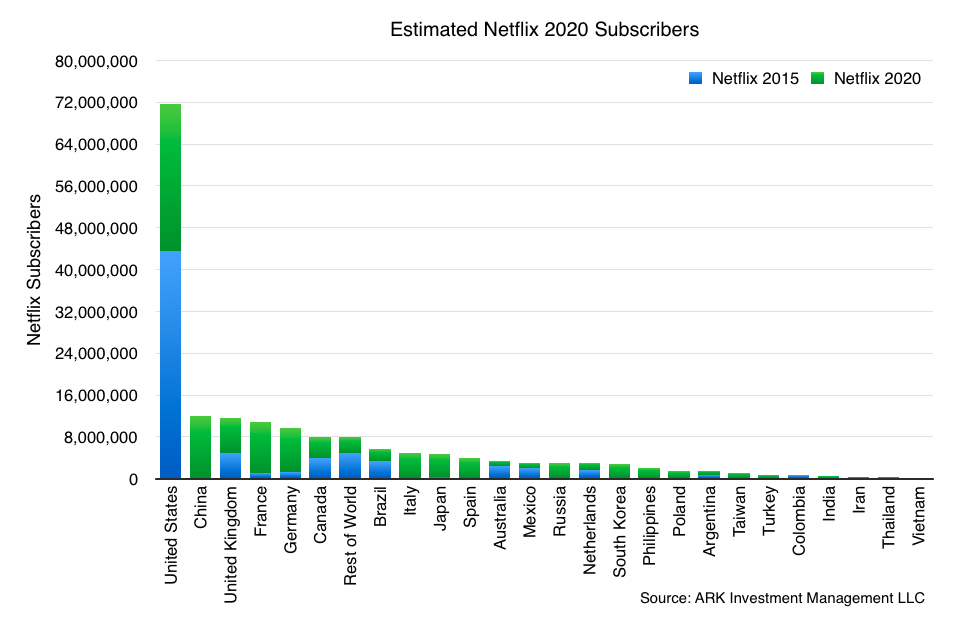

To estimate Netflix’s subscriber count in 2020, we multiplied the penetration estimates from above with the estimated broadband subscribers in 2020. The results are shown below.

The most striking data point here is the dominance of the United States, both today and in 2020. Even with a full international rollout next year, the US is estimated to be the largest single contributor to subscriber growth, adding 28 million subscribers over the next five years.

China at #2 is a surprise. Management has stated that it plans to operate “a small service” in the country. While our estimate anticipates only 4% penetration, China’s large broadband user base means it could still end up with a huge Netflix subscriber base with potentially 12 million subscribers.

France, Germany, Italy, and Japan should be strong drivers of subscriber growth, given their relatively recent launch and strong interest and ability to pay.

For the “Rest of World”, comprising of more than 180 smaller countries, we’ve deliberately taken a conservative stance. We estimated Netflix interest and GDP by discounting the global average by 50% to account for uncertainty in the quality, availability, and relevance of Netflix content for such a diverse set of countries. This assumption may be too conservative as there are a number of developed countries in the group such as Belgium, Sweden, Austria, and Norway could provide substantial growth.

Caveats

As this model draws its conclusions from some fairly abstract data, a few words of caution are warranted:

- Assessing Netflix interest based on Google Trends data of popular content is at best an approximation. The data set is small, presented only in relative terms, and the use of English search queries likely under-represents other geographies.

- GDP per capita as a measure of a country’s ability to pay ignores cultural and competitive dynamics. Certain countries may be wealthy but not willing pay for Netflix for other reasons.

- GDP per capita measures average wealth and underestimates the purchasing power of broadband subscribers. This means developing countries likely have a greater number of potential subscribers than their low per capita GDP numbers suggests.

- The estimated adoption rate for 2020 is based on observed trends in Netflix’s initial international rollout. Those countries generally had weak domestic offerings and/or favorable market conditions. Netflix’s adoption in upcoming countries could be slower.

Conclusion

A large and growing broadband base in conjunction with global interest in streaming content suggest that Netflix has a substantial opportunity ahead. In the US, after more than ten years of operating history and intense competition, Netflix continues to gain subscribers. With full international rollout (minus China) complete ahead of schedule in 2016, Netflix has opened up a number of new markets, especially in Asia. In total, our model expects 63% US penetration of broadband subscribers and 18% international penetration leading to an estimated 175 million total subscribers by 2020.

This subscriber growth will not happen automatically of course. Netflix still has to demonstrate relevance in Asia and less developed markets. Navigating China’s stringent regulatory environment will be challenging. Content wise, it must continue to improve its offering, especially in the face of fierce and well funded competitors such as HBO [TMX], Amazon [AMZN], and various local operators. All that said, the road to 2020 may prove to be Netflix’s golden years.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024