Autonomous taxis will create a tremendous amount of value for consumers and expand the mobility-as-a-service (MaaS) market dramatically, according to ARK. Today’s automakers and MaaS players, like Uber, Lyft, and Didi, will need to offer autonomous taxi services to stay competitive. ARK estimates that the companies with successful autonomous strategies stand to profit from a multi-trillion dollar opportunity.

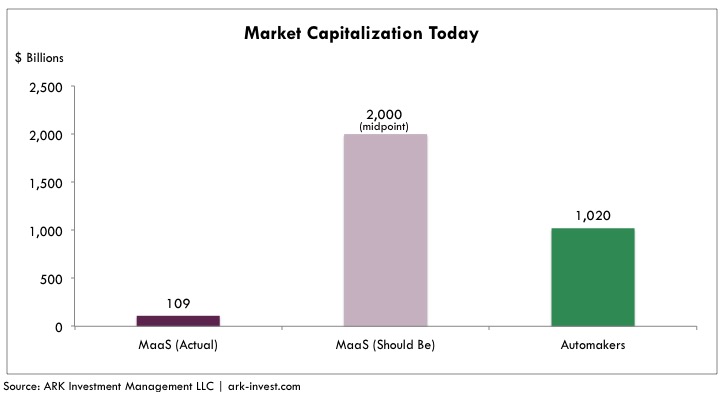

ARK believes that the net present value of the MaaS opportunity is much larger than investors appreciate. As shown below, MaaS players, like Lyft, Uber, Didi, Grab, and Ola, share a market valued at roughly $109 billion today. ARK thinks that when accounting for the potential cash flow from autonomous taxi services, the market today should be valued at between $600 billion and $3 trillion, depending on an investor’s time horizon.[1] Of course, this opportunity may not accrue to the benefit of the Didi’s and Uber’s of the world. Google [GOOG] just announced its plans to partner with original equipment manufacturers (OEMs), both nuTonomy and Delphi have launched pilots in Singapore, and several OEMs, notably Tesla [TSLA], VW, BMW [BMW3.DE], and Toyota [TM], have detailed plans for both autonomous vehicles and shared autonomous services.

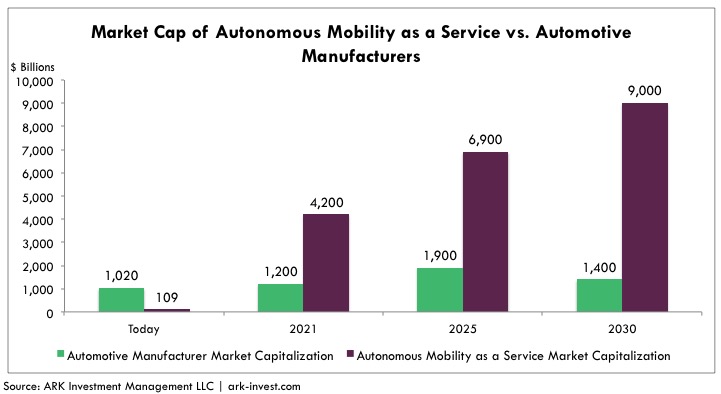

Although $2 trillion in net present value may seem farfetched for MaaS, ARK’s research indicates that the opportunity actually will scale toward $9 trillion by 2030, further crowding out the traditional OEM model. As can be seen below, by 2021 ARK expects the equity market value of global OEMs to be roughly one third the value of the MaaS market, and by 2025, roughly one sixth. Part of the explanation for this growing gap will be the substantially higher vehicle utilization that shared autonomous taxis will enable. We think the average MaaS vehicle will service more customer-miles, depressing auto unit sales and constraining OEM growth. That said, OEMs could insinuate themselves into the MaaS market. In theory, an investor could buy all of the OEMs around the world today for roughly $1 trillion, and if just one were to take majority share in the autonomous taxi space, the return on investment would be 4X in five years. The likely alternative, of course, is that technology players like Google or Uber capture the majority of the service value.

As in the PC market, software and services likely will take much more of the profit pie than will hardware. ARK believes that the MaaS market will evolve into regional monopolies because of the deluge of driving data necessary to train autonomous systems. First mover advantage in certain geographies will be important. Tesla appears to be the leader in autonomous data collection around the world, as it is alone in selling vehicles equipped with the necessary hardware sensors to collect autonomous driving data.[2]

While services will become more valuable, hardware manufacturers still will be able to tap into growth opportunities as MaaS takes off. As shown in the previous graph, ARK expects the market cap of traditional OEMs to nearly double by 2025, at which point it is likely to begin its descent as autonomous taxis cause a shift away from personally owned vehicles.

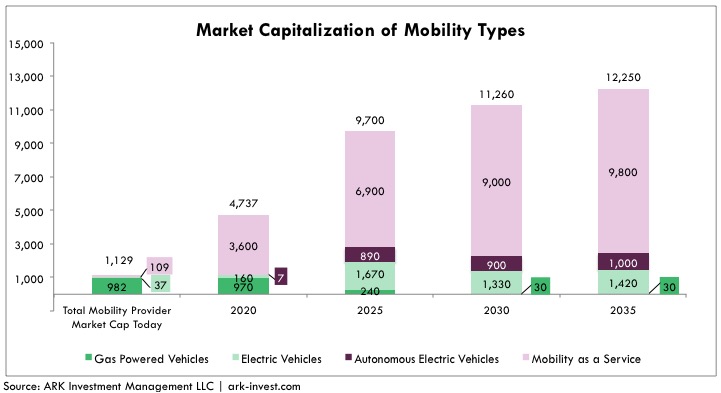

Automakers with successful electric vehicle (EV) and autonomous strategies should benefit disproportionately. ARK estimates that battery cost declines will drive higher EV and autonomous EV sales volumes, outpacing the growth of traditional gas powered car sales, as shown below. Electric vehicle manufacturers also may enjoy higher price to sales multiples than gasoline car manufacturers, as ARK believes the industry will consolidate.

The shift to MaaS most likely will create profound opportunities in financial markets. Relative to the $70 trillion in global equity market cap, MaaS could move the “needle” by more than 10% over the next decade. In other words, we think a subsector of opportunity previously unrecognized will evolve into a significant percent of equity of portfolio allocations, providing appropriately positioned investors with outsized returns. The closest contemporary proxy is the computational software industry, not recognized as a distinct portion of the value chain until the mid 1980s. It then increased its share of the S&P 500 to over 5% by the end of the 90s. In contrast to the software industry, which throughout the 90s was exposed to a small slice of the world’s population, ARK anticipates that MaaS platforms will proliferate across the income spectrum and across geographies quite rapidly. We may be at the cusp of a substantial transformation in the mode of transport throughout the world. Simple math suggests that such a transformation will prove substantial for investors who have anticipated it as well.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024